Salesforce.com 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

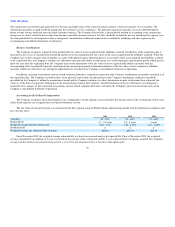

Table of Contents

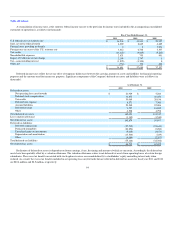

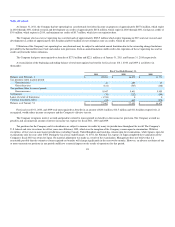

0.75% Convertible Senior Notes

In January 2010, the Company issued at par value $575.0 million of 0.75% convertible senior notes due January 15, 2015 (the "Notes"). Interest is

payable semi-annually in arrears on January 15 and July 15 of each year, commencing July 15, 2010.

The Notes are governed by an Indenture dated as of January 19, 2010, between the Company, as issuer, and U.S. Bank National Association, as trustee.

The Notes do not contain any financial covenants or any restrictions on the payment of dividends, the incurrence of senior debt or other indebtedness, or the

issuance or repurchase of securities by the Company. The Notes are unsecured and rank senior in right of payment to the Company's future indebtedness that

is expressly subordinated in right of payment to the Notes and rank equal in right of payment to the Company's existing and future unsecured indebtedness

that is not so subordinated and are effectively subordinated in right of payment to any of the Company's cash equal to the principal amount of the Notes, and

secured indebtedness to the extent of the value of the assets securing such indebtedness and are structurally subordinated to all existing and future

indebtedness and liabilities incurred by our subsidiaries, including trade payables.

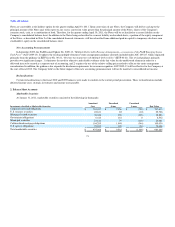

If converted, holders will receive cash equal to the principal amount of the Notes, and at the Company's election, cash and/or shares of the Company's

common stock for any amounts in excess of the principal amounts.

The initial conversion rate is 11.7147 shares of common stock per $1,000 principal amount of Notes, subject to anti-dilution adjustments. The initial

conversion price is $85.36 per share of common stock. Throughout the term of the Notes, the conversion rate may be adjusted upon the occurrence of certain

events, including for any cash dividends. Holders of the Notes will not receive any cash payment representing accrued and unpaid interest upon conversion of

a Note. Accrued but unpaid interest will be deemed to be paid in full upon conversion rather than cancelled, extinguished or forfeited. Holders may convert

their Notes under the following circumstances:

• during any fiscal quarter, if, for at least 20 trading days during the 30 consecutive trading day period ending on the last trading day of the

immediately preceding fiscal quarter, the last reported sales price of the Company's common stock for such trading day is greater than or equal to

130% of the applicable conversion price on such trading day share of common stock on such last trading day;

• in certain situations, when the trading price of the Notes is less than 98% of the product of the sale price of the Company's common stock and the

conversion rate;

• upon the occurrence of specified corporate transactions described under the Notes Indenture, such as a consolidation, merger or binding share

exchange; or

• at any time on or after October 15, 2014.

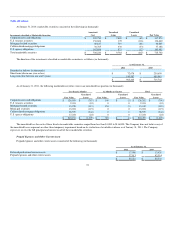

As of January 31, 2011, the Notes are not yet convertible up to 6.7 million shares of the Company's common stock.

For at least 20 trading days during the 30 consecutive trading days ended January 31, 2011, the Company's common stock price exceeded the

conversion price of $85.36 per share. Accordingly, the Notes are convertible at the holders' option for the quarter ending April 30, 2011. Upon conversion of

any Notes, the Company will deliver cash up to the principal amount of the Notes and with respect to any excess conversion value greater than the principal

amount of the Notes, shares of the Company's common stock, cash, or a combination of both at the Company's election.

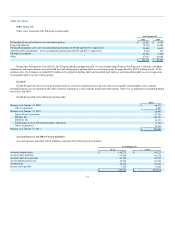

Holders of the Notes have the right to require the Company to purchase with cash all or a portion of the Notes upon the occurrence of a fundamental

change, such as a change of control at a purchase price equal to 100% of the principal amount of the Notes plus accrued and unpaid interest. Following certain

corporate transactions that constitute a change of control, the Company will increase the conversion rate for a holder who elects to convert the Notes in

connection with such change of control in certain circumstances.

75