Shutterfly 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

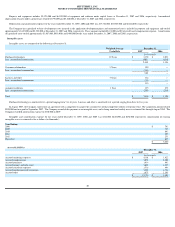

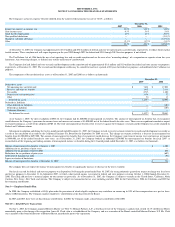

The Company’s actual tax expense (benefit) differed from the statutory federal income tax rate of 34.0%, as follows:

At December 31, 2007, the Company had approximately $31.0 million and $32.0 million of federal and state net operating loss carryforwards, respectively, to reduce future regular

taxable income. These carryforwards will expire beginning in the year 2020 through 2022 for federal and 2011 through 2012 for state purposes, if not utilized.

The Tax Reform Act of 1986 limits the use of net operating loss and tax credit carryforwards in the case of an “ownership change”

of a corporation or separate return loss year

limitations. Any ownership changes, as defined, may restrict utilization of carryforwards.

The Company also had federal and state research and development credit carryforwards of approximately $1.0 million and $1.0 million for federal and state income tax purposes,

respectively, at December 31, 2007. The research and development credits may be carried forward over a period of 20 years for federal tax purposes, and indefinitely for California tax

purposes.

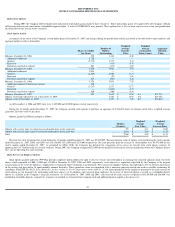

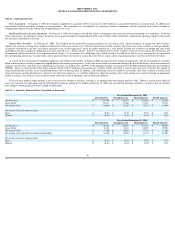

The components of the net deferred tax assets as of December 31, 2007 and 2006 are as follows (in thousands):

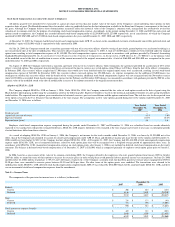

As of January 1, 2007, the date of adoption of FIN 48, the Company had $1,200,000 of unrecognized tax benefits. The amount of unrecognized tax benefits that, if recognized,

would decrease the Company’

s provision for income taxes and increase net income is $1,000,000, net of the federal benefit for state taxes. There was no significant cumulative impact

to retained earnings as a result of the adoption of FIN 48. The total unrecognized tax benefits relate to reserves against the Company’

s research and development tax credits claimed on

Federal and California returns.

Subsequent to adoption and during the twelve-

month period ended December 31, 2007, the Company revised its reserve estimate related to research and development tax credits as

a result of the conclusion of an audit by the California Franchise Tax Board for the September 30, 2004 tax year. This change in estimate resulted in a decrease in unrecognized tax

benefits from $1,200,000 to $497,000. The amount of unrecognized tax benefits that, if recognized, would decrease the Company’

s provision of income taxes and increase net income

is $448,000, net of the federal benefit for state taxes. As of December 31, 2007, the Company booked an additional $259,000 for unrecognized tax benefits for fiscal 2007. A

reconciliation of the beginning and ending amounts of unrecognized income tax benefits during the 12-month period ended December 31, 2007 is as follows (in thousands):

The company does not expect the balance of unrecognized tax benefits to significantly increase or decrease in the next 12 months.

Our fiscal year end for federal and state tax purposes was September 30. During the period ended June 30, 2007, the taxing authorities granted our request to change our fiscal year

end for tax purposes to December 31. In September 2007, we filed a short period income tax return for federal and state purposes covering October 1, 2006 through December 31,

2006. This filing did not have a material impact on our income tax provision. As of December 31, 2007, the Company is subject to taxation in the United States, California, North

Carolina, New Jersey, New York, and Arizona. The Company is subject to examination for tax years including and after 2003 for the United States, 2004 for California, and 2007 for

the remaining jurisdictions.

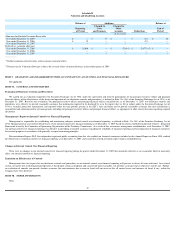

Note 9 — Employee Benefit Plan

In 2000, the Company established a 401(k) plan under the provisions of which eligible employees may contribute an amount up to 50% of their compensation on a pre-

tax basis,

subject to IRS limitations. The Company matches employees’ contributions at the discretion of the Board.

In 2007 and 2005, there were no discretionary contributions. In 2006, the Company made a discretionary contribution of $63,000.

Note 10 — Related Party Transactions

On June 1, 2005, the Company acquired Memory Matrix (see Note 5). Monaco Partners, L.P., a beneficial owner of the Company’

s capital stock, owned 14.1% of Memory Matrix

immediately prior to the closing of the acquisition. James H. Clark, who is a stockholder of the Company, and was a member of the Board, controlled Monaco Partners, L.P. Mr. Clark

was a member of the board of directors of Memory Matrix immediately prior to the acquisition.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31,

2007

2006

2005

Income tax expense at statutory rate

34.0

%

34.0

%

34.0

%

State income taxes

4.5

%

5.8

%

5.8

%

Stock

-

based compensation

2.0

%

4.3

%

10.7

%

Non

-

qualified deductions

—

—

(

13.1

)%

Change in valuation allowance

—

—

(

527.7

)%

Other

(2.1

)%

(3.7

)%

(3.5

)%

38.4

%

40.4

%

(493.8

)%

December 31,

2007

2006

Deferred tax assets:

Net operating loss carryforwards

$

7,481

$

17,028

Reserves and other tax benefits

3,485

2,111

Tax credits

2,715

1,800

Depreciation and amortization

1,196

32

Other

94

19

Deferred tax assets

14,971

20,990

Deferred tax liabilities:

Other deferred tax liabilities

—

(

107

)

Deferred tax liabilities

—

(

107

)

Valuation allowance

—

—

Net deferred tax assets

$

14,971

$

20,883

Balance of unrecognized tax benefits at January 1, 2007

$

1,200

Additions for tax positions of prior years

—

Additions for tax positions related to 2007

259

Reductions for tax positions of prior years

(607

)

Settlement of franchise tax audit

(96

)

Lapses in statutes of limitations

—

Balance of unrecognized tax benefits at December 31, 2007

$

756