Royal Caribbean Cruise Lines 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

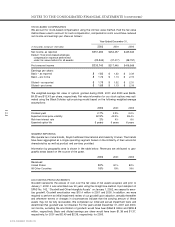

In May 2002, we entered into a $320.0 million term loan bearing interest at a variable rate of

six-month LIBOR plus 1.535%, due through 2010 and secured by

Constellation

. In September

2002, our $150.0 million 7.125% senior notes matured and were paid in full.

During 2001, we drew $360.0 million under our unsecured term loan that bears interest at

LIBOR plus 1.0%, due 2006. In August 2001, we entered into a $326.7 million term loan bear-

ing interest at a fixed rate of 8.0%, due in 2010 and secured by

Summit

.

In May 2001, we received net proceeds of $339.4 million from the issuance of Zero Coupon

Convertible Notes, due 2021. In February 2001, we received net proceeds of $494.6 million

and $560.8 million from the issuance of 8.75% Senior Notes due 2011 and Liquid Yield

Option™ Notes due 2021, respectively.

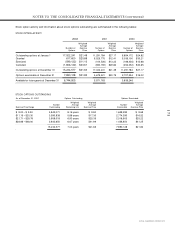

The Liquid Yield Option™ Notes and the Zero Coupon Convertible Notes are zero coupon

bonds with yields to maturity of 4.875% and 4.75%, respectively, due 2021. Each Liquid Yield

Option™ Note and Zero Coupon Convertible Note was issued at a price of $381.63 and

$391.06, respectively, and will have a principal amount at maturity of $1,000. The Liquid Yield

Option™ Notes and Zero Coupon Convertible Notes are convertible at the option of the hold-

er into 17.7 million and 13.8 million shares of common stock, respectively, if the market price

of our common stock reaches certain levels. These conditions were not met at December 31,

2002 for the Liquid Yield Option™ Notes or the Zero Coupon Convertible Notes and therefore,

the shares issuable upon conversion are not included in the earnings per share calculation.

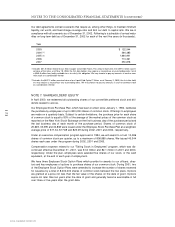

We may redeem the Liquid Yield Option™ Notes beginning on February 2, 2005, and the Zero

Coupon Convertible Notes beginning on May 18, 2006, at their accreted values for cash as a

whole at any time, or from time to time in part. Holders may require us to purchase any out-

standing Liquid Yield Option™ Notes at their accreted value on February 2, 2005 and February

2, 2011 and any outstanding Zero Coupon Convertible Notes at their accreted value on May

18, 2004, May 18, 2009, and May 18, 2014. We may choose to pay the purchase price in cash

or common stock or a combination thereof. In addition, we have a three-year $345.8 million

unsecured variable rate term loan facility available to us should the holders of the Zero Coupon

Convertible Notes require us to purchase their notes on May 18, 2004.

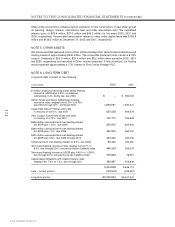

During 2002 and 2001, under the terms of two of our secured term loans, we elected to defer

principal payments totaling $64.4 million each year to 2004 through 2007.

The contractual interest rates on balances outstanding under our $1.0 billion unsecured revolv-

ing credit facility and the $625.0 million unsecured term loan vary with our debt rating.

The Senior Notes, Senior Debentures, Liquid Yield Option™ Notes and Zero Coupon

Convertible Notes are unsecured. The Senior Notes and Senior Debentures are not

redeemable prior to maturity.

We entered into a $264.0 million capital lease to finance

Splendour of the Seas

and a $260.0

million capital lease to finance

Legend of the Seas

in 1996 and 1995, respectively. The capital

leases each have semi-annual payments of $12.0 million over 15 years with final payments of

$99.0 million and $97.5 million, respectively.