Samsung 1999 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 1999 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

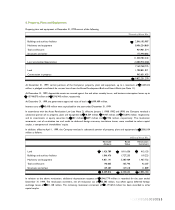

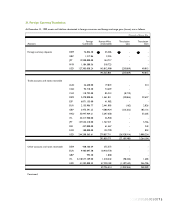

(L) Convertible bonds -

On October 15, 1999, the company issued foreign currency convertible bonds of US$200 million to Dell Computer Corporation.

A summary of the terms of bonds is as follows:

Interest: 2% per annum payable annually in arrears on December 31.

Conversion period: On or after October 15, 2000 through January 16, 2003.

Conversion price: Subject to adjustment based on certain events, 260,000 per share, with a fixed exchange rate applicable

to the conversion of 1,203.2: US$1.00.

The Company recognized interest expense using a 5.143% effective interest rate. The difference between the effective and

nominal interest rate was credited to long-term accrued interest. The additional interest expense of 1,595 million was

recognized as long-term accrued interest during 1999.

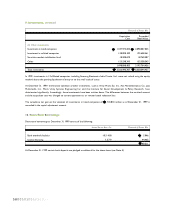

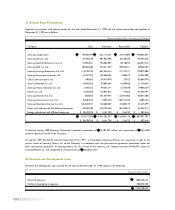

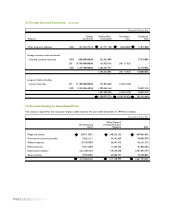

13. Commitments and Contingencies:

At December 31, 1999, the Company was contingently liable for guarantees of indebtedness, principally for related parties,

approximating 111,622 million and US$2,117,838,000. In addition, at December 31, 1999, the Company provided

guarantees of contract fulfillment for affiliated companies in the amount of 447,366 million.

At December 31, 1999, the Company has entered into technical assistance agreements with certain foreign companies. Total

royalty expense incurred related to these agreements for the year ended December 31, 1999 amounts to approximately

743,418 million.

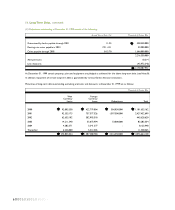

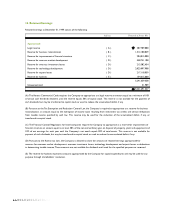

At December 31, 1999, the Company has entered into lease agreements with several leasing companies that are recognized as

direct financing leases. These lease agreements are summarized as follows:

Millions of Korean Won

Depreciation Expense Charged to

Accounts Acquisition Cost 1999 Operations

Machinery and equipment 712,678 449,063

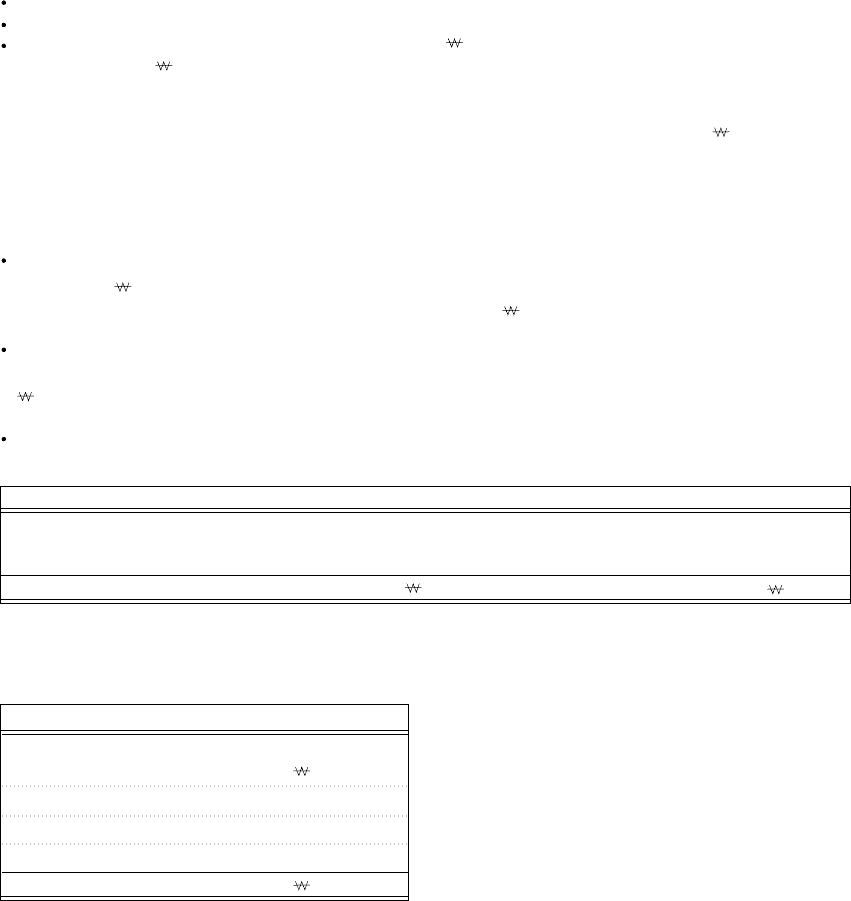

Scheduled future lease payments, net of interest, under these lease arrangements which are included in long-term debt

(see Note 11), are as follows:

Thousands of Korean Won

2000 259,982,166

2001 217,731,021

2002 84,389,464

2003 1,879,284

563,981,935

64001010010100101