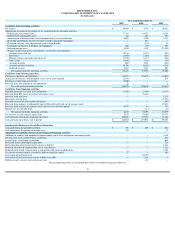

Shutterfly 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Website Development Costs

The Company capitalizes eligible costs associated with software developed or obtained for internal use in accordance with AICPA Statement of Position 98-1,

Accounting for the

Costs of Computer Software Developed or Obtained for Internal Use , and EITF 00-02, Accounting for Web Site Development Costs.

Accordingly, the Company expenses all costs that

relate to the planning and post implementation phases. Costs incurred in the development phase are capitalized and amortized over the product’

s estimated useful life, generally three

years. Costs associated with minor enhancements and maintenance for the Company

’s website are expensed as incurred.

Long-Lived Assets

The Company reviews long-

lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable in

accordance with Statement of Financial Accounting Standards No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets (“SFAS No. 144”).

Recoverability is

measured by comparison of the carrying amount to the future net cash flows which the assets are expected to generate. If such assets are considered to be impaired, the

impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the projected discounted future cash flows arising from the asset using a

discount rate determined by management to be commensurate with the risk inherent to the Company’s current business model.

Goodwill and Intangible Assets

The Company accounts for intangible assets and goodwill in accordance with Statement of Financial Accounting Standards No. 142,

Goodwill and Other Intangible Assets

(“SFAS No. 142”).

Goodwill and intangible assets with indefinite lives are not amortized but are tested for impairment on an annual basis or whenever events or changes in

circumstances indicate that the carrying amount of these assets may not be recoverable. Intangible assets with finite useful lives are amortized using the straight-

line method over their

useful lives and are reviewed for impairment in accordance with SFAS No. 144.

Intangible assets from acquisitions are amortized on a straight-line basis over the estimated useful lives which range from one to five years.

Preferred Stock Warrants

Warrants and other similar instruments related to shares that are redeemable are accounted for in accordance with Statement of Financial Accounting Standards No. 150,

Accounting for Certain Financial Instruments with

Characteristics of Both Liabilities and Equity (“SFAS No. 150”). Under SFAS No. 150, warrants that were related to the Company’

s

redeemable convertible preferred stock were recorded as liabilities on the consolidated balance sheet. The warrants were subject to re-

measurement at each balance sheet date and any

change in fair value was recognized as a component of other income (expense), net. Subsequent to the Company’s IPO and the associated conversion of the Company’

s outstanding

redeemable convertible preferred stock to common stock, the warrants to exercise the redeemable convertible preferred stock converted into common stock warrants; accordingly, the

liability related to the redeemable convertible preferred stock warrants was transferred to common stock and additional paid-in-

capital and the common stock warrants are no longer

subject to re-measurement.

Revenue Recognition

The Company generally recognizes revenue from product sales, net of applicable sales tax upon shipment when persuasive evidence of an arrangement exists, the selling price is

fixed or determinable and collection of resulting receivables is reasonably assured. Revenues from amounts billed to customers, including prepaid orders, are deferred until shipment of

fulfilled orders or until the prepaid period expires. Shipping charged to customers is recognized as revenue at the time of shipment.

The Company provides its customers with a 100% satisfaction guarantee whereby products can be returned within a 30-

day period for a reprint or refund. The Company maintains

an allowance for estimated future returns based on historical data. The provision for estimated returns is included in deferred revenue.

The Company periodically provides incentive offers to its customers in exchange for setting up an account and to encourage purchases. Such offers include free products and

percentage discounts on current purchases. Discounts, when accepted by customers, are treated as a reduction to the purchase price of the related transaction and are presented in net

revenues. Production costs related to free products are included in cost of revenues upon redemption.

Revenue from referral fees for click-throughs is recognized in the period that the click-through impression is delivered.

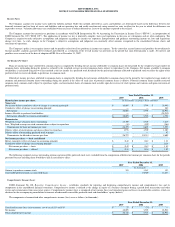

Advertising Costs

Advertising costs are expensed as incurred, except for direct mail advertising which is expensed when the advertising first takes place. Total direct mail costs capitalized as of

December 31, 2007 and December 31, 2006 was $355,000 and $0. Total advertising costs are included in selling and marketing expenses and totaled approximately $10,800,000,

$5,710,000 and $4,878,000 during the years ended December 31, 2007, 2006 and 2005, respectively.

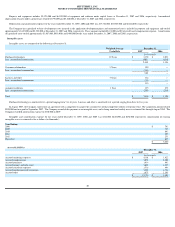

Stock-Based Compensation

Prior to January 1, 2006, the Company accounted for stock-

based employee compensation arrangements in accordance with the provisions of Accounting Principles Board Opinion

No. 25,

Accounting for Stock Issued to Employees (“APB No. 25”),

and related interpretations, and followed the disclosure provisions of Statement of Financial Accounting Standards

No. 123,

Accounting for Stock-Based Compensation (“SFAS No. 123”).

Under APB No. 25, compensation expense is based on the difference, if any, on the date of the grant, between

the fair value of the Company’s stock and the exercise price. Employee stock-

based compensation determined under APB No. 25 is recognized based on guidance provided in Financial

Accounting Standards Board Interpretation No. 28, Accounting for Stock Appreciation Rights and Other Variable Stock Option or Award Plans (“FIN 28”),

which provides for

accelerated expensing over the option vesting period.

The Company accounts for equity instruments issued to non-employees in accordance with the provisions of SFAS No. 123, Emerging Issues Task Force Abstract No. 96-

18,

Accounting for Equity Instruments that are Issued to Other than

Employees for Acquiring, or in Conjunction with Selling, Goods or Services (“EITF 96-18”), and FIN 28.

Effective January 1, 2006, the Company adopted the fair value provisions of Statement of Financial Accounting Standards No. 123R, Share-Based Payment (“SFAS No. 123R”

),

which supersedes its previous accounting under APB 25. SFAS No. 123R requires the recognition of compensation expense, using a fair-

value based method, for costs related to all

share-based payments including stock options. SFAS No. 123R requires companies to estimate the fair value of share-based payment awards on the date of grant using an option-

pricing model. The Company adopted SFAS No. 123R using the prospective transition method, which requires that for nonpublic entities that used the minimum value method for

either pro forma or financial statement recognition purposes, SFAS No. 123R shall be applied to option grants after the required effective date. For options granted prior to the

SFAS No. 123R effective date, which the requisite service period has not been performed as of January 1, 2006, the Company will continue to recognize compensation expense on the

remaining unvested awards under the intrinsic-

value method of APB 25. In addition, the Company will continue amortizing those awards valued prior to January 1, 2006 utilizing an

accelerated amortization schedule while all option grants valued after January 1, 2006 will be expensed on a straight-line basis over the requisite period.

In November 2005, the Financial Accounting Standards Board (“FASB”) issued FASB Staff Position No. FAS 123R-3, Transition Election Related to Accounting for

Tax Effects

of Share-Based Payment Awards. The Company has elected to adopt the prospective transition method provided in the FASB Staff Position for calculating the tax effects of stock-

based compensation pursuant to SFAS No. 123R.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS