Shutterfly 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

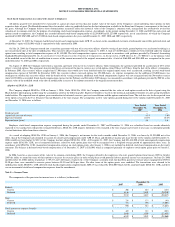

Legal Matters

On August 29, 2006, our former Chief Financial Officer, Virender Ahluwalia, sued the Company in San Mateo County Superior Court alleging causes of action for reformation of

contract, breach of contract and breach of fiduciary duty. The plaintiff claimed that he was entitled to exercise stock options for an additional 15,535 shares of the Company’

s common

stock because his vesting schedule should have been deemed to have started one year earlier than the date stated in the Company’

s corporate records. In addition, the plaintiff claimed

that the Company initially did not advise him that withholding taxes were due at the time of exercise of his nonqualified stock options to purchase 292,674 shares of common stock in

2005, but that the Company later modified that tax advice, extended his option exercise date, and required that he make provision for the applicable withholding taxes at the time of

exercise of such options. The plaintiff claimed he was damaged by having to immediately sell a portion of those shares upon his exercise in order to raise the funds necessary to pay

applicable withholding taxes. He also claimed that the calculation of the fair market value of the shares for the purpose of calculating his tax liability was improper. The plaintiff was

seeking compensatory and punitive damages. The case was stayed and sent to binding arbitration, and following a hearing on the legal issues and an evidentiary hearing, the Arbitrator

issued a Final Award on November 16, 2007 finding the Company not liable and dismissed all claims brought by Mr. Ahluwalia.

On or about June 18, 2007, Fotomedia Technologies, LLC filed suit in the United States District Court for the Eastern District of Texas, against the Company and several other

defendants alleging patent infringement. The Fotomedia Complaint sought unspecified damages, costs, interest and attorneys’

fees, and a permanent injunction. In lieu of answering

the Fotomedia Complaint, the Company moved to dismiss it under Rule 12 of the Federal Rules of Civil Procedure, by joining in a motion to the same effect filed by co-

defendant

Photobucket.com, Inc. While the motion was pending and not yet decided, on or about November 6, 2007, Fotomedia filed an Amended Complaint. The Amended Complaint likewise

alleges infringement of the same three patents and seeks unspecified damages, costs, interest and attorneys’

fees, and a permanent injunction. However, the amended complaint

dropped the allegations of willful infringement against the Company in connection with one of the patents-at-

issue. Defendants moved to dismiss the Amended Complaint as well. The

motion at this time is fully briefed but has not yet been ruled upon. As such, the Company has not yet been required to file an answer or other responsive pleading. On January 8,

2008, the court held a status conference and set May 28, 2009, as the date for the claims construction hearing, and set November 2, 2009 as the date for trial. Subsequently, the parties

agreed upon and submitted orders that establish a case schedule, which the court entered on February 29, 2008. At this time, the Company does not believe that the amount of potential

loss, if any, is reasonably estimable.

On or about February 5, 2008, Parallel Networks, LLC filed a lawsuit in the Eastern District of Texas against the Company and other companies, alleging patent

infringement. The Parallel Networks Complaint seeks damages of an unspecified amount, attorneys’

fees, and an injunction against all parties. The Company has not yet answered or

otherwise responded to the complaint At this time, the Company does not believe that the amount of potential loss, if any, is reasonably estimable.

From time to time, the Company may be involved in various legal proceedings arising in the ordinary course of business. At December 31, 2007, in the opinion of management,

there are no other matters that are expected to have a material adverse effect on the Company’s financial position, results of operations or cash flows.

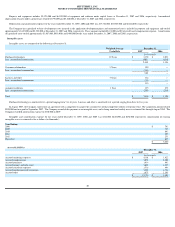

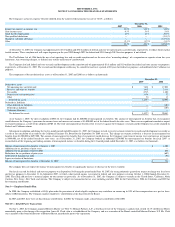

Note 7 — Common Stock

In

October 2006, the Company completed its IPO of common stock in which it sold and issued 5,800,000 shares of common stock, at an issue price of $15.00 per share. As a result

of the IPO, a total of $87.0 million in gross proceeds was raised, with net proceeds to the Company of $78.5 million after deducting underwriting fees and commissions of $6.1 million

and other offering costs of $2.4 million.

Upon the closing of the IPO, all shares of the Company’s redeemable convertible preferred stock outstanding automatically converted into 13,862,773 shares of common stock.

