Samsung 1999 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 1999 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

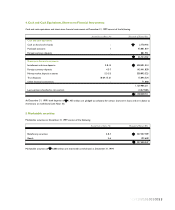

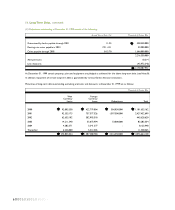

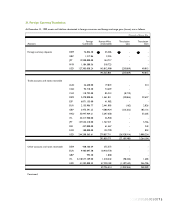

12. Foreign Currency Notes and Bonds:

Unsecured foreign currency notes and bonds at December 31, 1999 consist of the following:

Due Date Thousands of Korean Won

ECU denominated floating rate notes ( A ) May 16, 2000 122,420,352

US$ denominated straight bonds ( B ) November 1, 2002 178,619,403

DM denominated straight bonds ( C ) March 24, 2000 176,481,000

denominated straight bonds ( D) April 23, 2003 165,920,136

DM denominated straight bonds ( E ) December 16, 2001 176,481,000

US$ denominated straight bonds ( F ) October 1, 2027 114,540,000

US$ denominated straight bonds ( G ) October 1, 2002 175,091,571

Convertible bonds ( H ) December 31, 2006 18,911,736

Convertible bonds ( I ) December 31, 2007 178,650,695

Convertible bonds ( J ) February 1, 2004 117,300,000

Convertible bonds ( K ) July 30, 2002 120,470,000

Convertible bonds ( L ) January 31, 2003 240,640,000

1,785,525,893

Less: current maturities (299,056,662)

Add: premiums 1,158,941

Less: discounts (6,556,876)

Add: long-term accrued interest 3,110,418

Less: conversion rights (68,652,265)

1,415,529,449

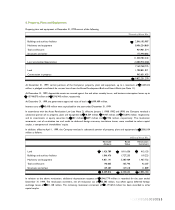

(A) ECU denominated floating rate notes -

On May 16, 1995, the Company issued ECU 80 million (US$106,880,000) of floating rate notes. These notes are listed on the

Luxembourg Stock Exchange, bear interest at ECU Libor plus 0.375% and will mature on May 16, 2000. The Company also

entered into a currency swap contract with Union Bank of Switzerland.

(B) US$ denominated straight bonds -

On November 1, 1992, the Company issued straight bonds of US$200 million at 99.5% of face value for the expansion of its

semiconductor product manufacturing facilities. The bonds bear interest at 8.5% per annum and mature on November 1, 2002.

The Company redeemed US$44,055,000 of these bonds during 1998 and 1999.

(C) DM denominated straight bonds -

On March 24, 1995, the Company issued straight bonds of DM300 million at 101.75% of face value. The bonds bear interest at

7.5% per annum and mature on March 24, 2000.

10101001010010061