Royal Caribbean Cruise Lines 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

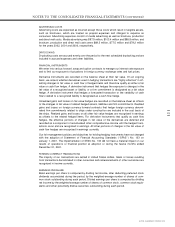

NOTE 1. GENERAL

DESCRIPTION OF BUSINESS

We are a global cruise company. We operate two cruise brands, Royal Caribbean International

and Celebrity Cruises, with 16 cruise ships and 9 cruise ships, respectively, at December 31,

2002. Our ships operate on a selection of worldwide itineraries that call on approximately 200

destinations.

BASIS FOR PREPARATION OF CONSOLIDATED FINANCIAL STATEMENTS

The consolidated financial statements are prepared in accordance with accounting principles

generally accepted in the United States and are presented in United States dollars. Estimates

are required for the preparation of financial statements in accordance with generally accepted

accounting principles. Actual results could differ from these estimates. All significant intercom-

pany accounts and transactions are eliminated in consolidation.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

CRUISE REVENUES AND EXPENSES

Deposits received on sales of guest cruises represent unearned revenue and are initially record-

ed as customer deposit liabilities on our balance sheet. Customer deposits are subsequently

recognized as cruise revenues, together with revenues from shipboard activities and all associ-

ated direct costs of a voyage, upon completion of voyages with durations of ten days or less

and on a pro rata basis for voyages in excess of ten days. Minor amounts of revenues and

expenses from pro rata voyages are estimated.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents include cash and marketable securities with original maturities

of less than 90 days.

INVENTORIES

Inventories consist of provisions, supplies and fuel carried at the lower of cost (weighted-

average) or market.

PROPERTY AND EQUIPMENT

Property and equipment are stated at cost less accumulated depreciation and amortization. We

capitalize interest as part of the cost of construction. Improvement costs that we believe add

value to our ships are capitalized as additions to the ship and depreciated over the improve-

ments’ estimated useful lives, while costs of repairs and maintenance are charged to expense

as incurred. We review long-lived assets for impairment whenever events or changes in cir-

cumstances indicate, based on estimated future cash flows, that the carrying amount of these

assets may not be fully recoverable.

Depreciation of property and equipment, which includes amortization of ships under capi-

tal leases, is computed using the straight-line method over estimated useful lives of pri-

marily 30 years for ships, three to twelve years for other property and equipment and the

shorter of the lease term or related asset life for leasehold improvements. (See Note 4 –

Property and Equipment.)