SkyWest Airlines 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

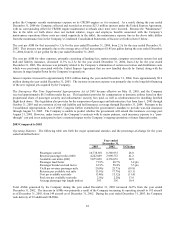

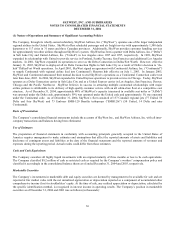

The Company has an interest rate swap agreement designed to manage its interest rate exposure on the debt instrument related to

the Company’s headquarters. The Company's policies do not permit management to enter into derivative instruments for any

purpose other than cash flow hedging purposes. Accordingly, the Company does not speculate using derivative instruments. The

Company assesses interest rate cash flow risk by identifying and monitoring changes in interest rate exposures that may adversely

impact expected future cash flows and by evaluating hedging opportunities. The fair values of the Company's derivative

instruments are recognized as other current liabilities in the accompanying balance sheet. The Company adopted SFAS No. 133

and SFAS No. 138 on January 1, 2001. In accordance with the provisions of SFAS No. 133, the Company recorded liabilities of

$691,000 and $900,000 at December 31, 2004 and 2003, respectively, in the Company’s consolidated balance sheets set forth in

Item 8 of this Report. The Company decreased interest expense by $209,000 during the year ended December 31, 2004 and

increased interest expense by $225,000 for the year ended December 31, 2003 in accordance with the interest swap agreement.

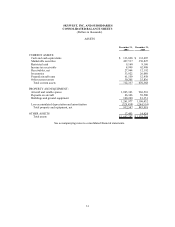

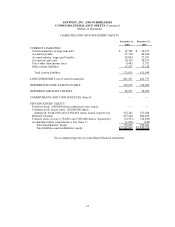

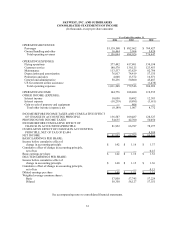

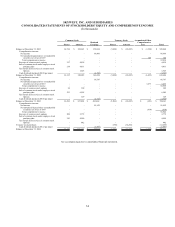

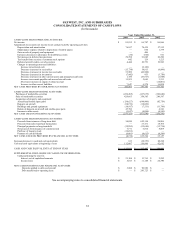

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The information set forth below should be read together with the “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” appearing elsewhere herein.