Royal Caribbean Cruise Lines 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Market risk associated with our long-term fixed rate debt is the potential increase in fair value

resulting from a decrease in interest rates. As of December 31, 2002, we had interest rate

swap agreements which exchanged fixed interest rates for floating interest rates in a notional

amount of $375.0 million, maturing in 2006 through 2011.

Market risk associated with our floating rate debt is the potential increase in interest expense

from an increase in interest rates. As of December 31, 2002, we had interest rate swap agree-

ments which, beginning January 2005, exchange floating rate term debt for a fixed interest rate

of 4.395% in a notional amount of $25.0 million, maturing in 2008.

Market risk associated with our operating lease for

Brilliance of the Seas

is the potential

increase in rent expense from an increase in interest rates. As of December 31, 2002, we had

interest rate swap agreements that effectively change British pound sterling 50.0 million of

sterling LIBOR-based operating lease payments to fixed rate lease payments with a weighted-

average fixed rate of 5.05% beginning January 2004.

FUEL SWAP AGREEMENTS

The fair values of our fuel swap and zero cost collar agreements were estimated based on quot-

ed market prices for similar or identical financial instruments to those we hold. Our exposure to

market risk for changes in fuel prices relates to the forecasted consumption of fuel on our ships.

We use fuel swap and zero cost collar agreements to mitigate the impact of fluctuations in fuel

prices. As of December 31, 2002, we had fuel swap agreements to pay fixed prices for fuel with

an aggregate notional amount of $39.4 million, maturing through 2003. Approximately $6.7 mil-

lion of unrealized gains and $7.0 million of unrealized losses on these contracts were deferred

at December 31, 2002 and 2001, respectively. Deferred unrealized gains, if realized, will be

recorded in earnings when the transactions being hedged are recognized in 2003.

Our exposure under foreign currency contracts, interest rate and fuel swap agreements is limited

to the cost of replacing the contracts in the event of non-performance by the counterparties to the

contracts, all of which are currently our lending banks. To minimize this risk, we select counter-

parties with credit risks acceptable to us and we limit our exposure to any individual counterparty.

Furthermore, all foreign currency forward contracts are denominated in primary currencies.

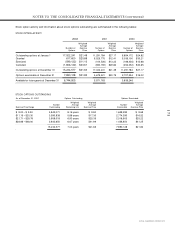

NOTE 12. COMMITMENTS AND CONTINGENCIES

CAPITAL EXPENDITURES

As of December 31, 2002, we had three ships on order for an additional capacity of 7,266

berths. The aggregate contract price of the three ships, which excludes capitalized interest and

other ancillary costs, is approximately $1.3 billion, of which we have deposited $0.2 billion as of

December 31, 2002. We anticipate that overall capital expenditures will be approximately $1.1

billion, $0.5 billion and $0.1 billion for 2003, 2004 and 2005, respectively.

LITIGATION

In April 1999, a lawsuit was filed in the United States District Court for the Southern District of

New York on behalf of current and former crew members alleging that we failed to pay the plain-

tiffs their full wages. The suit sought payment of (i) the wages alleged to be owed, (ii) penalty

wages under 46 United States Code Section 10313 and (iii) punitive damages. In November

1999, a purported class action suit was filed in the same court alleging a similar cause of action.

In October 2002, we entered into settlement agreements in connection with both lawsuits.

Under the terms of the settlement agreements, we could be required to make aggregate pay-

ments of $20.0 million, for which we recorded a reserve as of September 30, 2002.

We are routinely involved in other claims typical within the cruise industry. The majority of these

claims is covered by insurance. We believe the outcome of such other claims, net of expected

insurance recoveries, is not expected to have a material adverse effect upon our financial con-

dition or results of operations.