Samsung 1999 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 1999 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

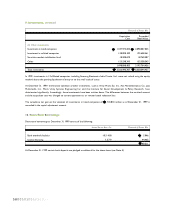

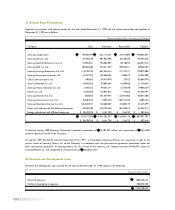

15. Dividends:

On June 30, 1999, the Company declared a 10% cash dividend to shareholders of common stock and preferred stock as an

interim dividend for the six-month period ended June 30, 1999. A cash dividend of 84,664 million was paid.

At December 31, 1999, the Company’s income available for year-end dividends under the Commercial Code of the Republic of

Korea amounts to 342,761 million and dividend propensity including interim dividend is approximately 13.48%.

For the year ended December 31, 1999, a cash dividend of 342,729 million (Common stock: 40%, Preferred stock: 41%)

excluding the interim dividends is proposed for the general stockholders’ meeting to be held on March 16, 2000.

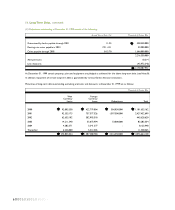

16. Treasury Stock:

As of December 31, 1999, the Company has acquired 3,449,625 shares of common stock and 869,693 shares of non-voting

preferred stock under the authorization of the Board of Directors.

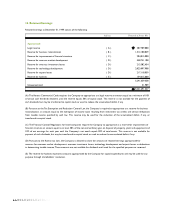

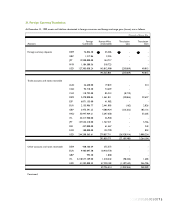

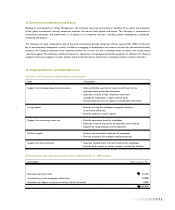

17. Income Tax Expense:

The statutory income tax rate applicable to the Company, including resident tax surcharges, is approximately 30.8%.

Income tax expense for the year ended December 31, 1999 consist of the following:

Thousands of Korean Won

Current income taxes 658,526,912

Deferred income taxes 199,038,851

857,565,763

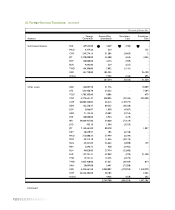

The following table reconciles the expected amount of income tax expense based on statutory rates to the actual amount of

taxes recorded by the Company:

Thousands of Korean Won

Income before taxes 4,027,968,337

Statutory tax rate 30.8%

Expected taxes at statutory rate 1,240,614,248

Tax credit (403,263,139)

Others, net 20,214,654

Actual taxes 857,565,763

Effective tax rate 21.3%

10101001010010067