Samsung 1999 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 1999 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

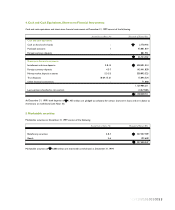

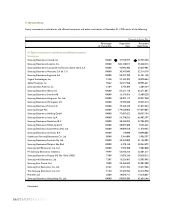

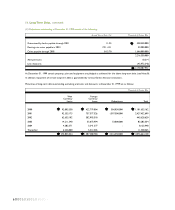

9. Investments, continued:

Thousands of Korean Won

Acquisition Recorded

Cost Book Value

(2) Other investments

Investment in listed companies 1,187,973,203 2,898,807,045

Investment in unlisted companies 138,828,189 122,658,461

Securities market stabilization fund 18,508,670 18,760,587

Other 153,538,343 153,538,343

1,498,848,405 3,193,764,436

Total investments 5,366,990,707 6,050,044,457

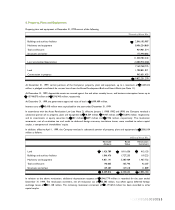

In 1999, investments in 13 affiliated companies, including Samsung Electronics India Private, Ltd., were not valued using the equity

method due to the pending liquidation of entity or to the small scale of assets.

At December 31, 1999, the financial condition of other investments, such as Array Micro Sys. Inc., Acc Microelectronics Co., Jazz

Multimedia, Inc., Micro Unity Systems Engineering Inc. and the Institute for Social Development & Policy Research, have

deteriorated significantly. Accordingly, these investments have been written down. The differences between the revalued amount

and the acquisition cost was charged to current operations as an invested stock reduction loss.

The cumulative net gain on the valuation of investments in listed companies of 1,710,834 million as of December 31, 1999 is

recorded in the capital adjustment account.

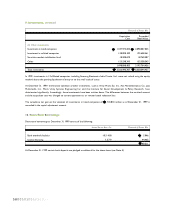

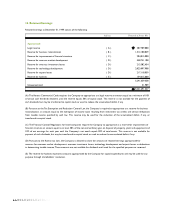

10. Short-Term Borrowings:

Short-term borrowings at December 31, 1999 consist of the following:

Annual Interest Rates (%) Thousands of Korean Won

Bank overdraft facilities 10.5-10.8 5,046

Usance financing 7.5-7.9 44,465

49,511

At December 31, 1999, certain bank deposits are pledged as collateral for the above loans (see Note 4).

58001010010100101