Samsung 1999 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1999 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 1999

1. The Company:

Samsung Electronics Co., Ltd. (the “Company”) is

incorporated under the laws of the Republic of Korea to

manufacture and sell electronic goods, communication

facilities, semiconductors, telecommunication products and

other similar products.

The Company’s stock is publicly traded and all issued and

outstanding shares are listed on the Korean Stock Exchange.

Under its Articles of Incorporation, the Company is

authorized to issue 500,000,000 shares of capital stock (par

value 5,000), of which 100,000,000 shares are cumulative,

participating preferred stock, which are non-voting and

entitled to a minimum cash dividend (9% of par value). The

non-cumulative, non-voting preferred stock issued on or

before February 28, 1997 is entitled to an additional cash

dividend (1% of par value) over common stock. At December

31, 1999, 151,214,992 shares of common stock and

23,893,427 shares of such preferred stock were issued and

outstanding.

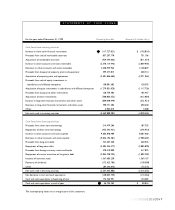

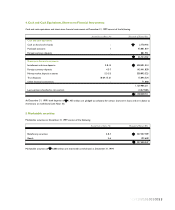

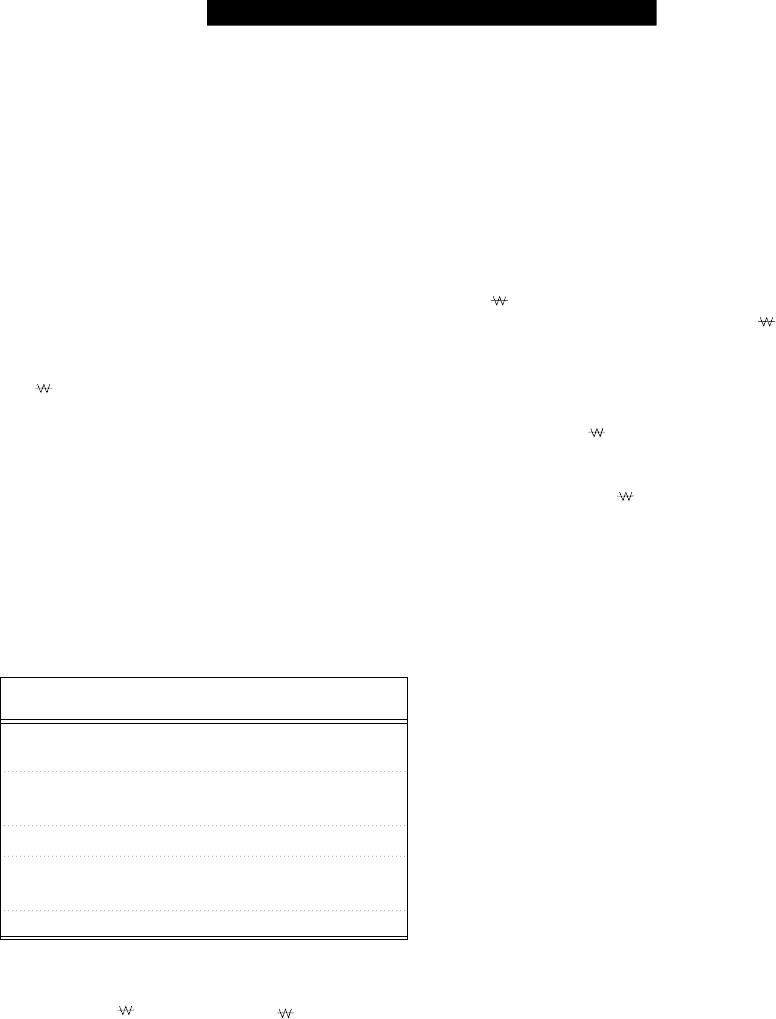

As of December 31, 1999, major shareholders of the

Company’s stock, including preferred stock, consist of the

following:

Name of Number of Percentage of

Shareholder Shares Ownership (%)

Citibank, N.A. 16,800,865 9.59

Samsung Life

Insurance Co., Ltd. 10,873,359 6.21

Samsung Corporation 5,917,362 3.38

Lee, Kun-Hee

and relatives 5,322,559 3.04

Seoul Bank 4,699,627 2.68

In addition, the Company is authorized to issue convertible

debentures and debentures with stock purchase options of

face values up to 4,000,000 million and 2,000,000 million,

respectively. The Company is authorized to issue depository

receipts free from any preemptive rights by shareholders.

Also, the Company is authorized to issue capital stock through

the exercise of stock options or general public subscription

and to domestic and foreign financial institutions for urgent

fund raising or to co-operating companies for technical

assistance free from any preemptive rights by shareholders.

The Company has a stock option plan under which options to

purchase shares of common stock may be granted to key

employees up to a maximum of 1% of issued shares per

employee by the approval of shareholders. No stock options

have been granted as of December 31, 1999.

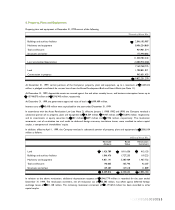

The Company issued 9,580,000 shares of common stock for

cash at 51,300 per share on February 12, 1999 and

15,400,000 shares of common stock for cash at 69,900 per

share on June 25, 1999. In addition, the Company issued

1,461,359 shares of common stock upon the conversion of

foreign currency convertible bonds in the amount of

US$153,050,000 in 1999 (see Note 12). The cash proceeds in

excess of par value of 1,568,120 million were credited to

paid-in capital in excess of par value.

As of December 31, 1999, 675,972,431,000 (face value of

US$624,010,000) of convertible bonds are outstanding (see

Note 12). No debentures with stock purchase options have

been issued as of December 31, 1999.

2. Summary of Significant Accounting Policies:

The significant accounting policies followed by the Company in

the preparation of its financial statements in accordance with

Financial Accounting Standards of the Republic of Korea are

summarized below.

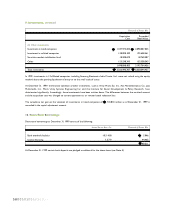

Transitional Presentation of Comparative Financial Statements -

In accordance with the transition clause of the revised financial

accounting standards generally accepted in the Republic of

Korea effective January 1, 1999, the Company has not

presented comparative financial statements for the year ended

December 31, 1999.

Basis of Financial Statement Presentation -

The official accounting records of the Company, on which the

Korean language financial statements are based, are maintained

in Korean Won in accordance with the laws and regulations of

the Republic of Korea.

NOTES TO FINANCIAL STATEMENTS

48001010010100101