Samsung 1999 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 1999 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

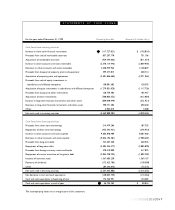

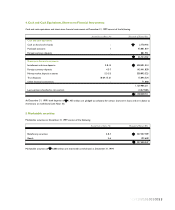

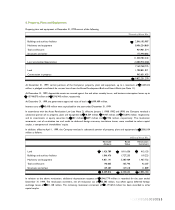

8. Property, Plant and Equipment:

Property, plant and equipment at December 31, 1999 consist of the following:

Thousands of Korean Won

Buildings and auxiliary facilities 2,046,105,987

Machinery and equipment 8,406,254,860

Tools and fixtures 924,901,314

Structures and other 173,440,082

11,550,702,243

Less: accumulated depreciation (4,380,933,468)

7,169,768,775

Land 1,708,831,071

Construction in progress 943,651,433

9,822,251,279

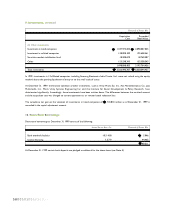

At December 31, 1999, certain portions of the Company’s property, plant and equipment, up to a maximum of 1,469,422

million, is pledged as collateral for various loans from the Korea Development Bank and Hanvit Bank (see Note 11).

At December 31, 1999, depreciable assets are insured against fire and other casualty losses, and business interruption losses up to

15,744,875 million and 7,596,945 million, respectively.

At December 31, 1999, the government-appraised value of land is 1,099,409 million.

Interest costs of 45,418 million were capitalized for the year ended December 31, 1999.

In accordance with the Asset Revaluation Law (see Note 2), effective January 1, 1980, 1982 and 1998, the Company revalued a

substantial portion of its property, plant and equipment by 18,564 million, 14,967 million and 956,696 million, respectively,

and its investments in equity securities by 502 million, 649 million and 6,956 million, respectively. The revaluation

increments, net of revaluation tax and credit to deferred foreign currency translation losses, were credited to other capital

surplus, a component of shareholders’ equity.

In addition, effective April 1, 1999, the Company revalued a substantial portion of property, plant and equipment by 2,056,184

million as follows:

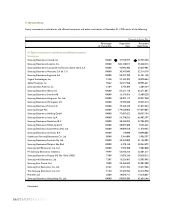

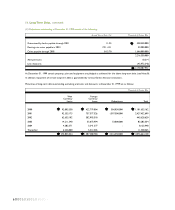

Millions of Korean Won

Revalued Book Revaluation

Amount Value Increment

Land 1,426,789 1,011,656 415,133

Buildings and auxiliary facilities 1,846,476 1,727,253 119,223

Machinery and equipment 4,851,141 3,383,409 1,467,732

Tools and fixtures 146,003 103,796 42,207

Structures and others 139,407 127,518 11,889

8,409,816 6,353,632 2,056,184

In relation to the above revaluation, additional depreciation expense of 1,046,779 million is recorded for the year ended

December 31, 1999. The revaluation increment, net of revaluation tax of 53,383 million, was offset against deferred foreign

exchange losses of 811,148 million. The remaining revaluation increment of 1,191,653 million has been recorded as other

capital surplus.

10101001010010055