Shutterfly 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

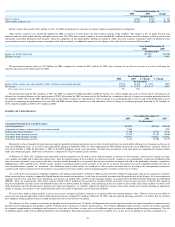

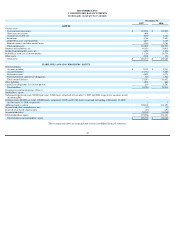

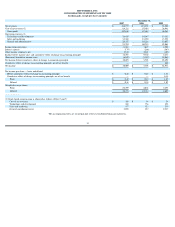

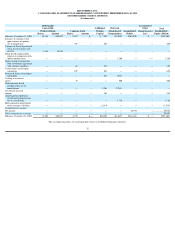

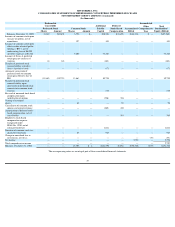

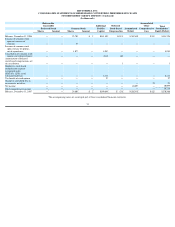

SHUTTERFLY, INC.

CONSOLIDATED STATEMENTS OF REDEEMABLE CONVERTIBLE PREFERRED STOCK AND

STOCKHOLDERS’ EQUITY (DEFICIT)

(In thousands)

The accompanying notes are an integral part of these consolidated financial statements.

Redeemable

Accumulated

Convertible

Additional

Deferred

Other

Total

Preferred Stock

Common Stock

Paid

-

In

Stock

-

Based

Accumulated

Comprehensive

Stockholders

’

Shares

Amount

Shares

Amount

Capital

Compensation

Deficit

Loss

Equity (Deficit)

Balances, December 31, 2004

12,448

$69,822

2,827

$

—

$

7,505

$(2,003)

$(65,070)

$

—

$(

59,568)

Issuance of common stock

upon exercise of options,

net of repurchases

—

—

750

—

205

—

—

—

205

Issuance of Series F preferred

stock, net of issuance cost

of $131

1,354

19,830

—

—

—

—

—

—

—

Stock-based compensation

expense in connection with

option modifications

—

—

—

—

—

1,100

—

—

—

1,100

Shares issued in connection

with a settlement agreement

with a former employee

—

—

65

—

352

—

—

—

352

Vested shares issued upon

acquisition

—

—

109

—

656

—

—

—

656

Restricted shares issued upon

acquisition

—

—

—

—

671

(671)

—

—

—

Vesting of restricted

shares

—

—

39

—

—

500

—

—

500

Deferred stock-based

compensation, net of

cancellations

—

—

—

—

2,261

(2,261)

—

—

—

Tax benefit of stock

options

—

—

—

—

365

—

—

—

365

Amortization of deferred

stock-based compensation,

net of cancellations

—

—

—

—

—

1,710

—

—

1,710

Reclassification of preferred

stock warrants to liability

—

—

—

—

(

1,514)

—

—

—

(

1,514)

Comprehensive income:

Net income

—

—

—

—

—

—

28,932

—

28,932

Total comprehensive income

—

—

—

—

—

—

—

—

28,932

Balances, December 31, 2005

13,802

$89,652

3,790

$

—

$

10,501

$(1,625)

$(36,138)

$

—

$(

27,262)

32