Shutterfly 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

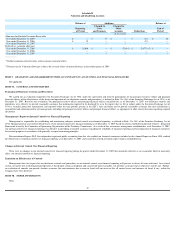

Inducement Options

During 2007, the Company offered employment inducement stock option grant awards to three executives. These inducement grants were approved by the Company’

s Board

of Directors and were not issued under a shareholder approved plan. A total of 380,000 NSOs were granted. These options have a 10 year term, and vest over a four year period from

the initial date of hire of each of the executives.

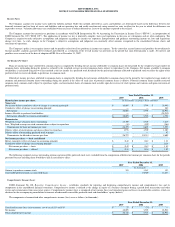

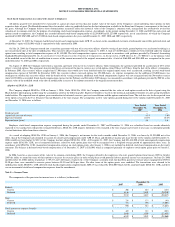

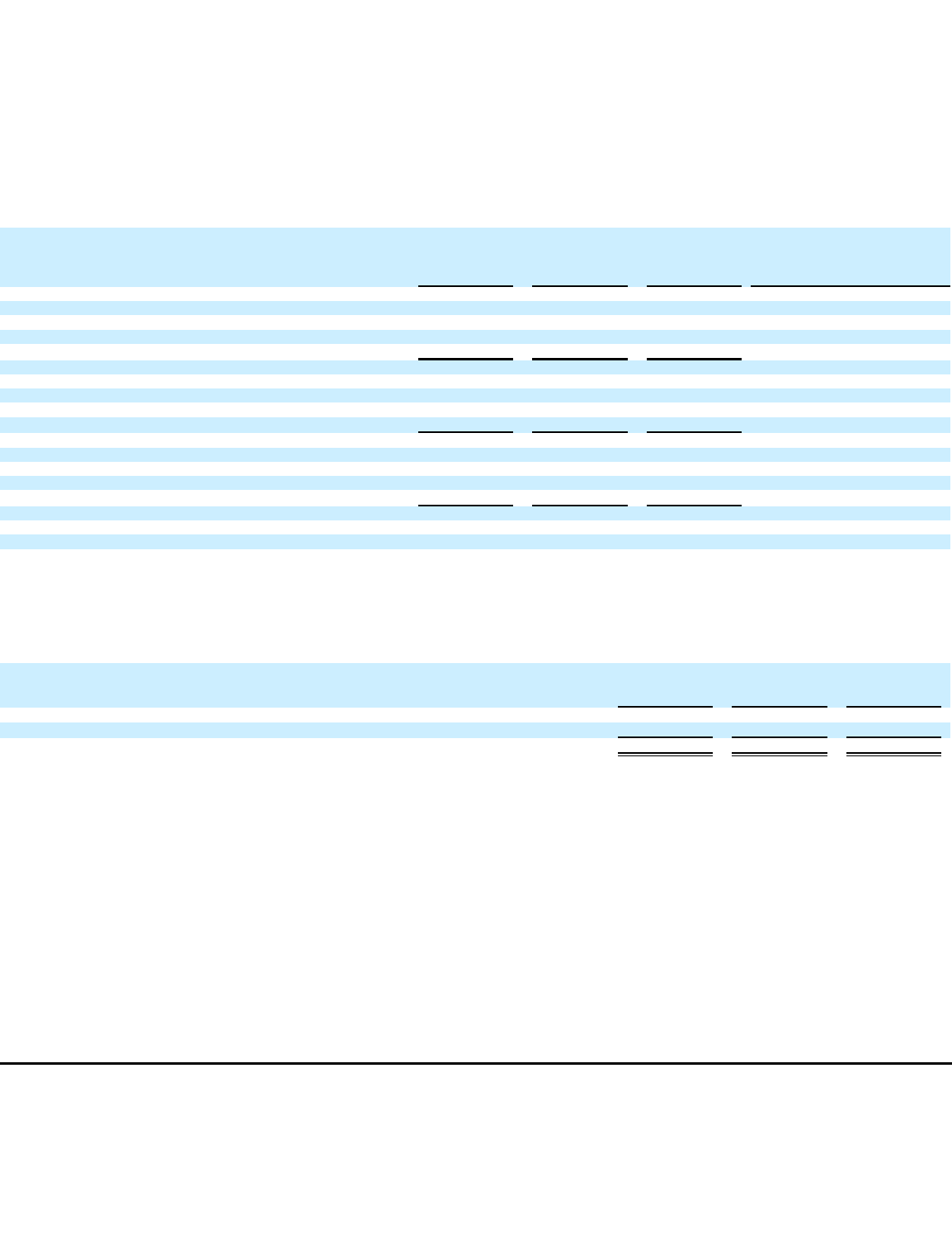

Stock Option Activity

A summary of the status of the Company’

s stock option plans at December 31, 2007 and changes during the periods then ended is presented in the table below (share numbers and

aggregate intrinsic value in thousands):

As of December 31, 2006 and 2005, there were 1,485,000 and 489,000 options vested, respectively.

