SkyWest Airlines 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

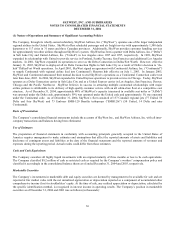

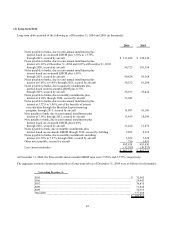

The Company’s total long-term debt at December 31, 2004 was $495.8 million, of which $487.9 million related to the acquisition

of EMB120 and CRJ200 aircraft and $7.9 million related to the construction of the Company’s new corporate office building. The

average effective rate on the debt related to the CRJ200 aircraft of $467.5 million was approximately 4.4% at December 31, 2004.

The Company has available $10.0 million in an unsecured bank line of credit through January 31, 2005, with interest payable at

the bank’s base rate less one-quarter percent, which was a net rate of 5.0% at December 31, 2004. The Company had $6,461,000

of letters of credit with no borrowings outstanding under this line of credit as of December 31, 2004. Additionally, the Company

had $1,515,000 of letters of credit outstanding with another bank as of December 31, 2004. The Company believes that in the

absence of unusual circumstances, the working capital available to the Company will be sufficient to meet its present financial

requirements, including expansion, capital expenditures, lease payments and debt service obligations for at least the next 12

months.

Certain of the Company’s long-term debt arrangements contain limitations on, among other things, the sale or lease of assets and

ratio of long-term debt to tangible net worth. As of December 31, 2004, the Company was in compliance with all debt covenants

contained in its long-term debt agreements.

During the December 31, 2004 and 2003 aircraft deposits with Bombardier of $3.1 million and $90.9 million, respectively, were

applied as down payments to Bombardier for temporarily financing of aircraft while the Company arranged for permanent long-

term financing through debt and other third party leasing arrangements. When the Company acquired long-term financing

through debt, the debt instruments were written, such that, the long-term debt could be refinanced into equity leases. Hence, in

2003, $243.7 million in debt was transferred to third party long-term lessors.

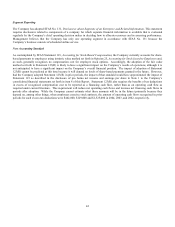

(3) Income Taxes

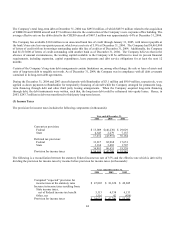

The provision for income taxes includes the following components (in thousands):

Year ended December 31,

2004 2003 2002

Current tax provision:

Federal $ 13,009 $ (46,230) $ 29,029

State 4,643 2,279 7,155

17,652 (43,951) 36,184

Deferred tax provision:

Federal 33,817 82,968 17,651

State 3,166 3,683 1,707

36,983 86,651 19,358

Provision for income taxes $ 54,635 $ 42,700 $ 55,542

The following is a reconciliation between the statutory Federal income tax rate of 35% and the effective rate which is derived by

dividing the provision for income taxes by income before provision for income taxes (in thousands):

Year ended December 31,

2004 2003 2002

Computed “expected” provision for

income taxes at the statutory rates $ 47,805 $ 38,320 $ 49,845

Increase in income taxes resulting from:

State income taxes,

net of Federal income tax benefit 5,313 4,338 6,133

Other, net 1,516 42 (436)

Provision for income taxes $ 54,634 $ 42,700 $ 55,542