Royal Caribbean Cruise Lines 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

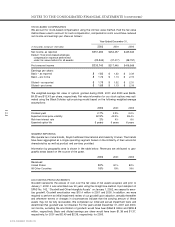

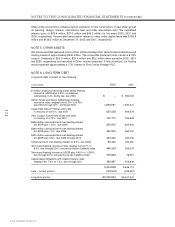

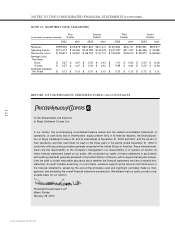

NOTE 8. EARNINGS PER SHARE

Below is a reconciliation between basic and diluted earnings per share:

Year Ended December 31,

(in thousands, except per share data)

2002 2001 2000

Basic:

Net income $351,284 $254,457 $445,363

Less preferred stock dividends –– (1,933)

Net income less preferred stock dividends $351,284 $254,457 $443,430

Weighted-average common shares outstanding 192,485 192,231 189,397

Basic earnings per share $ 1.82 $ 1.32 $ 2.34

Diluted:

Net income $351,284 $254,457 $445,363

Weighted-average common shares outstanding 192,485 192,231 189,397

Dilutive effect of stock options 3,246 1,250 1,428

Convertible preferred stock –– 2,110

Diluted weighted-average shares outstanding 195,731 193,481 192,935

Diluted earnings per share $ 1.79 $ 1.32 $ 2.31

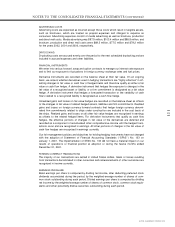

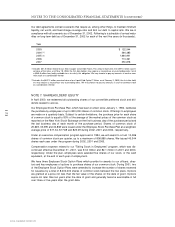

NOTE 9. RETIREMENT PLANS

We maintain a defined contribution pension plan covering all of our full-time shoreside employees

who have completed the minimum period of continuous service. Annual contributions to the plan

are based on fixed percentages of participants' salaries and years of service, not to exceed cer-

tain maximums. Pension cost was $8.5 million, $8.3 million and $7.3 million for the years 2002,

2001 and 2000, respectively.

Effective January 1, 2000, we instituted a defined benefit pension plan to cover all of our ship-

board employees not covered under another pension plan through their collective bargaining

agreement. Benefits to eligible employees are accrued based on the employee's years of serv-

ice. Pension expense was approximately $3.5 million, $3.2 million and $1.9 million in 2002, 2001

and 2000, respectively.

NOTE 10. INCOME TAXES

We and the majority of our subsidiaries are not subject to United States corporate income tax on

income generated from the international operation of ships pursuant to Section 883 of the

Internal Revenue Code, provided that we meet certain tests related to country of incorporation

and composition of shareholders. We believe that we and a majority of our subsidiaries meet

these tests. Income tax expense related to our remaining subsidiaries is not significant.