Shutterfly 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

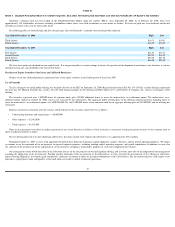

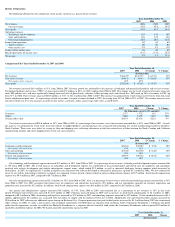

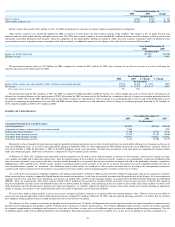

Personalized Products and Services Revenues as Percentage of Net Revenues.

We continue to innovate and improve our personalized products and services and expect the

net revenues from these products and services to increase as percentage of net revenues as we continue to diversify our product offerings. Personalized products and services as

a percentage of total net revenue increased from 51% in 2006 to 56% in 2007. In addition, as a percentage of total net revenues, revenues from 4x6 prints have been declining;

from 37% in 2005, to 28% in 2006, and to 22% in 2007.

We believe the analysis of these metrics and others provides us with important information on our overall net revenue trends and operating results. Fluctuations in these metrics are

not unusual and no single factor is determinative of our net revenues and operating results.

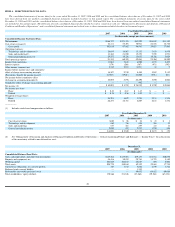

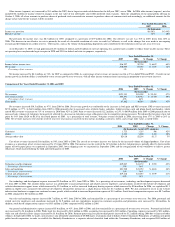

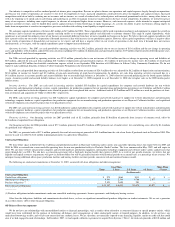

Cost of Net Revenues.

Cost of net revenues consist primarily of direct materials (the majority of which consists of paper, ink, and photo book covers), payroll and related expenses

for direct labor, shipping charges, packaging supplies, distribution and fulfillment activities, rent for production facilities, depreciation of production equipment, and third-

party costs

for photo-

based merchandise. Cost of net revenues also includes payroll and related expenses for personnel engaged in customer service. In addition, cost of revenues includes any

third-party software or patents licensed, as well as the amortization of acquired developed technology and capitalized website development costs.

Operating Expenses.

Operating expenses consist of technology and development, sales and marketing, and general and administrative expenses. We anticipate that each of the

following categories of operating expenses will increase in absolute dollar amounts, but remain relatively consistent as a percentage of net revenues.

Technology and development expense consists primarily of personnel and related costs for employees and contractors engaged in the development and ongoing maintenance of our

website, infrastructure and software. These expenses include depreciation of the computer and network hardware used to run our website and store the customer data, as well as

amortization of purchased software. Technology and development expense also includes colocation and bandwidth costs.

Sales and marketing expense consists of costs incurred for marketing programs and personnel and related expenses for our customer acquisition, product marketing, business

development and public relations activities. Our marketing efforts consist of various online and offline media programs, such as e-

mail and direct mail promotions, the purchase of

keyword search terms and various strategic alliances. We depend on these efforts to attract customers to our service.

General and administrative expense includes general corporate costs, including rent for our corporate offices, insurance, depreciation on information technology equipment and

legal and accounting fees. In addition, general and administrative expense includes personnel expenses of employees involved in executive, finance, accounting, human resources,

information technology and legal roles. Third-

party payment processor and credit card fees are also included in general and administrative expense and have historically fluctuated

based on revenues during the period.

Interest Expense. Interest expense consists of interest costs recognized under our capital lease obligations and other borrowings.

Other Income (Expense), Net.

Other income (expense), net consists primarily of the interest income on our cash and investment accounts and the net income (expense) related to

changes in the fair value of convertible preferred stock warrants. Subsequent to the completion of our initial public offering on October 4, 2006, all of our warrants to purchase shares

of preferred stock converted into warrants to purchase shares of common stock. Accordingly, the liability for the convertible preferred stock warrants was reclassified as common stock

and additional paid-in capital and the warrants are no longer subject to re-measurement.

Income Taxes.

