Shutterfly 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

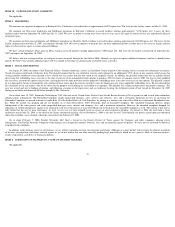

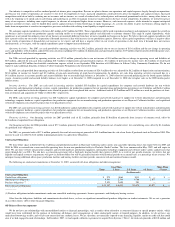

Other income (expense), net, increased by $3.1 million for 2007, due to larger invested cash balances for the full year 2007, versus 2006. In 2006, other income (expense), net also

included $0.1 million of income related to changes in the fair value of our redeemable convertible preferred stock warrants. Upon the completion of our initial public offering on

October 4, 2006, all of our warrants to purchase shares of preferred stock converted into warrants to purchase shares of common stock and accordingly, no additional amounts for the

change in fair value for the warrants will be recorded.

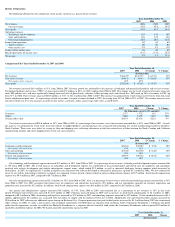

The provision for income taxes was $6.3 million for 2007, compared to a provision of $3.9 million for 2006. Our effective tax rate was 38% in 2007, down from 40% in

2006. This decrease in our effective tax rate is primarily the result of a favorable resolution of a state tax audit by California, as well as the changes that were made to our ongoing

research and development tax credits reserves. Other factors, such as the volume of disqualifying dispositions also contributed to the reduction in our tax rate, year-over-year.

As of December 31, 2007, we had approximately $31 million of federal and $32 million of state net operating loss carryforwards available to reduce future taxable income. These

net operating loss carryforwards begin to expire in 2020 and 2011 for federal and state tax purposes, respectively.

Net income increased by $4.3 million, or 74%, for 2007 as compared to 2006. As a percentage of net revenue, net income was flat at 5% in both FY06 and FY07. Overall, our net

income growth in absolute dollars is attributable to our revenue growth year-over-year; with all other income statement items increasing in-proportion to net revenue increases.

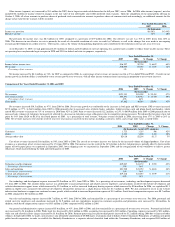

Comparison of the Years Ended December 31, 2006 and 2005

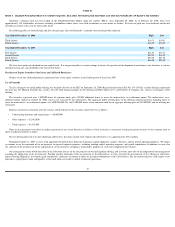

Net revenues increased $39.5 million, or 47%, from 2005 to 2006. Net revenue growth was attributable to the increases in both print and PPS revenues. PPS revenues increased

$27.2 million, or 77%, to $62.4 million from 2005 to 2006 primarily due to increased sales of photo books, calendars, folded greeting cards and photo-

based merchandise, which

caused PPS revenues to increase to 51% of revenues in 2006 from 42% in 2005. Print revenues increased $12.2 million, or 25%, to $60.9 million from 2005 to 2006 primarily due to

increased sales volumes of 4x6 prints, but negatively affected by a decrease in 4x6 print average selling prices due to competitive pricing pressures. We reduced the list price of our 4x6

prints by 34% from $0.29 to $0.19 in the fourth quarter of 2005. As a percentage of total revenue, 4x6 print revenue declined in 2006, decreasing from 37% in 2005 to 28% in

2006. Net revenue increases were also the result of year-over-year increases in all of our key metrics including, customers, orders, and average order value, as noted below:

Cost of net revenues increased $18.6 million, or 50%, from 2005 to 2006. The cost of net revenues increase was driven by the increased volume of shipped products. Cost of net

revenues as a percentage of net revenues increased by 1% from 2005 to 2006. The increase was the result of the 34% decline in the list 4x6 print prices, partially offset by the favorable

impact of lower paper prices we negotiated in September 2005, lower shipping costs we negotiated in September 2006, and the reorganization of our workflows to achieve greater

efficiencies which occurred during the third and fourth quarters of 2005.

