Samsung 1999 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 1999 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

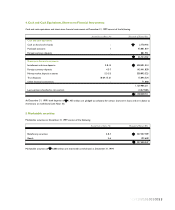

Income Tax Expense -

In accordance with the revised generally accepted accounting

principles in Korea, during the current fiscal year the

Company has adopted the deferred method of accounting for

income taxes. Under this method, the future tax effects of

temporary differences between the financial and tax bases of

assets and liabilities are reflected in the balance sheet as of

December 31, 1999. As a result of this change, shareholders’

equity as of December 31, 1999 is approximately 1,080,527

million greater and net income for the year ended December

31, 1999 is approximately 199,039 million less than that

which would have been reported under the previous

accounting method.

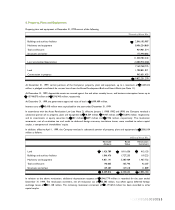

Valuation of Assets and Liabilities at Present Value -

Pursuant to the revised generally accepted financial accounting

standards effective January 1, 1999, assets acquired and

liabilities incurred through long-term installment transactions

and accounts and notes receivables under rescheduled debt

payments approved by the court are stated at present value.

As a result of this change, shareholder’s equity as of

December 31, 1999 and net income for the year ended

December 31, 1999 are approximately 2,452 million and

8,729 million, respectively, less than that which would have

been reported under the previous method.

Earnings Per Share -

Earnings per share is computed based on earnings available to

common shareholders, using the weighted average number of

common shares outstanding during the period.

Product Warranties and Performance Guarantees -

In conformity with accounting practices prevailing in the

Republic of Korea, costs related to repairs, service and other

work required in accordance with product warranties and

performance guarantees are charged to expense when

incurred.

Derivative Instruments -

The Company utilized derivative instruments to reduce its

exposure to fluctuations in interest and foreign currency

exchange rates. Pursuant to the revised generally accepted

accounting standards effective January 1, 1999, rights or

obligations derived from derivative instruments are recorded

as assets or liabilities at fair value on an accrual basis. Gain or

loss on valuation of derivative instruments is recognized as a

component of current operations, except for gains or losses

on valuation of derivative instruments used to hedge cash

flows, which are recorded as a capital adjustment. As a result

of this change, shareholders' equity as of December 31, 1999

is approximately 13,101 million less and net income for the

year ended December 31, 1999 is approximately 12,876

million greater than that which would have been reported

under the previous accounting method.

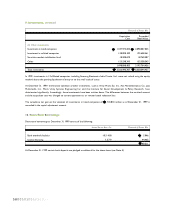

3. Amounts Stated in U.S. Dollars:

The Company operates primarily in Korean Won and its

official accounting records are maintained in Korean Won.

The U.S. Dollar amounts are provided herein as

supplementary information solely for the convenience of the

reader. Won amounts are expressed in U.S. Dollars at the

rate of 1,145: US$1, the rate in effect on December 31,

1999. This presentation is not in accordance with accounting

principles generally accepted in either the Republic of Korea

or the United States, and should not be construed as a

representation that the Won amounts shown could be

converted, realized or settled in U.S. Dollars at this rate.

52001010010100101