Royal Caribbean Cruise Lines 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

37

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

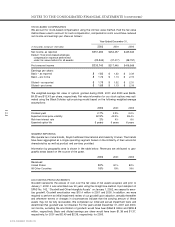

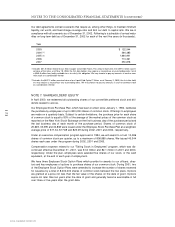

NOTE 11. FINANCIAL INSTRUMENTS

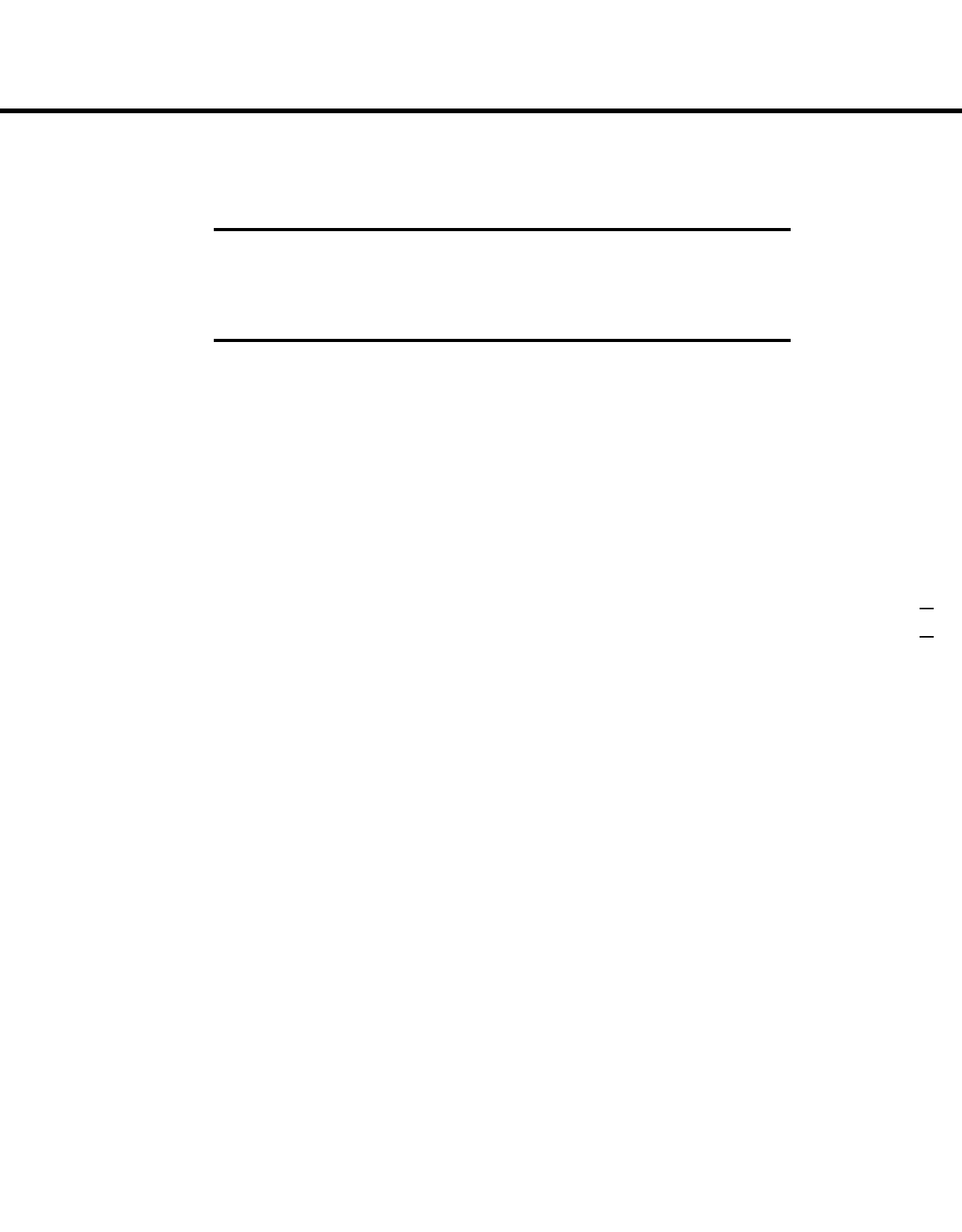

The estimated fair values of our financial instruments are as follows:

(in thousands)

2002 2001

Cash and Cash Equivalents $ 242,584 $ 727,178

Long-Term Debt (including current portion of long-term debt) (5,039,646) (5,031,858)

Foreign Currency Forward Contracts gains (losses) 37,376 (99,110)

Interest Rate Swap Agreements in a net receivable position 62,835 35,668

Fuel Swap and Zero Cost Collar Agreements in a net

receivable (payable) position 7,491 (7,799)

The reported fair values are based on a variety of factors and assumptions. Accordingly, the fair

values may not represent actual values of the financial instruments that could have been real-

ized as of December 31, 2002 or 2001 or that will be realized in the future and do not include

expenses that could be incurred in an actual sale or settlement. The following methods were

used to estimate the fair values of our financial instruments, none of which are held for trading

or speculative purposes:

CASH AND CASH EQUIVALENTS

The carrying amounts of cash and cash equivalents approximate their fair values due to the

short maturity of these instruments.

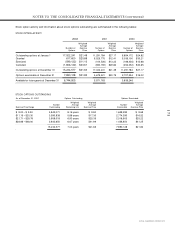

LONG-TERM DEBT

The fair values of our Senior Notes, Senior Debentures, Liquid Yield Option™ Notes and Zero

Coupon Convertible Notes were estimated by obtaining quoted market prices. The fair values

of all other debt were estimated using discounted cash flow analyses based on market rates

available to us for similar debt with the same remaining maturities.

FOREIGN CURRENCY CONTRACTS

The fair values of our foreign currency forward contracts were estimated using current market

prices for similar instruments. Our exposure to market risk for fluctuations in foreign currency

exchange rates relates to our firm commitments on ship construction contracts and forecasted

transactions. We use foreign currency forward contracts to mitigate the impact of fluctuations

in foreign currency exchange rates. As of December 31, 2002, we had foreign currency forward

contracts in a notional amount of $488.0 million maturing through 2003. Our foreign currency

forward contracts related to firm commitments on ships under construction had aggregate unre-

alized gains of approximately $31.0 million and unrealized losses of approximately $99.3 million

at December 31, 2002 and 2001, respectively. Approximately $6.4 million of unrealized gains

on our foreign currency forward contracts related to forecasted transactions were deferred at

December 31, 2002 and, if realized, will be recorded in earnings when the transactions being

hedged are recognized in 2003. Deferred gains from hedging forecasted transactions were not

material at December 31, 2001.

INTEREST RATE SWAP AGREEMENTS

The fair values of our interest rate swap agreements were estimated based on quoted market

prices for similar or identical financial instruments to those we hold. Our exposure to market risk

for changes in interest rates relates to our long-term debt obligations and our operating lease

for

Brilliance of the Seas

. We enter into interest rate swap agreements to modify our exposure

to interest rate movements and to manage our interest expense and rent expense.