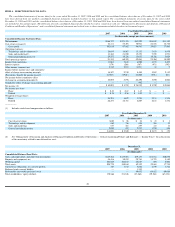

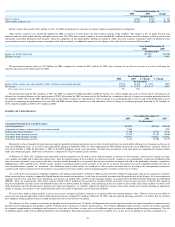

Our technology and development expense increased $5.9 million, or 45%, from 2005 to 2006. As a percentage of net revenues, technology and development expense decreased

1% from 2005 to 2006. The absolute dollar increase was attributable to increased personnel and related costs for employees and consultants involved with website development and

website infrastructure support teams, which increased by $3.1 million, as well as increased third-

party hosting expenses which increased by $0.6 million. In 2006, we capitalized $1.3

million in eligible costs associated with software developed or obtained for internal use, a slight decrease from the $1.7 million in 2005. We also continued to invest in our website

infrastructure hardware to support our continued revenue growth, which resulted in increased depreciation expense of $1.8 million. Stock-

based compensation expense was $0.7 million

in 2006, compared to $0.8 million in 2005.

Our sales and marketing expense increased $6.7 million, or 44%, from 2005 to 2006, and remained flat as a percentage of net revenues year-over-

year. For 2006, personnel and

related costs for employees and consultants increased by $1.9 million, and our expenditures incurred on customer acquisition and promotion costs increased by $4.6 million. In

addition, stock-based compensation expense was $0.5 million in 2006, compared to $0.2 million in 2005.

Our general and administrative expense increased $5.6 million, or 41%, from 2005 to 2006, and also remained flat as a percentage of revenue year over year. Personnel and related

costs increased by $1.6 million in 2006. While legal fees decreased by $0.8 million in 2006, accounting fees increased by $0.8 million. Consulting expenses increased by $0.8 million,

while rent and related facilities charges increased by $1.0 million for 2006. Payment processing fees paid to third parties increased by $1.2 million during 2006 due to increased order

volumes. In September 2006, we made a non-recourse, non-

refundable contribution of 65,000 shares of common stock to Silicon Valley Community Foundation, a California non profit

public benefit corporation, in order to establish the Shutterfly Foundation as a corporate

-

advised charitable fund within the Community Foundation, and recognized $0.9 million of

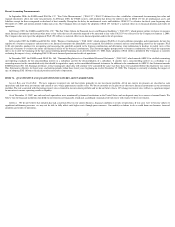

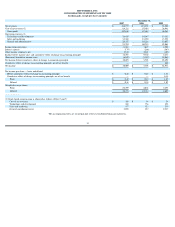

Year Ended December 31,

2007

2006

(In thousands)

Income tax provision

$(6,302)

$(3,942)

Effective tax rate

38%

40%

Year Ended December 31,

2007

2006

$ Change

% Change

(In thousands)

