SkyWest Airlines 2004 Annual Report Download - page 41

Download and view the complete annual report

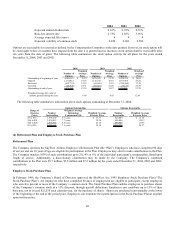

Please find page 41 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

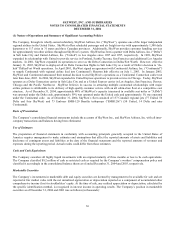

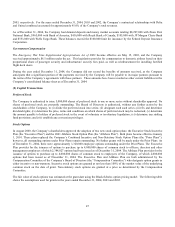

The Company’s flight and related operations conducted under the Delta contract flying relationship are governed by a ten-year

agreement signed with Delta in 2000. Effective August 1, 2003, essentially all EMB120 flights conducted by the Company under

the Delta code were transitioned from contract flying to “prorate” flying. Under the prorate flying arrangement, the Company

controls scheduling, ticketing, pricing and seat inventories and receives a prorated portion of passenger fares.

The Delta Connection Agreement also provides a monthly reimbursement for an amount per aircraft designed to reimburse the

Company for certain aircraft ownership costs. In accordance with Emerging Issues Task Force No. 01-08, "Determining Whether

an Arrangement Contains a Lease" ("EITF 01-08"), the Company has concluded that a component of its revenue under the Delta

Connection Agreement is rental income, inasmuch as the Delta Connection Agreement identifies the "right of use" of a specific

type and number of aircraft over a stated period of time. The amount deemed to be rental income under the Delta Connection

Agreement was $72.5 million for the year ended December 31, 2004, which is recorded in passenger revenue on the Company’s

consolidated statements of income.

In September 2003, the Company entered into the United Express Agreement, which sets forth the principal terms and conditions

governing the Company’s United Express obligations. The United Express Agreement received all the necessary approvals from

the U.S. Bankruptcy Court, creditors’ committee operating on behalf of United under bankruptcy protection and United’s pilot

union. Under the terms of the United Express Agreement, the Company is compensated primarily on a fee-per-completed-block

hour and departure basis plus a margin based on performance incentives, and reimbursed for fuel and other costs.

The United Express Agreement also provides a monthly reimbursement for an amount per aircraft designed to reimburse the

Company for certain aircraft ownership costs. In accordance with EITF 01-08, the Company has concluded that a component of

its revenue under the United Express Agreement is rental income, inasmuch as the United Express Agreement identifies the "right

of use" of a specific type and number of aircraft over a stated period of time. The amount deemed to be rental income under the

United Express Agreement was $114.5 million for the year ended December 31, 2004, which is recorded in passenger revenue on

the Company’s consolidated statements of income.

On April 3, 2003, the Company signed an agreement with Continental to supply Continental with regional airline feed into its

Houston hub beginning on July 1, 2003. The Company’s Continental Connection operations are currently conducted using the

Company’s EMB120s and EMB120s leased from Continental. The Continental agreement provides for payment to the Company

of a prorated portion of passenger fares, plus additional payments if minimum load factors aren’t achieved. The Company

announced on January 24, 2005 in conjunction with Continental Airlines to end its contractual relationship for flying turboprop

aircraft as a Continental Connection carrier. The decision was reached in part due to Continental’s desire for a different aircraft

due to certain operational constraints and in part due to SkyWest not achieving certain internal financial objectives. The

Company currently intends to phase out of its Continental Connection turbo-prop flying from March to June 2005. This flying

consisted of approximately 1.5% of SkyWest’s annual ASM production for 2004.

The Company’s agreements with Delta and United contain certain provisions pursuant to which the parties could terminate the

respective agreements, subject to certain rights of the other party, if certain performance criteria are not maintained. The

Company’s revenues could be impacted by a number of factors, including changes to the agreements, contract modifications

resulting from contract re-negotiations and the Company’s ability to earn incentive payments contemplated under the agreements.

In the event that the Company’s contractual rates have not been finalized at quarterly or annual financial statement dates, the

Company records revenues based on a prior period’s approved rates, adjusted to reflect management’s current estimate of the

results of the current contract negotiations. If the final contractual rates differ from those estimated by management, the

Company will reflect these changes in the consolidated financial statements in the period the contractual rates are finalized.

Deferred Aircraft Credits

The Company accounts for incentives provided by aircraft manufacturers as deferred credits. The deferred credits related to leased

aircraft are amortized on a straight-line basis as a reduction to lease expense over the respective lease term. Credits related to

owned aircraft are amortized on a straight-line basis as a reduction in depreciation expense over the life of the related aircraft. The

incentives are credits that may be used to purchase spare parts and pay for training and other expenses.