During the 12 months ended December 31, 2007, the Company granted stock options to purchase an aggregate of 2,216,694 shares of common stock with a weighted average

grant-date fair value of $9.33 per share.

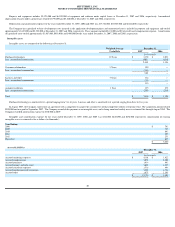

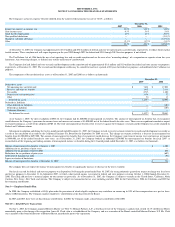

Options granted in 2006 are grouped as follows:

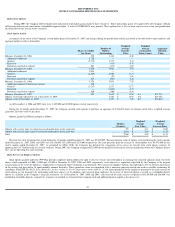

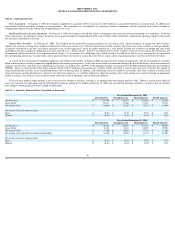

The total fair value of options that vested during the 12 months ended December 31, 2007 was $5,250,000. The total intrinsic value of options exercised during the twelve months

ended December 31, 2007, 2006, and 2005 was $18,136,000, $531,000 and $3,274,000 respectively. Net cash proceeds from the exercise of stock options were $4,975,000 for the

twelve months ended December 31, 2007. As permitted by SFAS 123R, the Company has deferred the recognition of its excess tax benefit from stock option exercises of

approximately $5.3 million until it is actually realized. During 2007, the Company recognized $27,000 of non-

qualified tax benefit in state tax jurisdictions where the Company did not

have any net operating loss carry forwards.

Early Exercise of Employee Options

Stock options granted under the 1999 Plan provides employee option holders the right to elect to exercise unvested options in exchange for restricted common stock. Unvested

shares, which amounted to 5,000, 31,000 and 138,000 at December 31, 2007, 2006 and 2005, respectively, were subject to a repurchase right held by the Company at the original

issuance price in the event the optionees’

employment is terminated either voluntarily or involuntarily. For exercises of employee options, this right lapses 25% on the first anniversary

of the vesting start date and in 36 equal monthly amounts thereafter. These repurchase terms are considered to be a forfeiture provision and do not result in variable accounting. In

accordance with EITF No. 00-23, Issues Related to the Accounting for Stock Compensation under APB No. 25,

the shares purchased by the employees pursuant to the early exercise of

stock options are not deemed to be outstanding until those shares vest. In addition, cash received from employees for exercise of unvested options is treated as a refundable deposit

shown as a liability in the Company’

s financial statements. As of December 31, 2007, 2006 and 2005, cash received for early exercise of options of $0, $9,000 and $38,000, was

included in refundable deposits, respectively. Amounts so recorded are transferred into common stock and additional paid-in capital as the shares vest.

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Shares

Available

for Grant

Number of

Options

Outstanding

Weighted

Average

Exercise

Price

Weighted

Average

Contractual

Term (Years)

Aggregate

Intrinsic

Value

Balances, December 31, 2004

510

1,336

0.40

Additional authorized

2,720

—

—

Granted

(2,372

)

2,372

5.12

Exercised

—

(

315

)

0.35

Forfeited, cancelled or expired

501

(375

)

2.89

Balances, December 31, 2005

1,359

3,018

3.91

Additional authorized

2,055

—

—

Granted

(2,269

)

2,269

11.11

Exercised

—

(

52

)

1.61

Forfeited, cancelled or expired

233

(201

)

6.10

Balances, December 31, 2006

1,378

5,034

7.28

Additional authorized (inducement grants)

380

—

—

Granted

(2,217

)

2,217

22.17

Exercised

—

(

1,049

)

4.75

Forfeited, cancelled or expired

560

(560

)

9.36

Balances, December 31, 2007

101

5,642

$

13.39

8.1

$71,253

Options vested and expected to vest at December 31, 2007

5,165

$

12.92

8.0

$67,468

Options vested at December 31, 2007

1,917

$

7.05

6.9

$35,610

Options

Granted

Weighted

Average

Fair Value

Weighted

Average

Exercise Price

Options with exercise price less than reassessed market price on the grant date

255

$

4.43

$

10.00

Options with exercise price equal to reassessed market price on the grant date

2,014

$

5.06

$

11.25

Total

2,269

$

4.99

$

11.11

43