Income before income taxes

$16,397

$9,740

$ 6,657

68%

Net income

$10,095

$5,798

$ 4,297

74%

Percentage of net revenues

5%

5%

-

-

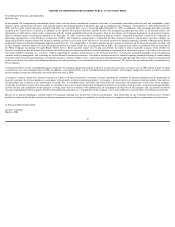

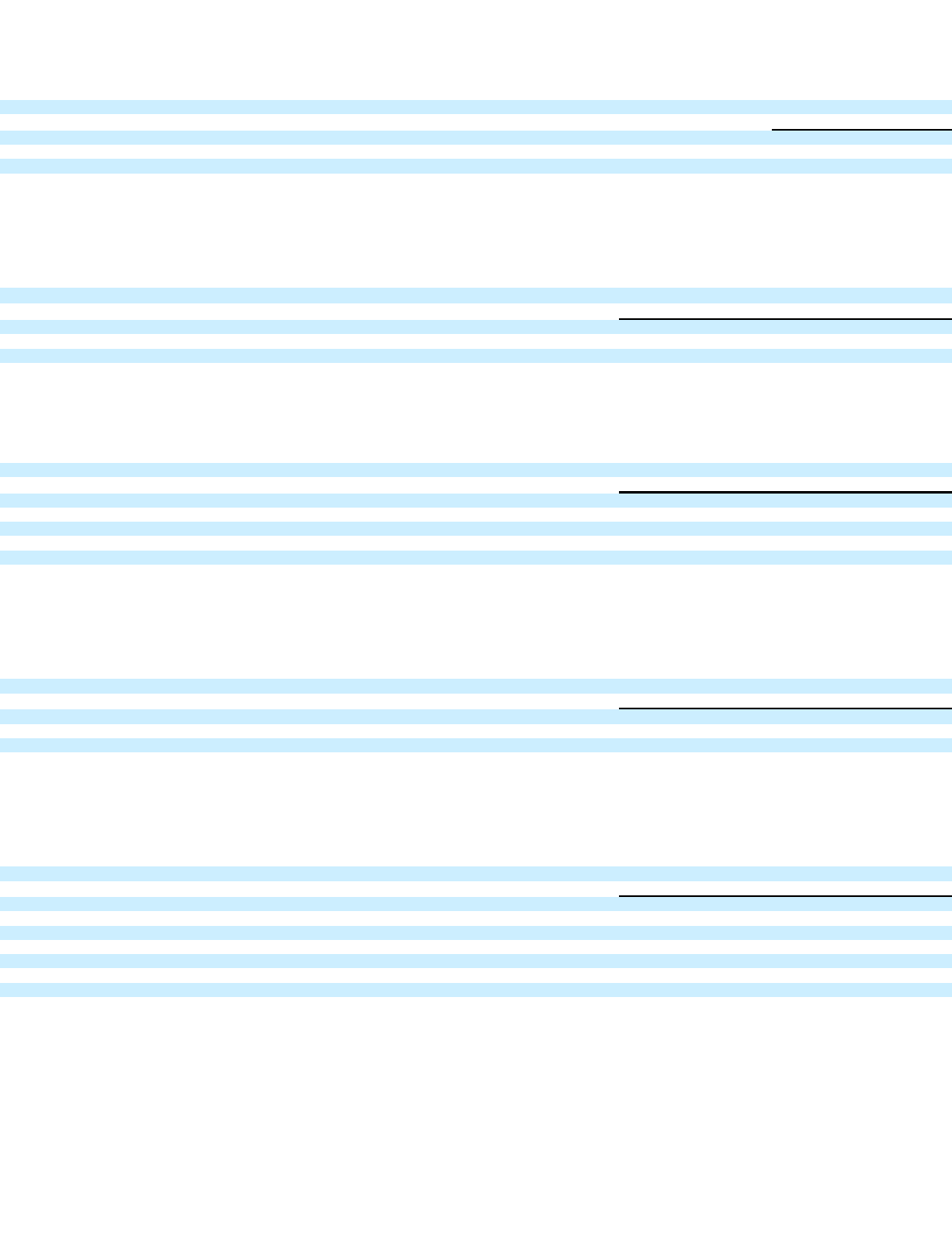

Year Ended December 31,

2006

2005

$ Change

% Change

(In thousands)

Net revenues

$123,353

$83,902

$ 39,451

47%

Cost of net revenues

$55,491

$36,941

$ 18,550

50%

Percentage of net revenues

45%

44%

-

-

Gross profit

67,862

46,961

20,901

45%

Year Ended December 31,

2006

2005

Change

% Change

(In thousands, except AOV amounts)

Customers

1,725

1,219

506

42%

Orders

5,105

3,650

1,455

40%

Average order value

$24.16

$22.99

$1.17

5%

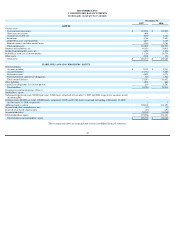

Year Ended December 31,

2006

2005

$ Change

% Change

(In thousands)

Technology and development

$19,087

$13,152

$ 5,935

45%

Percentage of net revenues

15%

16%

-

-

Sales and marketing

$21,940

$15,252

$ 6,688

44%

Percentage of net revenues

18%

18%

-

-

General and administrative

$19,216

$13,657

$ 5,559

41%

Percentage of net revenues

16%

16%

-

-