Royal Caribbean Cruise Lines 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AA ppaarraaddee ooff wwaaiitteerrss

sseerrvveess ccoommpplliimmeennttaarryy

ssoorrbbeett aatt ppoooollssiiddee

oonn MMiilllleennnniiuumm..

R

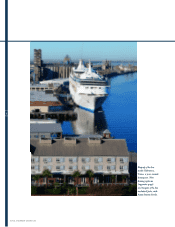

Rooyyaall CCeelleebbrriittyy

TToouurrss ((ooppppoossiittee

ppaaggee)) nnooww hhaass ffoouurr

g

gllaassss--ddoommeedd ttrraaiinn--

ccaarrss iinn AAllaasskkaa..

7

ROYAL CARIBBEAN CRUISES LTD.

include the wine bar Vintages, the cruise

industry’s first wine education and enter-

tainment venue; Boleros, the first Latin jazz

bar at sea; Chops Grille, a popular steak-

house borrowed from our Radiance-class

ships; Ben & Jerry’s Ice Cream Parlor,

another first; and Jade, a buffet-style spe-

cialty restaurant with Asian fusion foods.

Each of the 13 ships in our 1999-2004

expansion has a personality all her own. The

cumulative effect is an extremely high level of

customer satisfaction. In the “2002 Reader’s

Choice Awards” poll by Condé Nast Traveler, our

company claimed 16 of the top 26 places in

the Best Large Ships category. The previous

year, we garnered 14 of the top 23 places.

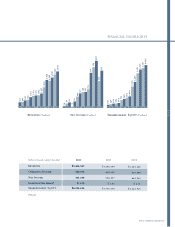

STRONGEST CASH FLOW

Even as our financial health grew more

robust in 2002, we were disappointed when

our proposed combination with P&O

Princess Cruises plc was scuttled in favor of

a nominally higher offer. We received a ter-

mination fee of $62.5 million, resulting in

net proceeds of $33 million that were

included in our fourth-quarter results.

We ended the year with $1.2 billion in

liquidity and the strongest cash flow in our

history. As we near completion of our recent

capital expansion program, we believe we

have also seen the peak of our leverage posi-

tion. Now that we have achieved the critical

mass for our brands, we are working to

reduce our leverage with a smaller newbuild

program and a continued strong cash flow.

We ended 2002 with a net debt-to-capital

ratio of 56.3 percent, and we expect it to fall

rapidly as our capital commitments decline.

In 2003, we will happily welcome three

million guests onboard our ships. It was only

in 1997 that we topped one million guests for

the first time. Industry-wide, the North

American market grew to 7.4 million guests

in 2002, and Cruise Lines International

Association predicts demand will keep rising

– an estimated 8 million cruisers in 2003.

In addition to our cruise offerings, Royal

Celebrity Tours continued to establish itself as