Royal Caribbean Cruise Lines 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

ROYAL CARIBBEAN CRUISES LTD.

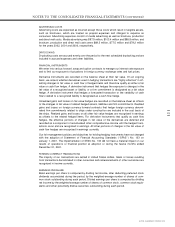

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

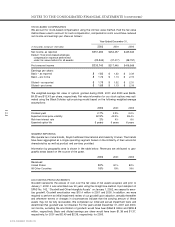

Ships under construction include progress payments for the construction of new ships as well

as planning, design, interest, commitment fees and other associated costs. We capitalized

interest costs of $23.4 million, $37.0 million and $44.2 million for the years 2002, 2001 and

2000, respectively. Accumulated amortization related to ships under capital lease was $159.9

million and $136.2 million at December 31, 2002 and 2001, respectively.

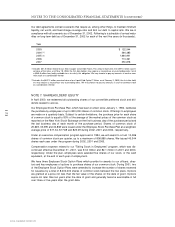

NOTE 5. OTHER ASSETS

We hold convertible preferred stock in First Choice Holidays PLC denominated in British pound

sterling valued at approximately $300 million. The convertible preferred stock carries a 6.75%

coupon. Dividends of $20.3 million, $19.4 million and $9.2 million were earned in 2002, 2001

and 2000, respectively and recorded in Other income (expense). If fully converted, our holding

would represent approximately a 17% interest in First Choice Holidays PLC.

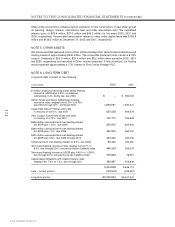

NOTE 6. LONG-TERM DEBT

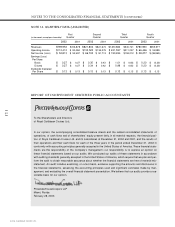

Long-term debt consists of the following:

(in thousands)

2002 2001

$1 billion unsecured revolving credit facility bearing

interest at LIBOR plus 0.45% on balances

outstanding, 0.2% facility fee, due 2003 $ – $ 350,000

Senior Notes and Senior Debentures bearing

interest at rates ranging from 6.75% to 8.75%,

due 2004 through 2011, 2018 and 2027 1,835,591 1,950,341

Liquid Yield Option™ Notes with yield

to maturity of 4.875%, due 2021 630,528 600,878

Zero Coupon Convertible Notes with yield

to maturity of 4.75%, due 2021 372,774 355,628

$625 million unsecured term loan bearing interest

at LIBOR plus 1.25%, due 2005 625,000 625,000

$360 million unsecured term loan bearing interest

at LIBOR plus 1.0%, due 2006 360,000 360,000

$300 million unsecured term loan bearing interest

at LIBOR plus 0.8%, due 2009 through 2010 300,000 300,000

Unsecured term loan bearing interest at 8.0%, due 2006 84,440 109,250

Term loans bearing interest at rates ranging from 6.7% to

8.0%, due through 2010, secured by certain Celebrity ships 466,209 506,675

Term loans bearing interest at LIBOR plus 0.45% to 1.535%,

due through 2010, secured by certain Celebrity ships 379,609 78,491

Capital lease obligations with implicit interest rates

ranging from 7.0% to 7.2%, due through 2011 390,687 409,849

5,444,838 5,646,112

Less – current portion (122,544) (238,581)

Long-term portion $5,322,294 $5,407,531