Redbox 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

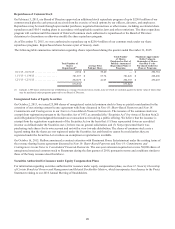

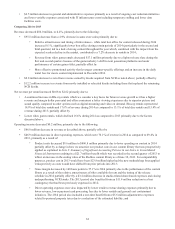

Income from continuing operations decreased $98.0 million, or 44.0%, primarily due to:

• $48.7 million increase in loss from equity method investments primarily due to a $68.4 million gain recorded in the

third quarter of 2013 on the re-measurement of our previously held equity interest in ecoATM to its acquisition date

fair value;

• $26.5 million increase in income tax expense due primarily to discrete tax benefits in 2013;

• $14.8 million increase in interest expense due to increased average borrowings which includes the impact of the

$300.0 million principal amount of our 2021 Notes that we issued on June 9, 2014 (see Note 8: Debt and Other Long-

Term Liabilities in our Notes to Consolidated Financial Statements for more information); and

• $10.5 million decrease in operating income discussed above.

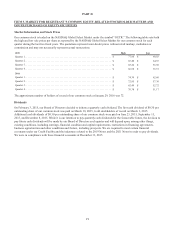

Share-Based Payments and Rights to Receive Cash

Our share-based payments consist of share-based compensation granted to executives, non-employee directors and employees,

and share-based payments granted to movie studios as part of content agreements. We grant stock options, restricted stock and

performance-based restricted stock to executives and non-employee directors, and restricted stock to our employees. In

connection with our acquisition of ecoATM, we also granted certain rights to receive cash (the "rights to receive cash"). We

also granted restricted stock to certain movie studios as part of content agreements with our Redbox segment. The expense

associated with the grants to movie studios is allocated to our Redbox segment and included within direct operating expenses.

The expenses associated with share-based compensation to our executives, non-employee directors, employees and related to

the rights to receive cash are part of our corporate function and are not allocated to our segments. The components of our

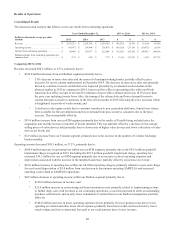

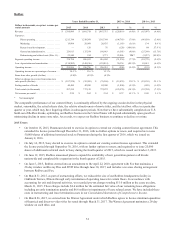

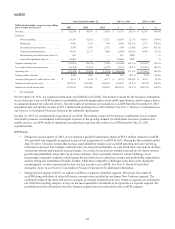

unallocated share-based compensation expense are presented in the following table:

Years Ended December 31, 2015 vs. 2014 2014 vs. 2013

Dollars in thousands, except per share

amounts 2015 2014 2013 $%$%

Direct operating . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,561 $ 6,585 $ 3,636 $ (4,024) (61.1)% $ 2,949 81.1 %

Marketing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 695 3,193 1,559 (2,498) (78.2)% 1,634 104.8 %

Research and development. . . . . . . . . . . . . . . . . . 1,737 3,851 1,375 (2,114) (54.9)% 2,476 180.1 %

General and administrative. . . . . . . . . . . . . . . . . . 11,756 11,658 14,164 98 0.8 % (2,506) (17.7)%

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 16,749 $ 25,287 $ 20,734 $ (8,538) (33.8)% $ 4,553 22.0 %

* Not meaningful

Unallocated share-based compensation expense decreased $8.5 million, or 33.8% and increased $4.6 million, or 22.0% during

the years ended December 31, 2015 and 2014, respectively. These changes are primarily due to the timing of expense

recognized for rights to receive cash we issued as replacement awards for unvested restricted stock as part of our acquisition of

ecoATM in the third quarter of 2013. See Note 10: Share-Based Payments in our Notes to Consolidated Financial Statements

for more information.

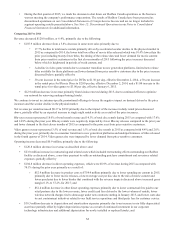

Segment Results

Our discussion and analysis that follows covers results of operations for our Redbox, Coinstar and ecoATM segments.

We manage our business by evaluating the financial results of our segments, focusing primarily on segment revenue and

segment operating income before depreciation, amortization and other and share-based compensation granted to executives,

non-employee directors and employees (“segment operating income”). Segment operating income contains internally allocated

costs of our shared services support functions, including but not limited to, corporate executive management, business

development, sales, customer service, finance, legal, human resources, information technology, and risk management. We also

review depreciation and amortization allocated to each segment.

Management utilizes segment revenue and segment operating income to evaluate the health of our business segments and in

consideration of allocating resources among our business segments. Specifically, our CEO evaluates segment revenue and

segment operating income, and assesses the performance of each business segment based on these measures, as well as, among

other things, the prospects of each of the segments and how they fit into our overall strategy. Our CEO then decides how

resources should be allocated among our business segments. For example, if a segment’s revenue increases more than expected,

our CEO may consider allocating more financial or other resources to that segment in the future. We periodically evaluate our

shared services support function’s allocation methods used for segment reporting purposes, which may result in changes to

segment allocations in future periods.

29