Royal Caribbean Cruise Lines 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

ROYAL CARIBBEAN CRUISES LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

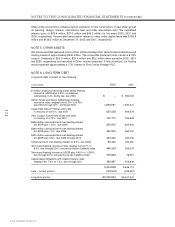

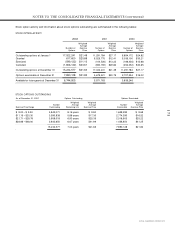

OPERATING LEASES

On July 5, 2002, we added

Brilliance of the Seas

to Royal Caribbean International’s fleet. In con-

nection with this addition, we novated our original ship building contract and entered into a long-

term operating lease denominated in British pound sterling. The total lease term is 25 years

cancelable by either party at years 10 and 18. In connection with the novation of the contract, we

received $77.7 million for reimbursement of shipyard deposits previously made. The lease pay-

ments vary based on sterling LIBOR. In addition, we are obligated under other noncancelable oper-

ating leases primarily for office and warehouse facilities, computer equipment and motor vehicles.

As of December 31, 2002, future minimum lease payments under noncancelable operating leas-

es were as follows (in thousands):

Year

2003 $ 47,020

2004 46,858

2005 43,538

2006 40,582

2007 39,870

Thereafter 196,065

$413,933

Total expense for all operating leases amounted to $24.3 million, $9.8 million and $6.7 million

for the years 2002, 2001 and 2000, respectively.

Under the

Brilliance of the Seas

long-term operating lease, we have agreed to indemnify the les-

sor to the extent its after-tax return is negatively impacted by unfavorable changes in corporate

tax rates and capital allowance deductions. These indemnifications could result in an increase in

our annual lease payments. We are unable to estimate the maximum potential increase in such

lease payments due to the various circumstances, timing or combination of events that could trig-

ger such indemnifications. Current facts indicate that an indemnification is not probable; howev-

er, if one occurs, we may have remedies available to us under the terms of the lease agreement.

OTHER

At December 31, 2002, we have future commitments to pay for our usage of certain port facil-

ities, maintenance contracts and communication services as follows (in thousands):

Year

2003 $ 39,259

2004 40,617

2005 28,479

2006 24,973

2007 21,443

Thereafter 106,821

$261,592

NOTE 13. SUBSEQUENT EVENTS

We currently have canceled a total of five weeks of sailings in the first quarter of 2003 due to

the unanticipated drydock of one ship.