Shutterfly 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

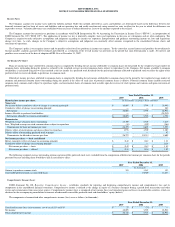

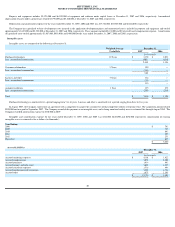

Property and equipment includes $5,121,000 and $6,502,000 of equipment and software under capital leases at December 31, 2007 and 2006, respectively. Accumulated

depreciation of assets under capital leases totaled $3,798,000 and $3,820,000 at December 31, 2007 and 2006, respectively.

Depreciation and amortization expense for the years ended December 31, 2007, 2006 and 2005 was $17,384,000, $10,525,000 and $6,246,000, respectively.

The Company has capitalized website development costs incurred in the application development phase and unamortized cost is included in property and equipment and totaled

approximately $3,619,000 and $2,582,000 at December 31, 2007 and 2006, respectively. These amounts included $111,000 and $0 of stock based compensation expense. Amortization

of capitalized costs totaled approximately $1,467,000, $993,000, and $404,000 for the years ended December 31, 2007, 2006 and 2005, respectively.

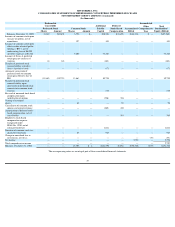

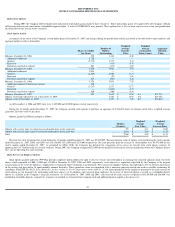

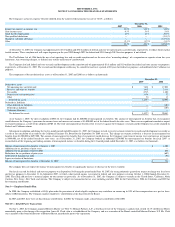

Intangible Assets

Intangible assets are composed of the following at December 31:

Purchased technology is amortized over a period ranging from 5 to 16 years. Licenses and other is amortized over a period ranging from three to five years.

In August 2007, the Company entered into an agreement with a competitor to acquire the customer list of that competitor without restriction of use. The acquisition amount totaled

$990,000 and was paid in September 2007. The Company recorded this payment as an intangible asset, and is being amortized ratably over its estimated life through August 2010. The

Company recorded amortization expense of $110,000 in 2007.

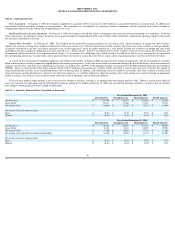

Intangible asset amortization expense for the years ended December 31, 2007, 2006 and 2005 was $412,000, $222,000 and $276,000 respectively. Amortization of existing

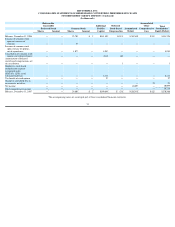

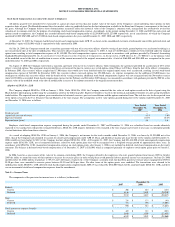

intangible assets is estimated to be as follows (in thousands):

Accrued Liabilities

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Weighted Average

December 31,

Useful Life

2007

2006

In thousands

Purchased technology

12 Years

$

3,350

$

2,030

Less: accumulated amortization

(905)

(634)

2,445

1,396

Customer relationships

3 Years

990

—

Less: accumulated amortization

(110)

---

880

---

Licenses and other

3 Years

186

—

Less: accumulated amortization

(31)

---

155

---

Acquired workforce

1 Year

279

279

Less: accumulated amortization

(279)

(279)

Total

$

3,480

$

1,396

Year Ending:

2008

$

783

2009

783

2010

643

2011

395

2012

251

Thereafter

625

$

3,480

December 31,

2007

2006

In thousands

Accrued marketing expenses

$

4,101

$

1,822

Accrued compensation

3,053

1,201

Accrued purchases

1,414

483

Accrued income and sales taxes

3,682

1,235

Accrued consultant expenses

1,516

884

Accrued production facility expenses

3,283

1,784

Accrued other

1,675

1,399

$

18,724

$

8,808

40