Shutterfly 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

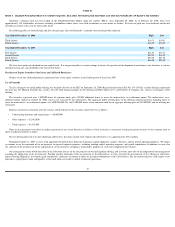

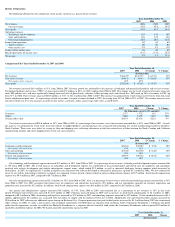

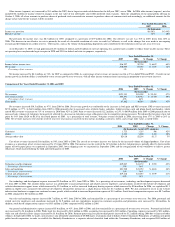

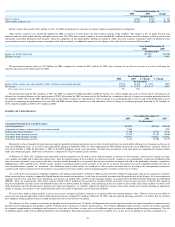

ITEM 6. SELECTED FINANCIAL DATA.

The consolidated statements of income data for the years ended December 31, 2007, 2006 and 2005 and the consolidated balance sheet data as of December 31,

2007 and 2006

have been derived from our audited consolidated financial statements included elsewhere in this annual report. The consolidated statements of income

data for the years ended

December 31, 2004 and 2003 and the consolidated balance

sheet data as of December 31, 2005, 2004 and 2003 have been derived from our

audited consolidated financial statements

not included in this annual report. The following selected consolidated financial data should be read in conjunction with our “Management’

s Discussion and Analysis of Financial

Condition and Results of Operations” and consolidated financial statements and related notes to those statements included elsewhere in this annual report.

__________

Year Ended December 31,

2007

2006

2005

2004

2003

(In thousands, except per share amounts)

Consolidated Income Statement Data:

Net revenues

$186,727

$123,353

$83,902

$54,499

$31,395

Cost of net revenues(1)

84,111

55,491

36,941

24,878

14,310

Gross profit

102,616

67,862

46,961

29,621

17,085

Operating expenses:

Technology and development(1)

28,635

19,087

13,152

7,433

4,970

Sales and marketing(1)

33,363

21,940

15,252

7,705

3,991

General and administrative(1)

29,557

19,216

13,657

10,126

5,629

Total operating expense

91,555

60,243

42,061

25,264

14,590

Income from operations

11,061

7,619

4,900

4,357

2,495

Interest expense

(179)

(266)

(367)

(471)

(392)

Other income (expense) net

5,515

2,387

(103

)

81

9

Income before income taxes and cumulative

effect of change in accounting principle

16,397

9,740

4,430

3,967

2,112

(Provision) / benefit for income taxes(2)

(6,302

)

(3,942

)

24,060

(258

)

(68

)

Net income before cumulative effect

of change in accounting principle(2)

10,095

5,798

28,490

3,709

2,044

Cumulative effect of change in accounting principle

—

—

442

—

—

Net income (2)

$

10,095

$

5,798

$

28,932

$

3,709

$

2,044

Net income per share:

Basic

$ 0.42

$ 0.67

$ 1.45

$

—

$

—

Diluted

$ 0.38

$ 0.56

$ 1.02

$

—

$

—

Weighted Average Shares

Basic

24,295

8,622

3,255

2,231

1,574

Diluted

26,273

10,331

4,609

2,231

1,574

(1)

Includes stock

-

based compensation as follows:

Year Ended December 31,

2007

2006

2005

2004

2003

(In thousands)

Cost of net revenues

$189

$ 96

$ 28

$ 21

$ 3

Technology and development

880

736

826

263

32

Sales and marketing

877

521

239

117

11

General and administration

2,055

947

2,217

1,790

124

$

4,001

$

2,300

$

3,310

$

2,191

$

170

(2)

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Critical Accounting Policies and Estimates — Income Taxes”

for a discussion

of the uncertainty related to our deferred tax asset.

