Redbox 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Credit Facility consists of (a) a $150.0 million amortizing term loan (the “Term Loan”) and (b) a $600.0 million revolving

line of credit (the “Revolving Line”), which includes (i) a $75.0 million sublimit for the issuance of letters of credit, (ii) a

$50.0 million sublimit for swingline loans and (iii) a $75.0 million sublimit for loans in certain foreign currencies available to

us and certain wholly owned Company foreign subsidiaries (the “Foreign Borrowers”). We may, subject to applicable

conditions and subject to obtaining commitments from lenders, request an increase in the Revolving Line of up to $200.0

million in aggregate (the “Accordion”).

We (or the Foreign Borrowers, if applicable), subject to applicable conditions, may generally elect interest rates on the Term

Loan and Revolving Line calculated by reference to (a) LIBOR (“London Interbank Offered Rate”) (or the Canadian Dealer

Offered Rate, in the case of loans denominated in Canadian Dollars or, if LIBOR is not available for a foreign currency, such

other interest rate customarily used by Bank of America for such foreign currency) for given interest periods (the “LIBOR/

Eurocurrency Rate”) or (b) on loans in U.S. Dollars made to us, Bank of America’s prime rate (or, if greater, (i) the average rate

on overnight federal funds plus 0.50% or (ii) the daily floating one month LIBOR plus 1%) (the “Base Rate”), plus a margin

determined by our consolidated net leverage ratio. For swingline borrowings, we will pay interest at the Base Rate, plus a

margin determined by our consolidated net leverage ratio. For borrowings made with the LIBOR/Eurocurrency Rate, the

margin ranges from 125 to 200 basis points, while for borrowings made with the Base Rate, the margin ranges from 25 to 100

basis points.

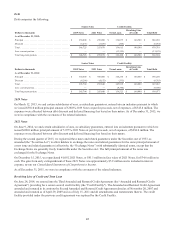

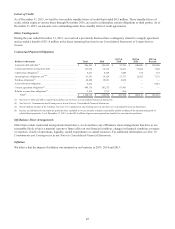

The Amended and Restated Credit Agreement requires principal amortization payments under the Term Loan as follows:

Dollars in thousands Repayment Amount

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 13,125

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,000

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,750

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90,000

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 136,875

The Revolving Line matures on June 24, 2019, at which time all outstanding borrowings must be repaid and all outstanding

letters of credit must have been terminated or cash collateralized. The maturity date of the borrowings under the Credit Facility

may be accelerated to December 18, 2018 if our senior unsecured notes due 2019 remain outstanding on or after such date. We

may prepay amounts borrowed under the Term Loan without premium or penalty (other than breakage costs in the case of

borrowings made with the LIBOR/Eurocurrency Rate), but amounts prepaid may not be re-borrowed.

The Amended and Restated Credit Agreement contains events of default that include, among others, non-payment of principal,

interest or fees, violation of covenants, inaccuracy of representations and warranties, bankruptcy and insolvency events,

material judgments, cross defaults to certain other indebtedness, and events constituting a change of control. The occurrence of

an event of default will increase the applicable rate of interest and could result in the acceleration of our obligations under the

Credit Facilities and the obligations of any or all of the Guarantors to pay the full amount of our (or any Foreign Borrower’s)

obligations under the Credit Facility.

The Amended and Restated Credit Agreement contains certain loan covenants, including, among others, financial covenants

providing for a maximum consolidated net leverage ratio (i.e., consolidated total debt (net of certain cash and cash equivalents

held by us and our domestic subsidiaries) to consolidated EBITDA) and a minimum consolidated interest coverage ratio, and

limitations on our ability with regard to the incurrence of debt, the existence of liens, capital expenditures, stock repurchases

and dividends, investments, and mergers, dispositions and acquisitions. Our obligations under the Credit Facility are guaranteed

by each of our direct and indirect U.S. subsidiaries (collectively, the “Guarantors”), and if any Foreign Borrower is added to the

Credit Facility, the Foreign Borrower’s obligations will be guaranteed by us and each of the Guarantors. The interest rate on

amounts outstanding under the Credit Facility was 2.29% and 1.92% as of December 31, 2015 and December 31, 2014,

respectively and as of December 31, 2015, we were in compliance with the covenants of the Credit Facility.

Convertible Debt

On September 2, 2014, our 4.0% Convertible Senior Notes (the “Convertible Notes”) matured. The Convertible Notes were

convertible as of December 31, 2013. In 2014, we retired or settled upon maturity, a combined 51,148 Convertible Notes for

total consideration of $51.1 million in cash and the issuance of 431,760 shares of common stock. The amount by which total

consideration exceeded the fair value of the Convertible Notes has been recorded as a reduction of stockholders’ equity. The

loss from early extinguishment of the Convertible Notes was approximately $0.3 million and is recorded in Interest expense,

net in our Consolidated Statements of Comprehensive Income.

46