SkyWest Airlines 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18

its assets through one or more transactions with third parties. Such events, individually or singly, could jeopardize the

Company’s United Express operations, leave the Company unable to efficiently utilize the additional aircraft which the Company

is currently obligated to purchase, or result in other outcomes which could have a material adverse effect on the operations,

activities or financial condition of the Company.

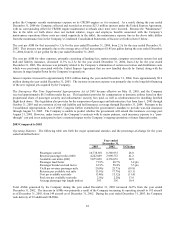

Critical Accounting Policies

The Company’s significant accounting policies are described in Note 1 to the Company’s Consolidated Financial Statements for

the year ended December 31, 2004 contained herein. Critical accounting policies are those policies that are most important to the

preparation of the Company’s consolidated financial statements and require management’s subjective and complex judgments due

to the need to make estimates about the effect of matters that are inherently uncertain. The Company’s critical accounting policies

relate to revenue recognition, aircraft maintenance, aircraft leases and impairment of long-lived assets as discussed below. The

application of these accounting policies involves the exercise of judgment and the use of assumptions as to future uncertainties

and, as a result, actual results will differ, and could differ materially from such estimates.

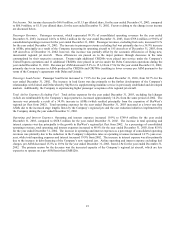

Revenue Recognition

Passenger and ground handling revenues are recognized when service is provided. Under the Company’s contract and prorate

flying agreements with Delta, United and Continental, revenue is considered earned when the flight is completed.

During the six months ended June 30, 2004, the Company and Delta had not finalized the terms of the rate agreement, but had

reached a conceptual understanding regarding rates, terms and conditions for contract flying under which the Company operated

as a Delta Connection carrier. Consequently, revenues under the Delta arrangement for the six months ended June 30, 2004 were

recorded based on the terms of the conceptual understanding. During the quarter ended September 30, 2004, the Company

finalized the contract rates with Delta for calendar 2004. No material adjustment resulted from the finalization of the rates for

2004. Under the terms of the Delta rate agreement for 2004, the Company is compensated primarily on a fee-per-completed-

block hour and departure basis plus a margin, and reimbursed for fuel and certain other costs. The Company and Delta are

continuing to negotiate rates for calendar 2005 that would provide for items such as multiple-year automatic rate reset provisions,

a contract extension and other provisions intended to enable more efficient contract administration for the parties.

In September 2003, the Company entered into the United Express Agreement, which had been previously approved on August 29,

2003 by the U.S. Bankruptcy Court. The United Express Agreement received all the necessary approvals from the creditors’

committee operating on behalf of United under bankruptcy protection and United’s pilot union. Under the terms of the United

Express Agreement, the Company is compensated primarily on a fee-per-completed-block hour and departure basis plus a margin

based on performance incentives, and reimbursed for fuel and certain other costs.

On April 3, 2003, the Company signed an agreement with Continental to supply Continental with regional airline feed into its

Houston hub beginning on July 1, 2003. The Company announced on January 24, 2005 in conjunction with Continental Airlines

to end its contractual relationship for flying turboprop aircraft as a Continental Connection carrier. The Company currently

intends to phase out of its Continental Connection turbo-prop flying from March to June 2005.

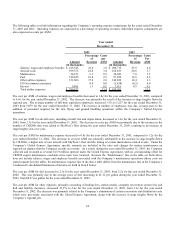

The Company’s agreements with Delta, United and Continental contain certain provisions pursuant to which the parties could

terminate the respective agreements, subject to certain rights of the other party, if certain performance criteria are not maintained.

The Company’s revenues could be impacted by a number of factors, including changes to the agreements, contract modifications

resulting from contract re-negotiations and the Company’s ability to earn incentive payments contemplated under applicable

agreements.

In the event that the Company’s contractual rates have not been finalized at quarterly or annual financial statement dates, the

Company records revenues based on a prior period’s approved rates, adjusted to reflect management’s current estimate of the

results of the current contract negotiations. If the final contractual rates differ from those estimated by management, the

Company will reflect these changes in the consolidated financial statements in the period the contractual rates are finalized.