Samsung 1999 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 1999 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

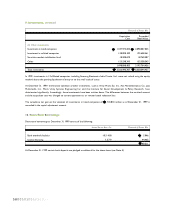

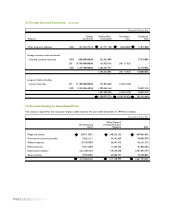

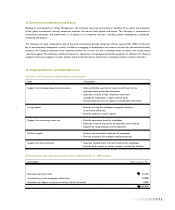

17. Income Tax Expense, continued:

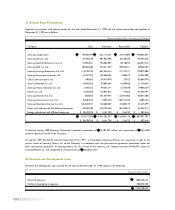

Components of deferred taxes as of December 31, 1999 are as follows:

Thousands of Korean Won

Beginning Increase Ending

Balance (Decrease) Balance

Deferred tax assets:

Loss (gain) on valuation of investments

using the equity method 759,579,159 (439,156,712) 320,422,447

Deferred foreign exchange losses 426,103,659 (189,616,883) 236,486,776

Invested stock reduction losses 34,689,080 51,093,513 85,782,593

Depreciation 419,407 311,052,912 311,472,319

Other 12,300,663 76,987,217 89,287,880

Tax credits 343,239,162 (103,051,280) 240,187,882

Total deferred tax assets 1,576,331,130 (292,691,233) 1,283,639,897

Deferred tax liabilities:

Special reserves appropriated for tax purposes 242,383,547 (82,081,969) 160,301,578

Capitalized interest expense 43,501,915 (8,832,340) 34,669,575

Accrued income 3,099,741 931,378 4,031,119

Other 7,780,153 (3,669,451) 4,110,702

Total deferred tax liabilities 296,765,356 (93,652,382) 203,112,974

Net deferred tax assets 1,279,565,774 (199,038,851) 1,080,526,923

The Company periodically assesses its ability to recover deferred tax assets. In the event of significant uncertainty regarding the

Company’s ultimate ability to recover such assets, a valuation allowance is recorded to reduce the asset to its estimated net

realizable value.

68001010010100101