Redbox 2015 Annual Report Download - page 97

Download and view the complete annual report

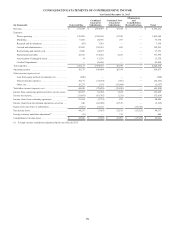

Please find page 97 of the 2015 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 14: Business Segments and Enterprise-Wide Information

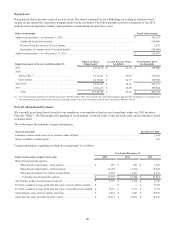

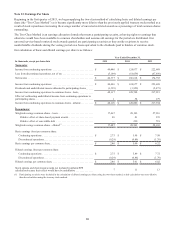

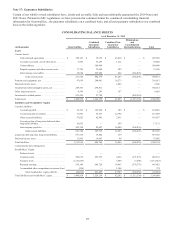

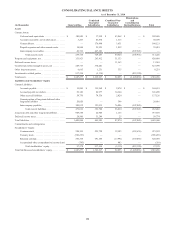

Management, including our chief operating decision maker, who is our CEO, evaluates the performances of our business

segments primarily on segment revenue and segment operating income (loss) before depreciation, amortization and other, and

share-based compensation granted to executives, non-employee directors and employees (“segment operating income (loss)”).

Segment operating income (loss) contains internally allocated costs of our shared service support functions, including but not

limited to, corporate executive management, business development, sales, finance, legal, human resources, information

technology and risk management. We also review depreciation and amortization allocated to each segment. Share-based

payments expense related to share-based compensation granted to executives, non-employee directors and employees and

expense related to the rights to receive cash issued in connection with our acquisition of ecoATM are not allocated to our

segments and are included in the Corporate Unallocated column in the analysis and reconciliation below; however, share-based

payments expense related to our content arrangements with certain movie studios has been allocated to our Redbox segment

and is included within direct operating expenses. Our performance evaluation does not include segment assets.

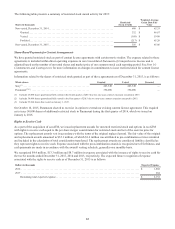

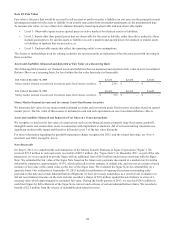

Changes in our Organizational Structure

We regularly assess the performance of our concepts to determine whether continued funding or other alternatives are

appropriate and as a result, we discontinued operating SAMPLEit in the fourth quarter of 2015. As SAMPLEit did not represent

a major component of our operations or financial results, the results of SAMPLEit did not qualify to be reported as a

discontinued operation and remain in our All Other reporting category.

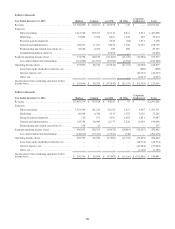

During the first quarter of 2015, we added ecoATM, our electronic device recycling business, as a separate reportable segment.

Previously, the results of ecoATM along with those of other self-service concepts were included in our former New Ventures

segment. The combined results of the other self-service concepts are now included in our All Other reporting category in the

reconciliation below, as they do not meet quantitative thresholds to be reported as a separate segment. All goodwill previously

allocated to the New Ventures segment has been allocated to the ecoATM segment. See Note 6: Goodwill and Other Intangible

Assets for further information.

Results of operations for Gazelle from the acquisition date, November 10, 2015, are included in our ecoATM segment. See

Note 3: Business Combinations for further information.

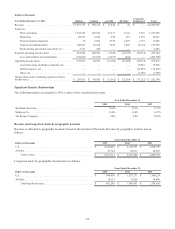

On July 23, 2013, we completed the acquisition of ecoATM. Prior to July 23, 2013 we held a non-controlling equity interest in

ecoATM and reported our share of ecoATM's operating results in loss from equity method investments in our Consolidated

Statements of Comprehensive Income. Subsequent to our acquisition of ecoATM on July 23, 2013, the assets acquired and

liabilities assumed, as well as the results of operations, with the exception of expense for rights to receive cash which are

unallocated corporate expenses, are included in our ecoATM segment.

Comparability of Segment Results

We have recast prior period results for the following:

• Discontinued operations, consisting of our Redbox operations in Canada which we shut down during the first quarter

of 2015. See Note 12: Discontinued Operations for further information; and

• The addition of our ecoATM segment and our All Other reporting category, which we added during the first quarter of

2015.

Our analysis and reconciliation of our segment information to the consolidated financial statements that follows covers our

results of operations, which consists of our Redbox, Coinstar and ecoATM segments, Corporate Unallocated expenses and our

All Other reporting category. All Other includes the results of other self-service concepts, which we regularly assess to

determine whether continued funding or other alternatives are appropriate.

89