Shutterfly 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEASE AGREEMENT

THIS LEASE AGREEMENT (the “Lease”) made and entered into as of the 22nd day of December, 2006 (the “Lease Date”), by and between

3915 SHOPTON ROAD, LLC, a North Carolina limited liability company

hereinafter called “Landlord”; and

SHUTTERFLY, Inc., a Delaware corporation

hereinafter called “Tenant”:

W I T N E S S E T H :

In consideration of the mutual covenants and agreements contained herein, the parties hereto agree for themselves, their successors and assigns, as follows:

1. DESCRIPTION OF PREMISES

. Landlord hereby leases to Tenant, and Tenant hereby accepts and rents from Landlord, that certain office/warehouse space (the

“Premises”) containing approximately 102,400 rentable square feet located in the building known as 18-B (the “Building”) in Shopton Ridge Business Park (the “Business Park”

),

Charlotte, North Carolina, said Building being located on a parcel of real property more particularly described on Exhibit ”A” attached hereto. For purposes of this Lease, Tenant’

s

“proportionate share” shall be one hundred percent (100%).

2. TERM

. Unless otherwise adjusted as hereinbelow provided, the term of this Lease shall commence on the later to occur of April 30, 2007 or upon substantial

completion of Landlord’s Work (the “Commencement Date”) and shall end at midnight on the date (the “Expiration Date”) which is the last day of the eighty-

ninth (89th) month after

the Commencement Date (as same may be adjusted as hereinbelow provided). As used herein, the term “Lease Year” shall mean each consecutive twelve-

month period of the Lease

term, beginning with the Commencement Date (as same may be adjusted as hereinbelow provided) or any anniversary thereof. Within five (5) days following the Commencement

Date, Tenant shall execute and deliver to Landlord duplicate originals of a written agreement in the form attached to this Lease as Exhibit F.

3. RENTAL

. During the full term of this Lease, Tenant shall pay to Landlord, without notice, demand, reduction (except as may be applicable pursuant to paragraph

13 or paragraph 19 herein or as otherwise provided in this Lease), setoff or any defense, a total rental (the “Annual Rental”) consisting of the sum total of the following:

(a) Minimum Rental . Commencing on the first day of the ninth (9

th

) month following the Commencement Date (the “Rent Commencement Date”),

as the same may

be adjusted pursuant to the last sentence of Section 4 hereof, and continuing through the remainder of the initial eighty-

nine (89) month term of this Lease, Tenant shall pay an annual

minimum rental (the “Minimum Rental”)

equal to Six and 48/100 Dollars ($6.48) per rentable square foot of space in the Premises during Lease Year 1, increasing every year thereafter

during the term at a rate of three percent (3%), based on 102,400 square feet, including the “free Annual Rent”,

as set forth below. If the actual square footage of the Premises, as

determined by Landlord’s architect and certified to Landlord and Tenant, shall be greater or lesser than 102,400 square feet based on the final as-

built square footage after completion

of the Improvements described on Exhibit ”C”

to this Lease, then the Minimum Rental shall be adjusted based on the actual square footage of the Premises. The Minimum Rental shall

be payable in equal monthly installments, each in advance on or before the first day of each month. If the Rent Commencement Date is a date other than the first day of a calendar

month, the Minimum Rental shall be prorated daily from such date to the first day of the next calendar month and paid on the Rent Commencement Date.

(b) Tenant’s Share of Taxes . Subject to the terms set forth in Section 3(j) below, Tenant shall pay an amount equal to Tenant’s “proportionate share”

of ad valorem

taxes (or any tax hereafter imposed in lieu thereof) with respect to the Building and the Business Park. Tenant’

s share of taxes shall be paid as provided in subparagraph (e)

below. Provided, any increase in ad valorem taxes on the Premises as a result of alterations, additions or improvements made by, for or on account of Tenant shall be reimbursed by

Tenant to Landlord as Additional Rent (as defined below) within thirty (30) days after receipt of written demand therefor.

(c) Tenant’s Share of Insurance Premiums . Subject to the terms set forth in Section 3(j) below, Tenant shall pay an amount equal to Tenant’s “proportionate share”

of

premiums charged for fire and extended coverage and liability insurance with all endorsements carried by Landlord on the Building payable for any calendar year (including any

applicable partial calendar year). Tenant’s proportionate share of premiums shall be paid as provided in subparagraph (e) below.

(d) Tenant’s Share of Common Area Operating and Maintenance Costs

. Subject to the terms set forth in Section 3(j) below, Tenant shall pay an amount equal to

Tenant’s “proportionate share” of the reasonable costs for operating and maintaining the Building’

s common areas, including, but not limited to, the cost of grass mowing, shrub care

and general landscaping, irrigation systems, maintenance and repair to parking and loading areas, driveways, sidewalks, exterior lighting, garbage collection and disposal, common

water and sewer, common plumbing, common signs and other facilities shared by the various tenants in the Building, the administrative costs associated therewith including

management fees, which shall be capped at 3% of the Minimal Rental actually collected by Landlord from the Building during the initial term and any subsequent renewal period(s),

and of the Building’

s share of the common area operating and maintenance costs for the entire Business Park. Landlord shall use good faith efforts to keep the operating and

maintenance costs in line with costs for other similarly situated business centers. Tenant’

s proportionate share shall be paid as provided in subparagraph (e) below. Notwithstanding

any term, covenant or condition as set forth in this Lease, costs for operating and maintaining the Building’s common areas and the Business Park’

s common areas (but only during

such time as Landlord and/or its affiliate own a majority of the Business Park and control the operation of the Business Park) shall specifically exclude the following:

(i) replacement of capital items (unless amortized over the useful life of such item according to normal accounting procedures (a) but only to the extent that such replacements

reduce other direct expenses and are made after the Commencement Date or (b) for replacements that are required under any governmental law or regulation that was not

applicable to the Building as of the Commencement Date).

(ii) financing and refinancing costs and principal and interest payments on mortgages and deeds of trust,

(iii) costs and expenses covered by insurance,

(iv) Landlord's insurance deductible,

(v) depreciation,

(vi) above market payments made to affiliates of Landlord, inside or related contractors and executives,

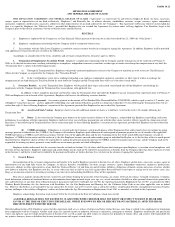

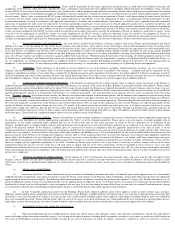

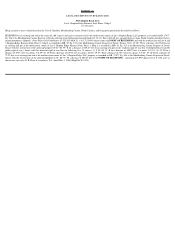

Period

80,000 SF Space

Annual Rent

22,400 SF Space

Annual Rent

Total Space

Annual Amount

Months 1

-

8

FREE

FREE

FREE

Months 9

-

13

$216,000.00

FREE

$216,000.00

Months 14

-

20

$302,400.00

$84,672.00

$387,072.00

Months 21

-

32

$533,600.00

$149,408.00

$683,008.00

Months 33

-

44

$549,600.00

$153,888.00

$703,488.00

Months 45

-

56

$565,600.00

$158,368.00

$723,968.00

Months 57

-

68

$582,400.00

$163,072.00

$745,472.00

Months 69

-

80

$599,200.00

$167,776.00

$766,976.00

Months 81

-

89

$462,600.00

129,528.00

$592,128.00