Royal Caribbean Cruise Lines 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

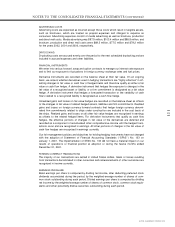

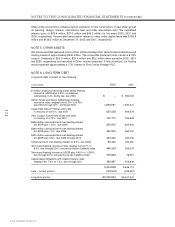

ADVERTISING COSTS

Advertising costs are expensed as incurred except those costs which result in tangible assets,

such as brochures, which are treated as prepaid expenses and charged to expense as

consumed. Advertising expenses consist of media advertising as well as brochure, production

and direct mail costs. Media advertising was $97.9 million, $103.4 million and $98.9 million, and

brochure, production and direct mail costs were $69.5 million, $77.5 million and $79.2 million

for the years 2002, 2001 and 2000, respectively.

DRYDOCKING

Drydocking costs are accrued evenly over the period to the next scheduled drydocking and are

included in accrued expenses and other liabilities.

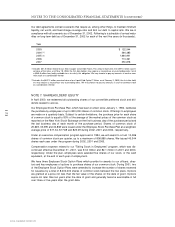

FINANCIAL INSTRUMENTS

We enter into various forward, swap and option contracts to manage our interest rate exposure

and to limit our exposure to fluctuations in foreign currency exchange rates and fuel prices.

Derivative instruments are recorded on the balance sheet at their fair value. On an ongoing

basis, we assess whether derivatives used in hedging transactions are "highly effective" in off-

setting changes in fair value or cash flow of hedged items and therefore qualify as either a fair

value or cash flow hedge. A derivative instrument that hedges the exposure to changes in the

fair value of a recognized asset or liability, or a firm commitment is designated as a fair value

hedge. A derivative instrument that hedges a forecasted transaction or the variability of cash

flows related to a recognized liability is designated as a cash flow hedge.

Unrealized gains and losses on fair value hedges are recorded on the balance sheet as offsets

to the changes in fair value of related hedged assets, liabilities and firm commitments. Realized

gains and losses on foreign currency forward contracts that hedge foreign currency denomi-

nated firm commitments related to ships under construction are included in the cost basis of

the ships. Realized gains and losses on all other fair value hedges are recognized in earnings

as offsets to the related hedged items. For derivative instruments that qualify as cash flow

hedges, the effective portions of changes in fair value of the derivatives are deferred and

recorded as a component of accumulated other comprehensive income until the hedged trans-

actions occur and are recognized in earnings. All other portions of changes in the fair value of

cash flow hedges are recognized in earnings currently.

Our risk-management policies and objectives for holding hedging instruments have not changed

with the adoption of Statement of Financial Accounting Standards (“ SFAS” ) No. 133 on

January 1, 2001. The implementation of SFAS No. 133 did not have a material impact on our

results of operations or financial position at adoption or during the twelve months ended

December 31, 2001.

FOREIGN CURRENCY TRANSACTIONS

The majority of our transactions are settled in United States dollars. Gains or losses resulting

from transactions denominated in other currencies and remeasurements of other currencies are

recognized in income currently.

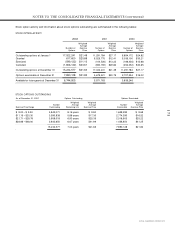

EARNINGS PER SHARE

Basic earnings per share is computed by dividing net income, after deducting preferred stock

dividends accumulated during the period, by the weighted-average number of shares of com-

mon stock outstanding during each period. Diluted earnings per share is computed by dividing

net income by the weighted-average number of shares of common stock, common stock equiv-

alents and other potentially dilutive securities outstanding during each period.