Royal Caribbean Cruise Lines 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

That ominous cloud of world tension con-

tinues to loom over global travel, heightened

now by the war in Iraq. We do not now know

the duration or full repercussions of this

conflict, nor can we predict the full impact

on the business of cruise vacations. However,

our performance during 2002 in the face of

economic and geopolitical uncertainty pro-

vides some comfort regarding the strength of

our company and of our industry. Within

months of the horrifying 9/11 terrorist

attacks, we experienced a dramatic rebound.

Rising demand and the lure of our ultra-

modern fleet enabled Royal Caribbean to

achieve Net Income of $351.3 million, or

$1.79 per share – a vigorous 38-percent

increase in profits. These are truly remark-

able results, given the negative influences that

buffeted all segments of the travel industry.

Unfortunately, the war-related uncertainties

have upset our expectations for a strong recov-

ery in cruise pricing in 2003. Recent booking

trends have been disappointing and indicate

another year of lackluster yields. Nevertheless,

the very strong booking trends we saw in most

of the second half of 2002 provide ample

evidence that the current weakness is not a

fundamental industry issue but rather a

shorter-term reaction to world events.

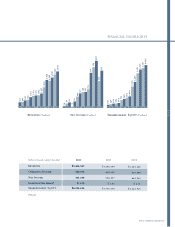

Revenues in 2002 climbed 9.2 percent to

$3.4 billion. More importantly, our key index

of net yields showed surprising firmness, edg-

ing down a mere seven-tenths of one percent.

During 2002, we had a capacity increase of

15.0 percent (one of the largest in our histo-

ry), and our ability to absorb this increase dur-

ing such traumatic times with only nominal

yield declines is very gratifying. But revenues

are only half of the equation. The impact of

our aggressive cost controls was apparent again

in 2002 as we cut operating and SG&A

expenses by 7.4 percent per available berth. We

are resolute in managing our business as effi-

ciently as possible, constantly seeking – and

finding – ways to control or avoid costs.

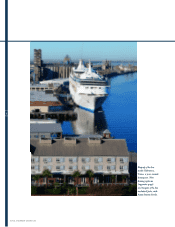

By launching a combined seven new ships

and 16,500 berths in 2001 and 2002 –

peak years in a decade of expansion – we

raised our profile in the eyes of vacationers

RRiicchhaarrdd DD.. FFaaiinn

Chairman and CEO

2

ROYAL CARIBBEAN CRUISES LTD.

CHAIRMAN’S LETTER

March 24, 2003

DEAR SHAREHOLDERS: