Shutterfly 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

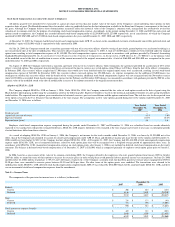

Note 11 – Subsequent Events

Nexo Acquisition:

On January 4, 2008, the Company completed its acquisition of Nexo Systems for $10.0 million in cash and $4.0 million in restricted stock. In addition, the

two founders of Nexo joined the Company as vice presidents. The acquisition was accounted for as a purchase business combination, and the restricted stock will be recorded as

compensation expense over the vesting term of approximately two years.

Intellectual Property License Agreement

: On February 8, 2008, the Company entered into a license arrangement of certain of its patented technology to a third party. Under the

terms of the license, the third party will pay the license fee in annual installments through March 2010, each of which will be recorded as a reduction of operating expense in the period

that the license installment is received.

Auction Rate Securities : At February 29, 2008, $52.3 million of our marketable securities portfolio was invested in AAA rated investments in auction-

rate debt securities.

Auction-rate securities are long-term variable rate bonds tied to short-

term interest rates. After the initial issuance of the securities, the interest rate on the securities is reset periodically,

at intervals established at the time of issuance (primarily every twenty-eight days), based on market demand for a reset period. Auction-

rate securities are bought and sold in the

marketplace through a competitive bidding process often referred to as a “Dutch auction”.

If there is insufficient interest in the securities at the time of an auction, the auction may not

be completed and the rates may be reset to predetermined “penalty” or “maximum”

rates. Following such a failed auction, we would not be able to access our funds that are invested in

the corresponding auction-rate securities until a future auction of these investments is successful or new buyers express interest in purchasing these securities in between reset dates.

As a result of the current negative liquidity conditions in the global credit markets, in February 2008, auctions for $42.3 million of original par value of our auction-

rate securities

failed, rendering these securities temporarily illiquid through the normal auction process. At the time of our initial investment and through the date of this Report, all of our auction-

rate

securities remain AAA rated. The assets underlying each security are student loans and 95% of the principal amounts are guaranteed by the Federal Family Education Loan Program

(FFELP). Since we cannot predict when future auctions related to $52.3 million of our auction-

rate securities will be successful, it may become necessary to classify this amount as

long-

term marketable securities in our consolidated balance sheet in future periods. In addition, if the underlying issuers are unable to successfully clear future auctions or if their credit

rating deteriorates and the deterioration is deemed to be other-than-temporary, we would be required to adjust the carrying value of the auction-

rate securities through an impairment

charge to earnings. Any of these events could materially affect our results of operations and our financial condition.

To access these funds in future periods, it may be necessary to attempt to sell these securities at an amount below our original purchase value. However, based on our ability to

access our cash and cash equivalents and our other liquid investments, totaling $53.7 million at February 29, 2008, and our expected operating cash flows, we believe that we currently

have adequate working capital resources to fund our operations.