Historically, we have only been subject to taxation in the United States because we have sold almost all of our products to customers in the United States. If we

continue to sell our products primarily to customers located within the United States, we anticipate that our long-term future effective tax rate will range between 38% and 45%.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States, or GAAP. The preparation of these

consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, costs and expenses and related

disclosures. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. In many instances, we could

have reasonably used different accounting estimates, and in other instances, changes in the accounting estimates are reasonably likely to occur from period to period. Accordingly,

actual results could differ significantly from the estimates made by our management. To the extent that there are material differences between these estimates and actual results, our

future financial statement presentation of our financial condition or results of operations will be affected.

In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does not require management’

s judgment in its application, while in other

cases, management’

s judgment is required in selecting among available alternative accounting standards that allow different accounting treatment for similar transactions. We believe

that the accounting policies discussed below are the most critical to understanding our historical and future performance, as these policies relate to the more significant areas involving

management’s judgments and estimates.

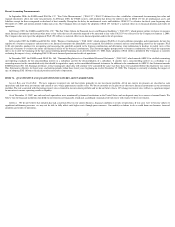

Revenue Recognition. We generate revenues primarily from the printing and shipping of prints and other photo-

based products, and referral fees. We generally recognize revenues

from product sales upon shipment when persuasive evidence of an arrangement exists (typically through the use of a credit card or receipt of a check), the selling price is fixed or

determinable and collection of resulting receivables is reasonably assured. Revenues from amounts billed to customers, including prepaid orders, are deferred until shipment of fulfilled

orders. We provide our customers with a 100% satisfaction guarantee whereby products can be returned within a 30-

day period for a reprint or refund. We maintain an allowance for

estimated future returns based on historical data. During the year ended December 31, 2007, returns totaled less than 1% of net revenues and have been within management’

s

expectations. We periodically provide incentive offers to our customers in exchange for setting up an account and to encourage purchases. Such offers include free products and

percentage discounts on current purchases. Discounts, when accepted by customers, are treated as a reduction to the purchase price of the related transaction and are included in net

revenues. Production costs related to free products are included in costs of revenues upon redemption. Shipping charged to customers is recognized as revenue at the time of

shipment. Revenue from referral fees for click-throughs is recognized in the period that the click-through impression is delivered.

Inventories. Our inventories consist primarily of paper, photo book covers and packaging supplies and are stated at the lower of cost on a first-in, first-

out basis or net realizable

value. The value of inventories is reduced by an estimate for excess and obsolete inventories. The estimate for excess and obsolete inventories is based upon management’

s review of

utilization of inventories in light of projected sales, current market conditions and market trends.

Software and Website Development Costs.

We capitalize eligible costs associated with software developed or obtained for internal use in accordance with the AICPA Statement of

Position No. 98-1 and EITF Issue No. 00-2. Accordingly, payroll and payroll-related costs incurred in the development phase are capitalized and amortized over the product’

s estimated

useful life, which is generally three years. Costs associated with minor enhancements and maintenance for our website are expensed as incurred.

Income Taxes.

We use the asset and liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are recognized by applying the statutory

tax rates in effect in the years in which the differences between the financial reporting and tax filing bases of existing assets and liabilities are expected to reverse. We have considered

future taxable income and ongoing prudent and feasible tax planning strategies in assessing the need for a valuation allowance against our deferred tax assets. We believe that all net

deferred tax assets shown on our balance sheet are more likely than not to be realized in the future and no valuation allowance is necessary. In the event that actual results differ from

those estimates or we adjust those estimates in future periods, we may need to record a valuation allowance, which will impact deferred tax assets and the results of operations in the

period the change in made.

Stock-based Compensation Expense. Effective January 1, 2006, we adopted the fair value recognition provisions of SFAS No. 123R, “Share-Based Payment,”

using the

prospective transition method, which requires us to apply the provisions of SFAS No. 123R only to new awards granted, and to awards modified, repurchased or cancelled, after the

effective date. Under this transition method, stock-based compensation expense recognized beginning January 1, 2006 is based on the following: (a) the grant-

date fair value of stock

option awards granted or modified after January 1, 2006; and (b) the balance of deferred stock-

based compensation related to stock option awards granted prior to January 1, 2006,

which was calculated using the intrinsic value method as previously permitted under APB Opinion No. 25.

Under SFAS No 123R, we estimate the fair value of stock options granted using the Black

-

Scholes valuation model. This model requires us to make estimates and assumptions