Royal Caribbean Cruise Lines 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

In July 2000, we invested approximately $300 million in convertible preferred stock issued by

First Choice Holidays PLC. (See Note 5 – Other Assets.) Independently, we entered into a joint

venture with First Choice Holidays PLC to launch a new cruise brand, Island Cruises. As part

of the transaction, ownership of

Viking Serenade

was transferred to the joint venture at a valu-

ation of $95.4 million. The contribution of

Viking Serenade

represented our 50% investment in

the joint venture, as well as $47.7 million in proceeds used towards the purchase price of the

convertible preferred stock.

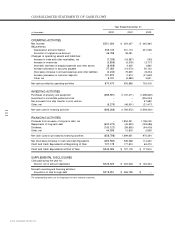

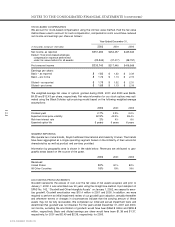

We made principal payments totaling approximately $603.3 million, $45.6 million and $128.1

million under various term loans, senior notes, revolving credit facility and capital leases during

2002, 2001 and 2000, respectively.

During 2002, 2001 and 2000, we paid quarterly cash dividends on our common stock totaling

$100.1 million, $100.0 million and $91.3 million, respectively. In April 2000, we redeemed all

outstanding shares of our convertible preferred stock and dividends ceased to accrue. We paid

quarterly cash dividends on our convertible preferred stock totaling $3.1 million in 2000.

FUTURE COMMITMENTS

We currently have three ships on order for an additional capacity of 7,266 berths. The aggre-

gate contract price of the three ships, which excludes capitalized interest and other ancillary

costs, is approximately $1.3 billion, of which we have deposited $0.2 billion as of December 31,

2002. We anticipate that overall capital expenditures will be approximately $1.1 billion, $0.5 bil-

lion and $0.1 billion for 2003, 2004 and 2005, respectively.

We have options to purchase two additional Radiance-class ships with delivery dates in the

fourth quarters of 2005 and 2006. The options have an aggregate contract price of $0.8 billion

and expire on September 19, 2003. Under the terms of the options, the shipyard has the abili-

ty to terminate them upon providing us advance notice.

We have $5.4 billion of long-term debt of which $0.1 billion is due during the 12-month period

ending December 31, 2003. Included in Long-term debt are two ships financed with capital

leases. (See Note 6 – Long-Term Debt.)

We are obligated under noncancelable operating leases primarily for a ship, office and warehouse

facilities, computer equipment and motor vehicles. As of December 31, 2002, future minimum

lease payments under noncancelable operating leases aggregated to $413.9 million, due through

2028. We have future commitments to pay for our usage of certain port facilities, maintenance

contracts and communication services aggregating to $261.6 million, due through 2027. (See

Note 12 – Commitments and Contingencies.)

Under the

Brilliance of the Seas

long-term operating lease, we have agreed to indemnify the les-

sor to the extent its after-tax return is negatively impacted by unfavorable changes in corporate

tax rates and capital allowance deductions. These indemnifications could result in an increase in

our annual lease payments. We are unable to estimate the maximum potential increase in such

lease payments due to the various circumstances, timing or combination of events that could trig-

ger such indemnifications. Current facts indicate that an indemnification is not probable; howev-

er, if one occurs, we may have remedies available to us under the terms of the lease agreement.

As a normal part of our business, depending on market conditions, pricing and our overall

growth strategy, we continuously consider opportunities to enter into contracts for the building

of additional ships. We may also consider the sale of ships. We continuously consider potential

acquisitions and strategic alliances. If any of these were to occur, they would be financed

through the incurrence of additional indebtedness, the issuance of additional shares of equity

securities or through cash flows from operations.