SkyWest Airlines 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

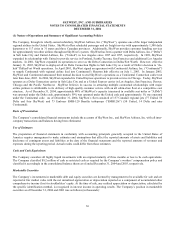

Impairment of Long Lived Assets

As of December 31, 2004, the Company had $932.5 million of flight equipment and related long-lived assets, net of accumulated

depreciation and amortization. In addition to the original cost of these assets, their recorded value is impacted by a number of

policy elections made by the Company, including estimated useful lives and salvage values. The Company reviews its long-lived

assets for impairment upon certain triggering events, such as a reduction to fleet lives, at each balance sheet date that may indicate

the book value of an asset may not be recoverable. The Company uses an estimate of future undiscounted net cash flows of the

related asset or group of assets over the remaining life in measuring whether the assets are recoverable. The Company records

and impairment charge if the net book value of the assets being assessed exceeds future undiscounted net cash flows of such

assets and the net book value of such assets exceed their fair value. The Company assesses the impairment of long-lived assets at

the lowest level for which there are identifiable cash flows that are independent of other groups of assets. During the year, no

impairment charges were recorded.

Reclassifications

Certain reclassifications have been made to the December 31, 2003 and 2002 consolidated financial statements to conform to the

current year presentation.

Capitalized Interest

Interest is capitalized on aircraft purchase deposits and long-term construction projects and is depreciated over the estimated

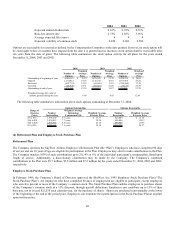

useful life of the asset. During the years ended December 31, 2004, 2003 and 2002, the Company capitalized interest costs of

approximately $3,397,000, $5,084,000, and $7,041,000, respectively.

Maintenance

The Company operates under an FAA-approved continuous inspection and maintenance program. The Company uses the direct

expense method of accounting for its Canadair 50-seat Regional Jet (“CRJ200”) engine overhauls where the expense is recorded

when the overhaul event occurs. During the quarter ended December 31, 2004, the Company completed negotiations and signed

an engine services agreement with a third party vendor to provide long-term engine services covering the scheduled and certain

unscheduled repairs for engines on its CRJ700 regional jet aircraft effective January, 2004. Under the terms of the agreement, the

Company will pay a set dollar amount per engine hour flown on a monthly basis and the third party vendor will assume the

responsibility to repair the engines at no additional cost to the Company, subject to certain specified exclusions. During the year

ended December 31, 2004, the Company recorded expenses of approximately $2.8 million related to the agreement.

The Company uses the “deferral method” of accounting for its 30-seat Embraer Brasilia EMB120 (“EMB120”) engine overhauls

where the overhaul costs are capitalized and depreciated over the estimated useful life of the engine. The costs of maintenance for

airframe and avionics components, landing gear and normal recurring maintenance are expensed as incurred. For leased aircraft,

the Company is subject to lease return provisions that require a minimum portion of the “life” of an overhaul be remaining on the

engine at the lease return date. For EMB120 engine overhauls related to leased aircraft to be returned, the Company adjusts the

estimated useful lives of the final engine overhauls based on the respective lease return dates.

Due to the change in the Company’s contractual arrangement with one of its major partners and based on a letter agreement

executed by and between the Company and GE Engine Services, Inc. in April 2002 (the “Letter Agreement”), the Company

elected to change from the accrual method of accounting to the direct-expense method of accounting for CRJ200 engine overhaul

costs effective January 1, 2002. The Company believes the direct-expense method is preferable in the circumstances because the

maintenance liability is not recorded until the maintenance services are performed, the direct-expense method eliminates

significant estimates and judgments inherent under the accrual method, and it is the predominant method used in the airline

industry. Accordingly, effective January 1, 2002, the Company reversed its engine overhaul accrual that totaled $14.1 million by

recording a cumulative effect of change in accounting principle of $8.6 million (net of income taxes of $5.5 million).

Passenger and Ground Handling Revenues

Passenger and ground handling revenues are recognized when service is provided. Under the Company’s contract and prorate

flying agreements with Delta, United and Continental, revenue is considered earned when the flight is completed.