Royal Caribbean Cruise Lines 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

In January 2002, we adopted SFAS No. 144, "Accounting for the Impairment or Disposal of

Long-Lived Assets," which requires the measurement and recognition of the impairment of

(i) long-lived assets to be held and used and (ii) long-lived assets to be held for sale. The

implementation of SFAS No. 144 did not have a material impact on our results of operations

or financial position at adoption or during the year ended December 31, 2002.

In June 2002, the Financial Accounting Standards Board issued SFAS No.146, “ Accounting for

Costs Associated with Exit or Disposal Activities.” SFAS No. 146 requires that liabilities for

costs associated with an exit activity or disposal of long-lived assets be recognized when the

liabilities are incurred and when the fair value can be determined. SFAS No. 146 is effective for

any exit or disposal activities that are initiated after December 31, 2002.

In November 2002, Financial Accounting Standards Board Interpretation (“ FIN” ) No. 45,

“ Guarantor’s Accounting and Disclosure Requirements for Guarantors, Including Indirect

Guarantees of Indebtedness of Others” was issued. FIN No. 45 requires recognition of an initial

liability for the fair value of the guarantor’s obligation upon issuance of a guarantee. Disclosure

requirements have been expanded to include information about each guarantee, even if the

likelihood of any required payment is remote. We adopted the disclosure requirements of

FIN No. 45 as of December 31, 2002. The initial recognition and measurement provisions are

effective on a prospective basis for guarantees issued or modified after December 31, 2002.

In December 2002, the Financial Accounting Standards Board issued SFAS No. 148, “ Accounting

for Stock-Based Compensation – Transition and Disclosure – an Amendment of SFAS No. 123,”

to provide alternative methods of transition for a voluntary change to the fair value based method

of accounting for stock-based employee compensation. SFAS No. 148 amends the requirements

of SFAS No. 123 requiring prominent disclosures in annual and interim financial statements about

the method of accounting for stock-based employee compensation and the effect of the method

used on reported results. We continue to use the intrinsic value method and, as a result, the adop-

tion of SFAS No. 148 had no impact on our results of operations or financial position.

In January 2003, the Financial Accounting Standards Board issued FIN No. 46, “ Consolidation

of Variable Interest Entities, an Interpretation of ARB No. 51.” FIN No. 46 requires certain vari-

able interest entities to be consolidated by the primary beneficiary of the entity if specific crite-

ria are met. FIN No.46 is effective for all new variable interest entities created or acquired after

January 31, 2003. For variable interest entities created or acquired prior to February 1, 2003,

the provisions of FIN No. 46 must be applied for the first interim or annual period beginning after

June 15, 2003. We are currently evaluating the effect that the adoption of FIN No. 46 will have

on our results of operations and financial position.

NOTE 3. TERMINATION OF PROPOSED COMBINATION WITH P&O PRINCESS

In October 2002, our proposed combination with P&O Princess was terminated prior to its con-

summation and P&O Princess paid us a break fee of $62.5 million. We incurred approximately

$29.5 million of merger-related costs. The net proceeds of $33.0 million were included in Other

income (expense). We also agreed to terminate, effective as of January 1, 2003, our joint ven-

ture with P&O Princess. The venture was terminated before it commenced business operations.

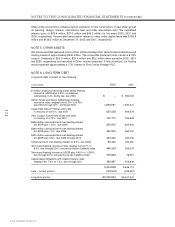

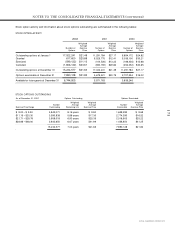

NOTE 4. PROPERTY AND EQUIPMENT

Property and equipment consists of the following:

(in thousands)

2002 2001

Land $ 7,056 $ 7,056

Ships 9,404,959 8,289,028

Ships under capital lease 772,096 771,131

Ships under construction 265,782 396,286

Other 378,345 366,914

10,828,238 9,830,415

Less – accumulated depreciation and amortization (1,551,754) (1,224,967)

$ 9,276,484 $8,605,448

ROYAL CARIBBEAN CRUISES LTD.