Warrants for Common Stock

During 2007, two warrant holders exercised their warrants for an aggregate of 27,299 shares of common stock. The transactions were effected through a net-

exercise, and as a

result, no cash proceeds were received by the Company. As of December 31, 2007, there were no remaining warrants outstanding.

Upon the effective date of the IPO, warrants to purchase 40,816 shares of redeemable convertible preferred stock converted into warrants to purchase 40,816 shares of common

stock, and warrants to purchase 40,816 shares of redeemable convertible preferred stock expired.

As discussed in Note 3, in 2005 the Company reclassified the freestanding preferred stock warrants as a liability and began adjusting the warrants to fair value at each reporting

period until the completion of the IPO.

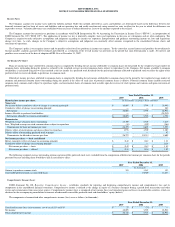

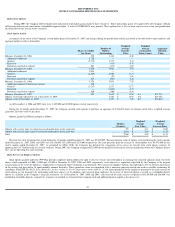

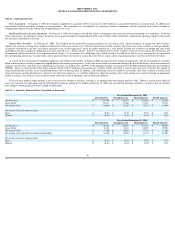

1999 Stock Plan

In September 1999, the Company adopted the 1999 Stock Plan (the “1999 Plan”).

Under the 1999 Plan, the Company issued shares of common stock and options to purchase

common stock to employees, directors and consultants. Options granted

under the Plan were incentive stock options or non-qualified stock options. Incentive stock options (“ISO”)

were granted only to Company employees, which includes officers and

directors of the Company. Non-qualified stock options (“NSO”)

and stock purchase rights were able to be granted to employees and consultants. Options under the Plan were to be

granted at prices not less than 85% of the deemed fair value of the shares on the date of the grant as determined by the Company’s Board of Directors (“the Board”),

provided, however,

that (i) the exercise price of an ISO and NSO was not less than 100% and 85% of the deemed fair value of the shares on the date of grant, respectively, and (ii) the exercise price of an

ISO and NSO granted to a 10% stockholder was not less than 110% of the deemed fair value of the shares on the date of grant. The Board determined the period over which options

become exercisable. The term of the options was to be no longer than five years for ISOs for which the grantee owns greater than 10% of the voting power of all classes of stock and no

longer than ten years for all other options. Options granted under the 1999 Plan generally vested over four years. The Board of Directors determined that no further grants of awards

under the 1999 Plan would be made after the Company’s IPO.

2006 Equity Incentive Plan

In June 2006, the Board adopted, and in September 2006 the Company’s stockholders approved, the 2006 Equity Incentive Plan (the “2006 Plan”),

and all shares of common stock

available for grant under the 1999 Plan transferred to the 2006 Plan. The 2006 Plan provides for the grant of ISOs to employees (including officers and directors who are also

employees) of the Company or of a parent or subsidiary of the Company, and for the grant of all other types of awards to employees, officers, directors, consultants, independent

contractors and advisors of the Company or any parent or subsidiary of the Company, provided such consultants, independent contractors and advisors render bona-

fide services not in

connection with the offer and sale of securities in a capital-

raising transaction. Other types of awards under the 2006 Plan include NSO restricted stock awards, stock bonus awards,

restricted stock units, and performance shares.

Options issued under the 2006 Plan are generally for periods not to exceed 10 years and are issued at the fair value of the shares of common stock on the date of grant as

determined by the Board. Prior to the Company’

s IPO, the Board determined the fair value of common stock in good faith based on the best information available to the Board and

Company’s management at the time of the grant. Following the IPO, the fair value of the Company’

s common stock is determined by the last sale price of such stock on the Nasdaq

Global Market. Options issued under the 2006 Plan typically vest with respect to 25% of the shares one year after the options’

vesting commencement date, and the remainder ratably

on a monthly basis over the following three years. Option holders under the 2006 Plan are allowed to exercise options prior to vesting.

At the time of adoption of the 2006 Plan, there were 1,358,352 shares of common stock authorized for issuance under the 2006 Plan, plus 92,999 shares of common stock from the

1999 Plan that were unissued. The 2006 Plan provides for automatic replenishments on January 1 of 2008, 2009, and 2010, of the lesser of a) 4.62% of stock options issued and

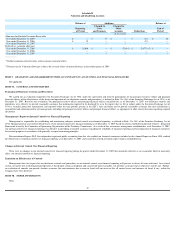

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS