Samsung 1999 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 1999 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

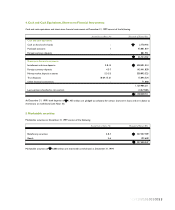

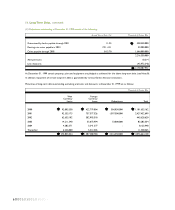

Certain of the accounting policies for investments stated

above represent revised policies that were adopted in the

current year in accordance with revisions in generally

accepted accounting principles in Korea. As a result of these

changes, shareholders’ equity as of December 31, 1999 is

approximately 1,908,784 million less and net income for the

year ended December 31, 1999 is approximately 305,855

million greater than that which would have been reported

under the previous accounting method.

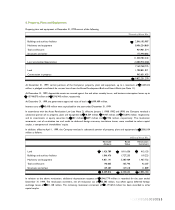

Stock and Debenture Issuance Costs -

Pursuant to the revised generally accepted accounting

standards effective January 1, 1999, stock and debenture

issuance costs are credited to capital surplus and debentures.

As a result of this change, net income for the year ended

December 31, 1999 is approximately 230 million greater

than that which would have been reported under the previous

accounting method.

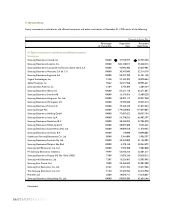

Accrued Severance Benefits -

Employees and directors with more than one year of service

are entitled to receive a lump-sum payment upon termination

of their employment with the Company, based on their length

of service and rate of pay at the time of termination. Accrued

severance benefits represent the amount which would be

payable assuming all eligible employees terminated their

employment at the balance sheet date.

Severance pay expense is calculated based on the net change

in accrued severance benefit liability assuming the termination

of all eligible employees’ employment as of the beginning and

end of the accounting period. Under the prevailing generally

accepted accounting standards, as of December 31, 1990,

accrued severance benefits were underaccrued by

approximately 42,255 million. The Company was adjusting

the underaccrued severance benefits over 10 years beginning

in 1991. Pursuant to the revised generally accepted accounting

standards effective January 1, 1999, the Company deducted

8,451 million of the underaccrued severance benefits

balance as of December 31, 1998 from retained earnings to

account for the remaining underaccrued severance benefits.

As a result of this change, shareholders’ equity as of

December 31, 1999 is approximately 4,225 million less than

that which would have been reported under the previous

accounting method.

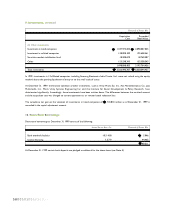

Accrued severance benefits are funded approximately 56% at

December 31, 1999 through a group severance insurance plan

to guarantee retirement grants of employees with Samsung

Life Insurance Company, Ltd. The amounts funded under this

insurance plan are classified as a deduction to accrued

severance benefits liability. Subsequent accruals are to be

funded at the discretion of the Company.

In accordance with the National Pension Act, a certain portion

of accrued severance benefits is deposited with the National

Pension Fund and deducted from the accrued severance

benefits liability. The contributed amount shall be refunded

from the National Pension Fund to employees on their

retirement.

Discounts and Premiums on Debentures -

Discounts and premiums on debentures represent the

difference between the issue price and par value of

debentures. Pursuant to the revised generally accepted

accounting standards effective January 1, 1999, discounts and

premiums on debentures are amortized over the redemption

period of the related debentures using the effective interest

rate method. The amortization of discount on debentures is

recorded as interest expense and the amortization of

premiums on debentures is deducted from interest expense.

As a result of this change, shareholders’ equity as of

December 31, 1999 and net income for the year ended

December 31, 1999 are approximately 7,581 million and

1,912 million, respectively, greater than that which would

have been reported under the previous accounting method.

Foreign Currency Translation -

Monetary assets and liabilities denominated in foreign

currencies are translated into Korean Won at the rates

prevailing at the balance sheet date (in the case of U.S. Dollars,

US$1: 1,145.40) and resulting translation losses and gains

are recognized currently.

Foreign currency convertible debentures are translated at a

fixed conversion exchange rate in accordance with accounting

practices prevailing in the Republic of Korea.

10101001010010051