Royal Caribbean Cruise Lines 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

CONTINGENCIES – LITIGATION

On an ongoing basis, we assess the potential liabilities related to any lawsuits or claims brought

against us. While it is typically very difficult to determine the timing and ultimate outcome of

such actions, we use our best judgment to determine if it is probable that we will incur an

expense related to the settlement or final adjudication of such matters and whether a reason-

able estimation of such probable loss, if any, can be made. In assessing probable losses, we

take into consideration estimates of the amount of insurance recoveries, if any. We accrue a

liability when we believe a loss is probable and the amount of loss can be reasonably estimat-

ed. Due to the inherent uncertainties related to the eventual outcome of litigation and potential

insurance recoveries, it is possible that certain matters may be resolved for amounts material-

ly different from any provisions or disclosures that we have previously made.

PROPOSED STATEMENT OF POSITION

On June 29, 2001, the Accounting Standards Executive Committee of the American Institute

of Certified Public Accountants issued a proposed Statement of Position (“ SOP” ),

“ Accounting for Certain Costs and Activities Related to Property, Plant and Equipment.” Under

the proposed SOP, we would be required to adopt a component method of accounting for our

ships. Using this method, each component of a ship would be identified as an asset and depre-

ciated over its own separate expected useful life. In addition, we would have to expense dry-

docking costs as incurred which differs from our current policy of accruing future drydocking

costs evenly over the period to the next scheduled drydocking. Lastly, liquidated damages

received from shipyards as mitigation of consequential economic costs incurred as a result of

the late delivery of a new ship would have to be recorded as a reduction of the ship's cost basis

versus our current treatment of recording liquidated damages as nonoperating income. We

have not yet analyzed the impact that this proposed SOP would have on our results of opera-

tion or financial position, as we are uncertain whether, or in what form, it will be adopted.

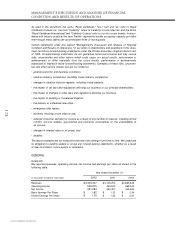

RESULTS OF OPERATIONS

The following table presents operating data as a percentage of revenues:

Year Ended December 31,

2002 2001 2000

Revenues 100.0% 100.0% 100.0%

Expenses:

Operating 61.5 61.5 57.7

Marketing, selling and administrative 12.6 14.4 14.4

Depreciation and amortization 9.9 9.6 8.0

Operating Income 16.0 14.5 19.9

Other Income (Expense) (5.8) (6.4) (4.4)

Net Income 10.2% 8.1% 15.5%