Redbox 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

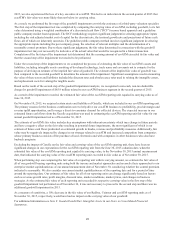

Comparing 2014 to 2013

Income tax expense increased by $26.5 million resulting from higher taxable income primarily driven by:

• $34.5 million in tax benefits related to discrete items occurring in 2013 composed of:

$16.7 million related to the recognition of a worthless stock deduction from an outside basis difference in a

corporate subsidiary in 2013; and

$17.8 million, net of a valuation allowance, through the realization of capital and ordinary gains and losses

associated with the series of transactions to reorganize Redbox related subsidiary structures through the sale

of a wholly owned subsidiary; partially offset by

• $5.3 million increase in the domestic production activities deduction from $1.5 million in 2013 to $6.8 million in

2014; and

• $2.7 million in additional impact primarily driven by various permanent and discrete items as well as the $3.2 million

decrease in Income from continuing operations before income taxes excluding the $68.4 million non-taxable gain on

previously held equity interest in ecoATM.

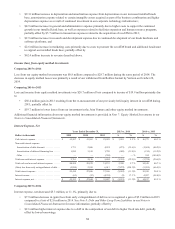

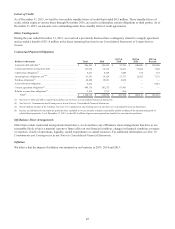

Non-GAAP Financial Measures

Non-GAAP measures may be provided as a complement to results provided in accordance with United States generally

accepted accounting principles (“GAAP”).

We use the following non-GAAP financial measures to evaluate our financial results:

• Core adjusted EBITDA from continuing operations;

•Core diluted earnings per share (“EPS”) from continuing operations;

• Free cash flow; and

• Net debt and net leverage ratio.

These measures, the definitions of which are presented below, are non-GAAP because they exclude certain amounts which are

included in the most directly comparable measure calculated and presented in accordance with GAAP. Our non-GAAP

financial measures are not meant to be considered in isolation or as a substitute for our GAAP financial measures and may not

be comparable with similarly titled measures of other companies.

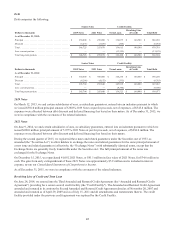

Core and Non-Core Results

We distinguish our core activities, those associated with our primary operations which we directly control, from non-core

activities. Non-core activities may include nonrecurring events or events we do not directly control. Our non-core adjustments

for the periods presented include i) goodwill impairment, ii) restructuring costs (including severance and contract termination

costs, that include early lease terminations and the related asset impairments) associated with actions to reduce costs in our

continuing operations across the Company, iii) acquisition costs related to the acquisitions of Gazelle and ecoATM, iv)

compensation expense for rights to receive cash issued in conjunction with our acquisition of ecoATM and attributable to post-

combination services as they are fixed amount acquisition related awards and not indicative of the directly controllable future

business results, v) loss from equity method investments, which represents our share of income or loss from entities we do not

consolidate or control and includes the impacts of the gain on re-measurement of our previously held equity interest in ecoATM

upon acquisition, vi) gain on bargain purchase of Gazelle, vii) benefits from release of indemnification reserves upon

settlement of the Sigue Note, viii) tax benefits related to a net operating loss adjustment and a worthless stock deduction ("Non-

Core Adjustments").

We believe investors should consider our core results because they are more indicative of our ongoing performance and trends,

are more consistent with how management evaluates our operational results and trends, provide meaningful supplemental

information to investors through the exclusion of certain expenses which are either nonrecurring or may not be indicative of our

directly controllable business operating results, allow for greater transparency in assessing our performance, help investors

better analyze the results of our business and assist in forecasting future periods.

40