Redbox 2015 Annual Report Download - page 91

Download and view the complete annual report

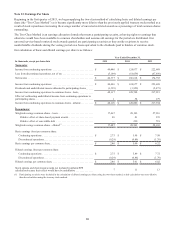

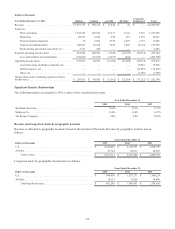

Please find page 91 of the 2015 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 11: Restructuring

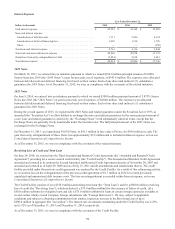

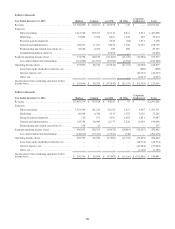

2015 Restructuring

During the first quarter of 2015, we recorded restructuring charges arising from the following activities:

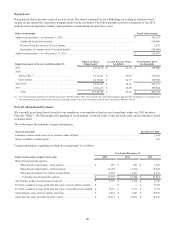

• Discontinuing our Redbox operations in Canada. The disposal was completed on March 31, 2015. See Note 12:

Discontinued Operations for further information;

• Reducing the size of our Redbox headquarters facility in Oakbrook Terrace, Illinois through early termination of

operating leases for certain floors. We ceased using the office space on March 31, 2015, and the effective date of the

early termination is July 31, 2016. Prior to exercising our early termination option, the leases had been scheduled to

expire in July 2021; and

• Implementing actions to further align costs with revenues in our continuing operations primarily through workforce

reductions across the Company and subleasing a floor of a corporate facility.

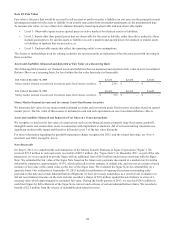

The restructuring liability for this workforce reduction was recorded in the first quarter of 2015 in accordance with ASC 420,

consistent with management's approval and commitment to the restructuring plan in the first quarter of 2015, and the

communication of those plan details to affected employees within that quarter.

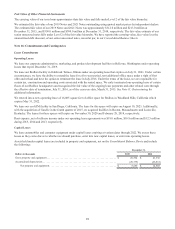

During the fourth quarter of 2015, we recorded restructuring charges arising from the following additional activities:

• Discontinuing our SAMPLEit concept, which is recorded in our All Other reporting category. See Note 14: Business

Segments and Enterprise-Wide Information for additional information; and

• Continuing to implement actions to further align costs with revenues in our continuing operations primarily through

workforce reductions across the Company, a one-time payment to settle an outstanding purchase commitment, and

vacating a floor of a corporate facility. See Note 16: Commitments and Contingencies for further information related to

the purchase commitment.

We recorded the restructuring liabilities in the fourth quarter of 2015 under ASC 712, consistent with management's approval

and commitment to the restructuring plan. We had a substantive plan in place, for purposes of ASC 712, based on the fact that

the termination benefits to be paid to our employees were similar to the termination benefits historically paid by us, thereby

enabling employees to determine the type and amount of benefits they would receive if they were involuntarily terminated. The

restructuring liability represented our obligation related to our employees' rights to receive compensation attributable to

services already rendered, which rights had already vested or accumulated. Due to the fact that management had approved and

committed to the restructuring plan and based on historical experience, payment of the severance was probable and the amount

was reasonably estimated.

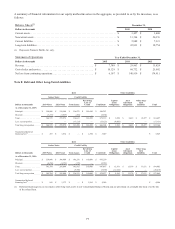

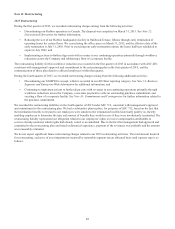

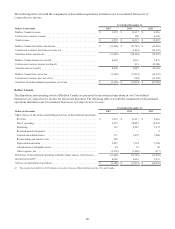

We do not expect significant future restructuring charges related to our 2015 restructuring activities. The total amount incurred

for restructuring, exclusive of asset impairments incurred by reportable segment (on an allocated basis) and expense type is as

follows:

83