Royal Caribbean Cruise Lines 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (continued)

15

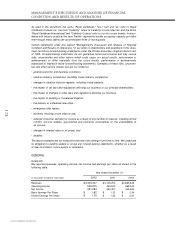

Unaudited selected statistical information is shown in the following table:

Year Ended December 31,

2002 2001 2000

Guests Carried 2,768,475 2,438,849 2,049,902

Guest Cruise Days 18,112,782 15,341,570 13,019,811

Occupancy Percentage 104.5% 101.8% 104.4%

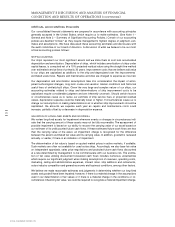

Net income increased 38.1% to $351.3 million or $1.79 per share on a diluted basis in 2002

compared to $254.5 million or $1.32 per share in 2001. The increase in net income was prima-

rily the result of an increase in capacity associated with the addition of

Infinity

,

Radiance of the

Seas

,

Summit

and

Adventure of the Seas

in 2001 and

Constellation

,

Brilliance of the Seas

and

Navigator of the Seas

in 2002.

Net income for 2002 included net proceeds of $33.0 million received in connection with the

termination of our merger agreement with P&O Princess Cruises plc (“ P&O Princess” ) and a

charge of approximately $20.0 million recorded in connection with a litigation settlement. (See

Note 12 – Commitments and Contingencies.) Net income for 2001 was adversely impacted

by approximately $47.7 million due to lost revenues and extra costs directly associated with

passengers not being able to reach their departure ports during the weeks following the ter-

rorist attacks of September 11, 2001 and costs associated with business decisions taken in

the aftermath of the attacks.

We have canceled a total of five weeks of sailings in the first quarter of 2003 due to the un-

anticipated drydock of one ship, which we estimate will negatively impact net income by

approximately $0.06 per share.

TERMINATION OF PROPOSED COMBINATION WITH P&O PRINCESS

In October 2002, our proposed combination with P&O Princess was terminated prior to its con-

summation and P&O Princess paid us a break fee of $62.5 million. We incurred approximately

$29.5 million of merger-related costs. We also agreed to terminate, effective as of January 1,

2003, our joint venture with P&O Princess. The venture was terminated before it commenced

business operations.

FLEET EXPANSION

Our current fleet expansion program encompasses three distinct ship designs known as the

Voyager class, Millennium class and Radiance class. Since 1999, we have taken delivery of four

Voyager, four Millennium and two Radiance-class ships. We currently operate 25 ships with

53,042 berths.

We have three ships on order for the Royal Caribbean International brand. The planned berths

and expected delivery dates of the ships on order are as follows:

Ship Expected Delivery Date Berths

Voyager class:

Mariner of the Seas

4th Quarter 2003 3,114

Radiance class:(1)

Serenade of the Seas

3rd Quarter 2003 2,076

Jewel of the Seas

2nd Quarter 2004 2,076

(1) We have options on two Radiance-class ships with delivery dates in the fourth quarters of 2005 and 2006.

We believe the Voyager-class ships are the largest and the most innovative passenger

cruise ships ever built. The Radiance-class ships are a progression from Royal Caribbean

International's Vision-class ships.

ROYAL CARIBBEAN CRUISES LTD.