Redbox 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

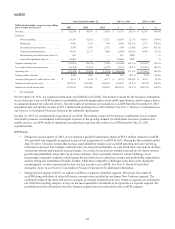

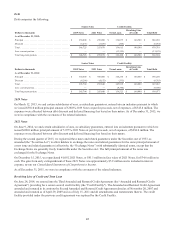

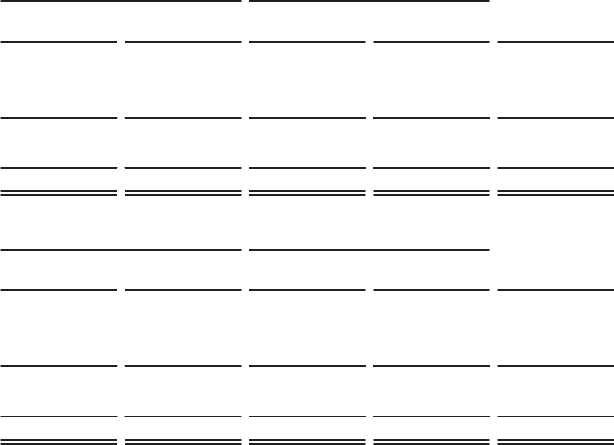

Debt

Debt comprises the following:

Senior Notes Credit Facility

Total DebtDollars in thousands 2019 Notes 2021 Notes Term Loans

Revolving Line

of Credit

As of December 31, 2015:

Principal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 350,000 $ 258,908 $ 136,875 $ 140,500 $ 886,283

Discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,275) (3,029) (260) — (6,564)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 346,725 255,879 136,615 140,500 879,719

Less: current portion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (13,125) — (13,125)

Total long-term portion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 346,725 $ 255,879 $ 123,490 $ 140,500 $ 866,594

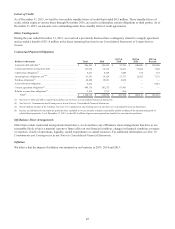

Senior Notes Credit Facility

Total DebtDollars in thousands 2019 Notes 2021 Notes Term Loans

Revolving Line

of Credit

As of December 31, 2014:

Principal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 350,000 $ 300,000 $ 146,250 $ 160,000 $ 956,250

Discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,296) (4,152) (335) — (8,783)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 345,704 295,848 145,915 160,000 947,467

Less: current portion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (9,390) — (9,390)

Total long-term portion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 345,704 $ 295,848 $ 136,525 $ 160,000 $ 938,077

2019 Notes

On March 12, 2013, we and certain subsidiaries of ours, as subsidiary guarantors, entered into an indenture pursuant to which

we issued $350.0 million principal amount of 6.000% 2019 Notes at par for proceeds, net of expenses, of $343.8 million. The

expenses were allocated between debt discount and deferred financing fees based on their nature. As of December 31, 2015, we

were in compliance with the covenants of the related indenture.

2021 Notes

On June 9, 2014, we and certain subsidiaries of ours, as subsidiary guarantors, entered into an indenture pursuant to which we

issued $300.0 million principal amount of 5.875% 2021 Notes at par for proceeds, net of expenses, of $294.0 million. The

expenses were allocated between debt discount and deferred financing fees based on their nature.

During the second quarter of 2015, we registered these notes and related guarantees under the Securities Act of 1933, as

amended (the “Securities Act”) to allow holders to exchange the notes and related guarantees for the same principal amount of

a new issue and related guarantees (collectively, the “Exchange Notes”) with substantially identical terms, except that the

Exchange Notes are generally freely transferable under the Securities Act. The full principal amount of the notes was

exchanged for the Exchange Notes.

On December 15, 2015, we repurchased 41,092 2021 Notes, or $41.1 million in face value of 2021 Notes, for $34.6 million in

cash. The gain from early extinguishment of these 2021 Notes was approximately $5.9 million and is included in interest

expense, net on our Consolidated Statements of Comprehensive Income.

As of December 31, 2015, we were in compliance with the covenants of the related indenture.

Revolving Line of Credit and Term Loan

On June 24, 2014, we entered into the Third Amended and Restated Credit Agreement (the “Amended and Restated Credit

Agreement”) providing for a senior secured credit facility (the "Credit Facility"). The Amended and Restated Credit Agreement

amended and restated in its entirety the Second Amended and Restated Credit Agreement dated as of November 20, 2007 and

amended and restated as of April 29, 2009 and as of July 15, 2011 and all amendments and restatements thereto. The credit

facility provided under the previous credit agreement was replaced by the Credit Facility.

45