Shutterfly 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

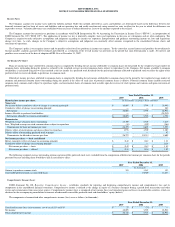

Segment Reporting

The Company operates in one industry segment — digital photofinishing services. The Company operates in one geographic area, being the United States of America.

FASB Statement No. 131, Disclosures about Segments of an Enterprise and Related Information

, establishes standards for reporting information about operating segments.

Operating segments are defined as components of an enterprise about which separate financial information is available that is evaluated regularly by the chief operating decision maker,

or decision making group, in deciding how to allocate resources and in assessing performance. The Company’

s chief operating decision maker is its Chief Executive Officer. The

Company’

s Chief Executive Officer reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial performance. The

Company has one business activity and there are no segment managers who are held accountable for operations, operating results and plans for products or components below the

consolidated unit level. Accordingly, the Company reports as a single operating segment.

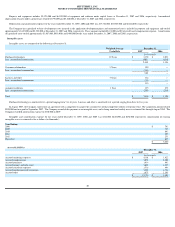

Recent Accounting Pronouncements

In September 2006, the FASB issued FAS No. 157, “Fair Value Measurements” (“FAS 157”).

FAS 157 defines fair value, establishes a framework for measuring fair value and

expands disclosures about fair value measurements. In February 2008, the FASB issued a staff position that delays the effective date of SFAS 157 for all nonfinancial assets and

liabilities except for those recognized or disclosed at least annually. Except for the delay for nonfinancial assets and liabilities, SFAS 157 is effective for fiscal years beginning after

November 15, 2007 and interim periods within such years. The Company does not expect the adoption of FAS 157 will have a material effect on its financial position and results of

operations.

In February 2007, the FASB issued FAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities” (“FAS 159”)

which permits entities to choose to measure

many financial instruments and certain other items at fair value that are not currently required to be measured at fair value. FAS 159 was effective for the Company on January 1, 2008.

The Company does not expect the adoption of FAS 159 will have a material effect on its financial position and results of operations.

In December 2007, the FASB issued FAS No. 141R, “Business Combinations” (“FAS 141R”)

which replaces FAS No. 141 and establishes principles and requirements for how the

acquirer of a business recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree. FAS

141R also provides guidance for recognizing and measuring the goodwill acquired in the business combination and determines what information to disclose to enable users of the

financial statements to evaluate the nature and financial effects of the business combination. This Statement applies prospectively to business combinations for which the acquisition

date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. Early adoption of FAS 141R is prohibited. The Company is currently

evaluating the impact, if any, of adopting FAS 141R on its financial position and results of operations.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements” (“FAS 160”)

which amends ARB 51 to establish accounting

and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an

ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. In addition to the amendments to ARB 51, this Statement amends

FASB Statement No. 128, Earnings per Share; so that earnings-per-

share data will continue to be calculated the same way those data were calculated before this Statement was issued.

This Statement is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. The Company is currently evaluating the impact, if

any, of adopting FAS 160 on its financial position and results of operations.

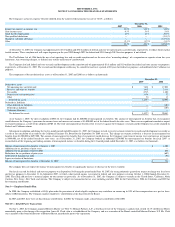

Note 3 — Change in Accounting Policy

On June 29, 2005, the FASB issued Staff Position 150-5, Issuer’s Accounting under FASB Statement No. 150 (“SFAS 150”) for Freestanding Warrants and

Other Similar

Instruments on Shares That Are Redeemable

(“FSP 150-5”). Under FSP 150-5, the freestanding warrants that were related to the Company’

s redeemable convertible preferred stock

were classified as liabilities and were recorded at fair value. The Company previously accounted for freestanding warrants for the purchase of redeemable convertible preferred stock

under EITF Issue No. 96-18, Accounting for Equity Instruments that are Issued to Other than Employees for Acquiring, or in Conjunction with Selling, Goods or Services (“EITF 96-

18”).

The Company adopted FSP 150-

5 and accounted for the cumulative effect of the change in accounting principle as of July 1, 2005. For the year ended December 31, 2005, the

impact of the change in accounting principle was to increase net income by $442,000, or $0.14 per share. There was $464,000 of additional expense recorded in other income

(expense), net to reflect the increase in fair value between July 1, 2005 and December 31, 2005. In the year ended December 31, 2006, the Company recorded $153,000 of additional

income reflected as other income (expense), net to reflect the decrease in fair value of the warrants. There were no amounts recorded in 2007.

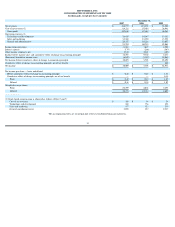

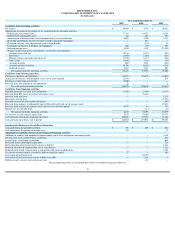

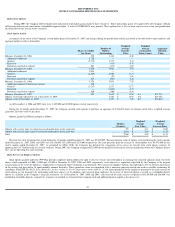

Note 4 — Balance Sheet Components

Cash, Cash Equivalents, and Short Term Investments

The components of the Company’s cash, cash equivalents, and short term investments, including the unrealized gains (losses) associated with each are as follows:

The contractual maturities for all of the Company’s available for sale securities are less than one year (See subsequent event Note 11.)

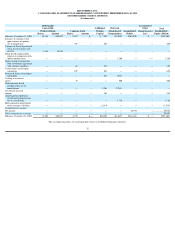

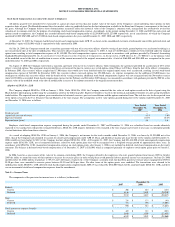

Property and Equipment

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2007

December 31, 2006

Book Value

Gross Unrealized

Gains/(Losses)

Fair Value

Book Value

Gross Unrealized

Gains/(Losses)

Fair Value

In thousands

In thousands

Cash

$

15,955

$

-

$

15,955

$

9,154

$

-

$

9,154

Cash Equivalents

Money Market Funds

22,363

-

22,363

17,829

-

17,829

Commercial Paper

84,284

(20

)

84,264

92,123

(54

)

92,068

Total Cash Equivalents

106,647

(20

)

106,627

109,952

(54

)

109,897

US Government Agency Securities

3,000

2

3,002

-

-

-

Total Cash, Cash Equivalents, and

Short Term Investments

$

125,602

$

(18

)

$

125,584

$

119,106

$

(54

)

$

119,051

December 31,

2007

2006

In thousands

Computer and other equipment

$

66,663

$

41,880

Software

12,745

8,791

Leasehold improvements

7,952

4,903

Furniture and fixtures

2,282

1,348

89,642

56,922