Shutterfly 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

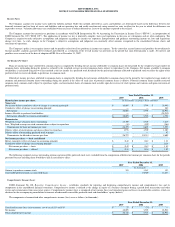

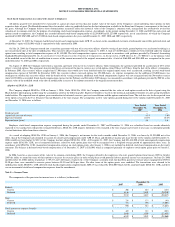

Note 5 — Acquisitions

Make It About Me

On June 14, 2007, the Company acquired CustomAbility, LLC, a publishing company that produces customized children’s books under the brand name

Make It About Me

(“MIAM”). This acquisition augmented the Company’s personal publishing platform. The transaction was accounted for as a purchase business combination.

The total purchase price of $1,632,000 consisted of $1,600,000 in cash consideration and approximately $32,000 in transaction fees. The initial purchase price was allocated to the

assets and liabilities acquired based on their fair value, with the majority of the cost being allocated to purchased technology of $1,320,000 and licensed content of $150,000. The

identifiable intangible assets have useful lives not exceeding five years, and a weighted average life of 4.8 years. No amount was allocated to in-

process research and development and

$179,000 was initially allocated to goodwill. Goodwill represents the excess of the purchase price over the fair value of the net tangible and intangible assets acquired and for tax

purposes, will be amortized over 15 years.

In addition to the initial cash consideration, the sellers of MIAM can earn additional consideration totaling $200,000 and $400,000 if certain contingencies are met. If these

contingencies are met, these earn-

out payments will be recorded as additional goodwill. The first contingency was met as of November 2007, increasing goodwill by $200,000. This

amount was subsequently paid in January 2008.

Prior to the acquisition, the Company was as a reseller of MIAM’

s publishing products. As a part of this transaction, the existing fulfillment agreement between the two parties was

cancelled. No gain or loss resulted from the settlement of this pre-existing relationship.

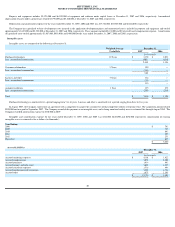

Memory Matrix

On June 1, 2005, the Company acquired 100% of Memory Matrix, Inc., (“Memory Matrix”)

a Nevada corporation, in exchange for 109,302 shares of common stock. The

acquisition was effected using a “reverse triangular”

merger in which a wholly owned Shutterfly subsidiary was merged with and into Memory Matrix, resulting in Memory Matrix

becoming a wholly owned subsidiary of Shutterfly. Memory Matrix was considered to be a “developmental stage” enterprise and did not meet the definition of a “business”

under

SFAS No. 141, Business Combinations

, for business combination purposes. In accordance with SFAS No. 141, the acquisition of Memory Matrix was accounted for as an acquisition

of assets.

As additional consideration for the acquisition, the Company also issued 120,698 shares of common stock to the employees of Memory Matrix, subject to vesting and repurchase

rights over a period of 18 months, in exchange for unvested Memory Matrix restricted shares held by such employees prior to the merger. $671,000 of deferred stock-

based

compensation was recorded based on the intrinsic value of the shares at the time of the acquisition. The Company recognized $0 and $94,000 of stock-

based compensation expense for

the year ended December 31, 2007 and 2006, respectively, relating to the vesting of the restricted shares.

The total purchase price was $690,000, based on an estimated per share fair value of $6.00 on the date of the transaction, and was allocated to various tangible and intangible assets

including: acquired workforce of $279,000 and purchased technology of $564,000.

These were offset by other net liabilities of $153,000 which consisted primarily of a deferred tax liability of $336,000, other assumed liabilities of $100,000, and cash and other assets

of $283,000. In addition, the Company recorded a deferred tax asset on the date of acquisition of $201,000, which was offset in full by a valuation allowance. In the fourth quarter of

2005, the valuation allowance was released, which reduced non-current intangibles accordingly.

The acquired workforce intangible asset was amortized on a straight-line basis over one year. The net core technology asset is amortized on a straight-line basis over the asset’

s

life, which is estimated as three years.

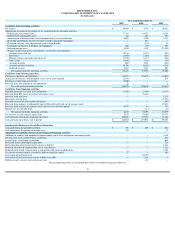

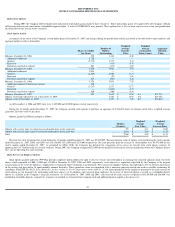

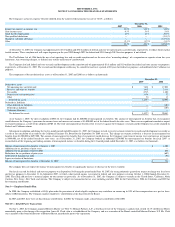

Note 6 — Commitments and Contingencies

Leases

The Company leases office and production space under various non-

cancelable operating leases that expire no later than November 2014. Rent expense was $1,925,000,

$1,295,000 and $1,181,000, for the years ended December 31, 2007, 2006 and 2005, respectively.

Rent expense is recorded on a straight-

line basis over the lease term. When a lease provides for fixed escalations of the minimum rental payments, the difference between the

straight-line rent charged to expense, and the amount payable under the lease is recognized as deferred rent.

The Company leases certain equipment, software and colocation services under non-cancelable capital leases, operating leases or long-

term agreements that expire at various dates

through the year 2011. The leased equipment is subject to a security interest. The total outstanding obligation under capital leases at December 31, 2007 and 2006 was $915,000 and

$3,703,000, respectively.

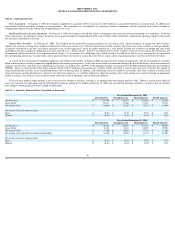

At December 31, 2007, the total future minimum payments under non-cancelable scheduled rentals are as follows:

Purchase obligations consist of non-cancelable marketing agreements, co-location services and printing equipment rental. As of December 31, 2007, the Company’

s purchase

obligations totaled $2,821,000.

Indemnifications

In the normal course of business, the Company enters into contracts and agreements that contain a variety of representation and warranties and provide for general

indemnifications. The Company’

s exposure under these agreements is unknown because it involves future claims that may be made against the Company, but have not yet been made.

To date, the Company has not paid any claims or been required to defend any action related to its indemnification obligations. However, the Company may record charges in the future

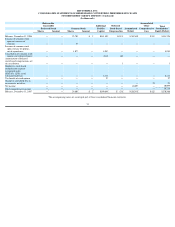

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Operating

Leases

Capital

Leases

Year Ending:

In thousands

2008

$

2,548

$

864

2009

2,508

93

2010

1,537

12

2011

721

6

2012

742

—

Thereafter

1,335

—

Total minimum lease payments

$

9,391

$

975

Less: amount representing interest

(60

)

Present value of future minimum lease payments

915

Less: current portion

(808

)

Non

-current portion of capital lease obligations

$

107