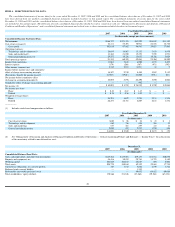

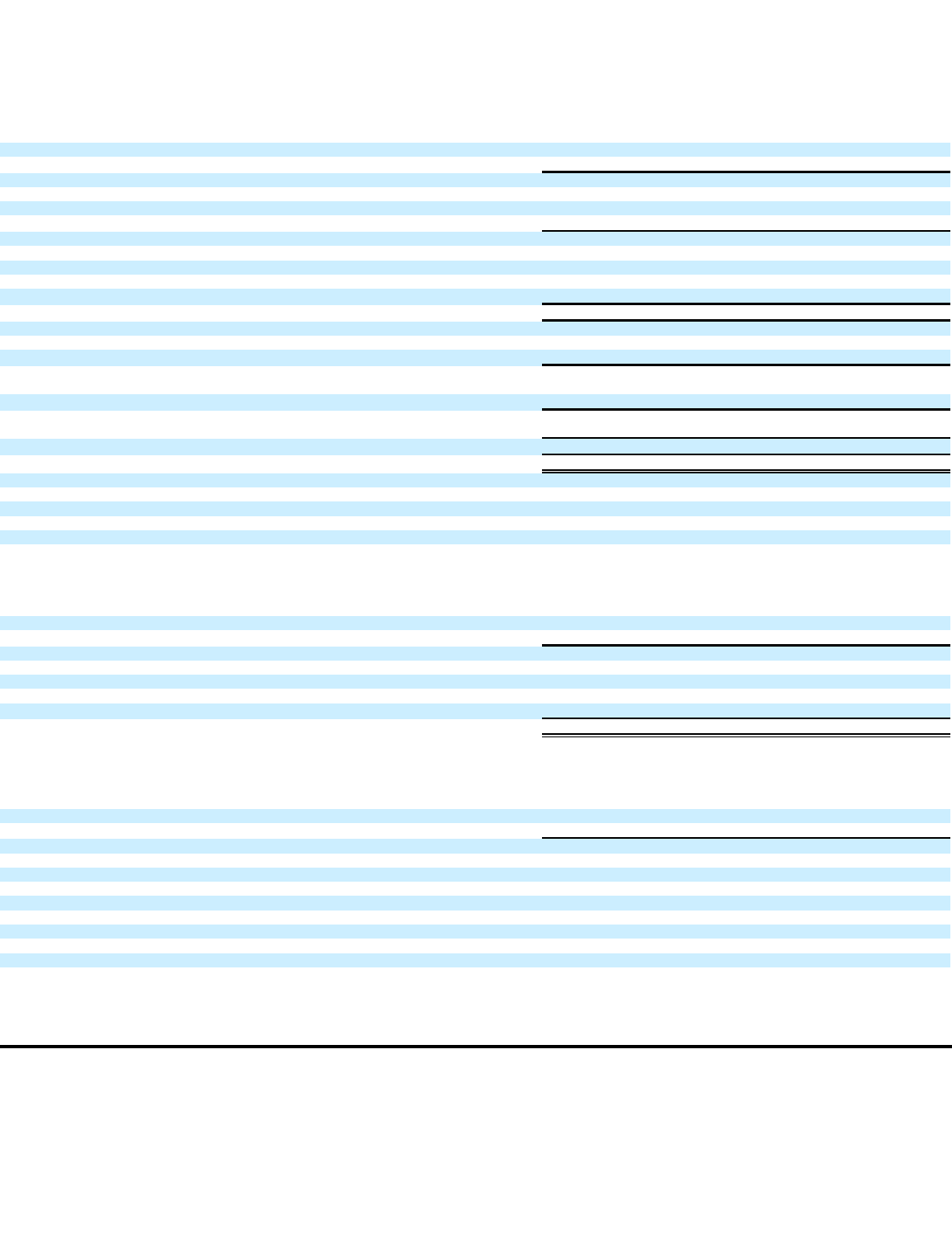

December 31,

2007

2006

2005

2004

2003

(In thousands)

Consolidated Balance Sheet Data:

Cash, cash equivalents, and short term investments

$125,584

$119,051

$39,153

$13,781

$10,670

Property and equipment, net

48,416

30,919

20,761

11,723

5,140

Working capital

104,025

102,165

22,687

690

2,002

Total assets

208,770

180,160

89,552

29,865

17,754

Capital lease obligations, less current portion

107

1,742

3,646

2,709

1,314

Preferred stock warrant liability

—

—

1,535

—

—

Redeemable convertible preferred stock

—

—

89,652

69,822

69,668

Total stockholders

’

equity (deficit)

170,566

151,326

(27,262)

(59,568)

(65,333)

20