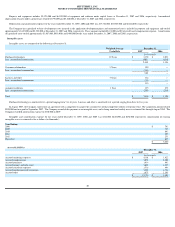

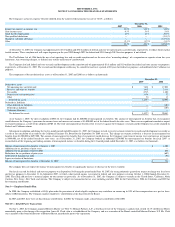

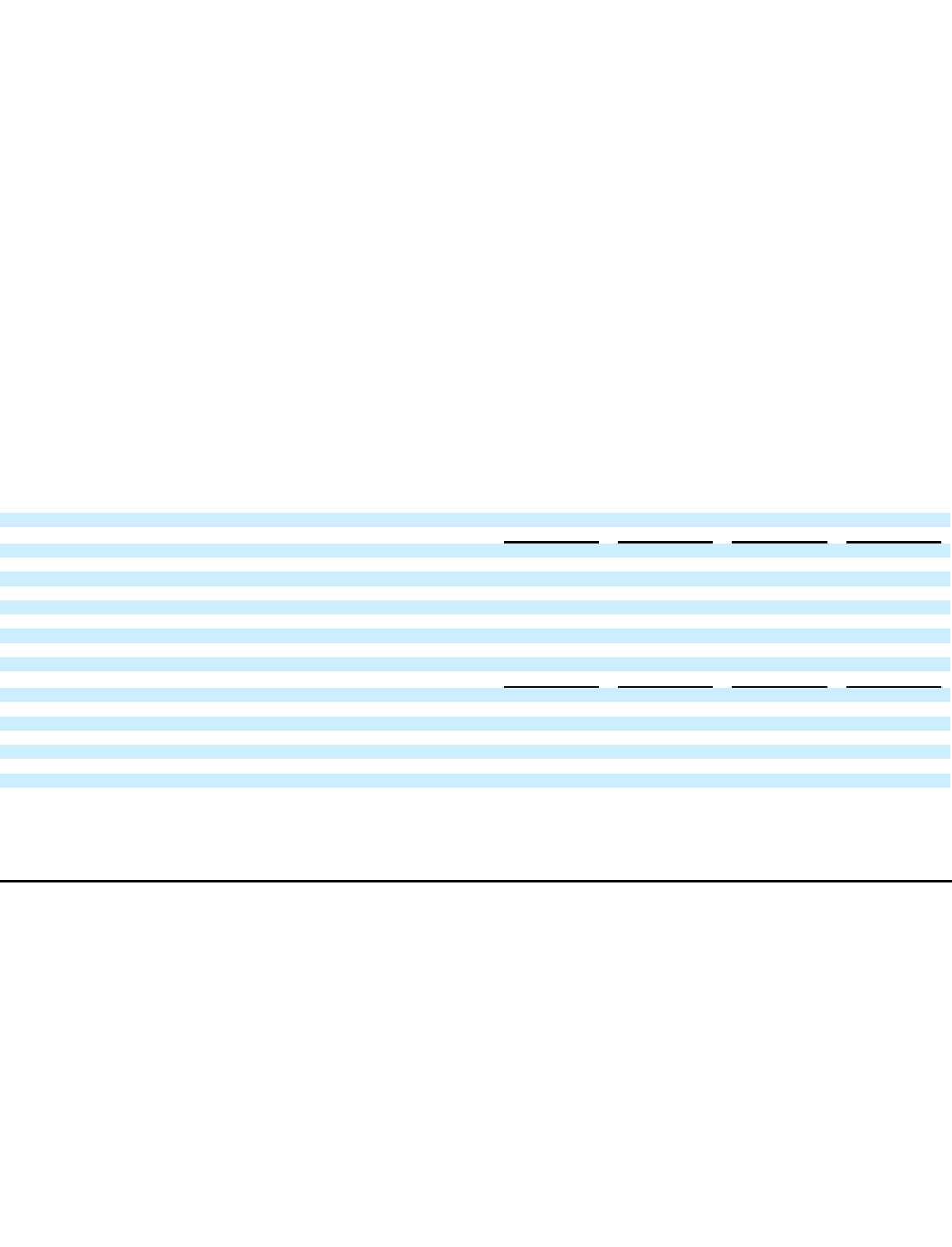

Note 12 — Quarterly Financial Data (Unaudited, in thousands)

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Year Ended December 31, 2007

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Net Revenues

$

26,705

$

29,877

$

32,602

$

97,543

Gross Profit

13,671

15,045

15,362

58,538

Net income (loss)

$

(1,060

)

$

(2,439

)

$

(3,314

)

$

16,909

Net income (loss) per common share:

Basic

$

(0.04

)

$

(0.10

)

$

(0.14

)

$

0.68

Diluted

$

(0.04

)

$

(0.10

)

$

(0.14

)

$

0.63

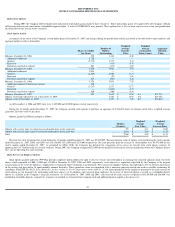

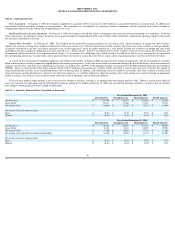

Year Ended December 31, 2006

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Net Revenues

$

16,883

$

19,637

$

21,155

$

65,678

Gross Profit

8,134

9,881

10,289

39,558

Net income (loss)

$

(1,565

)

$

(2,093

)

$

(2,747

)

$

12,203

Net income (loss) allocable to common shareholders

$

(1,565

)

$

(2,093

)

$

(2,747

)

$

12,203

Net income (loss) per common share:

Basic

$

(0.41

)

$

(0.54

)

$

(0.70

)

$

0.53

Diluted

$

(0.41

)

$

(0.54

)

$

(0.70

)

$

0.50

46