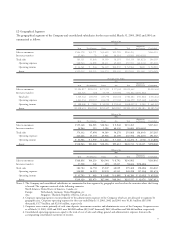

Pentax 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

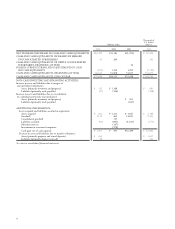

49

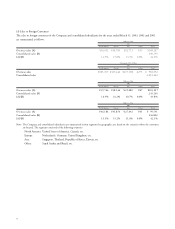

On March 31, 2003, a tax reform law was enacted in Japan which changed the normal effective statutory tax rate from approximately

41.7% to 40.4%, effective for years beginning April 1, 2004. The effect of this change on deferred taxes in the consolidated statements of

income for the year ended March 31, 2003 was a decrease of approximately ¥94 million ($783 thousand).

No»12 RESEARCH AND DEVELOPMENT EXPENSES

Research and development expenses charged to income for the years ended March 31, 2003, 2002 and 2001 were ¥6,843 million

($57,025 thousand), ¥5,511 million and ¥5,161 million, respectively.

No»13 LEASES

Income from equipment leases for the years ended March 31, 2002, and 2001 was ¥4 million and ¥38 million, respectively.

The Group leases certain machinery, computer equipment, office space and other assets. Total rental expenses for the years ended

March 31, 2003, 2002 and 2001 were ¥7,967 million ($66,392 thousand), ¥8,739 million and ¥8,352 million, including ¥1,344

million ($11,200 thousand), ¥1,413 million and ¥1,745 million of lease payments under finance leases, respectively.

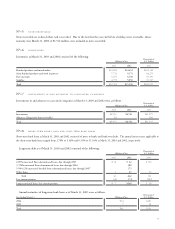

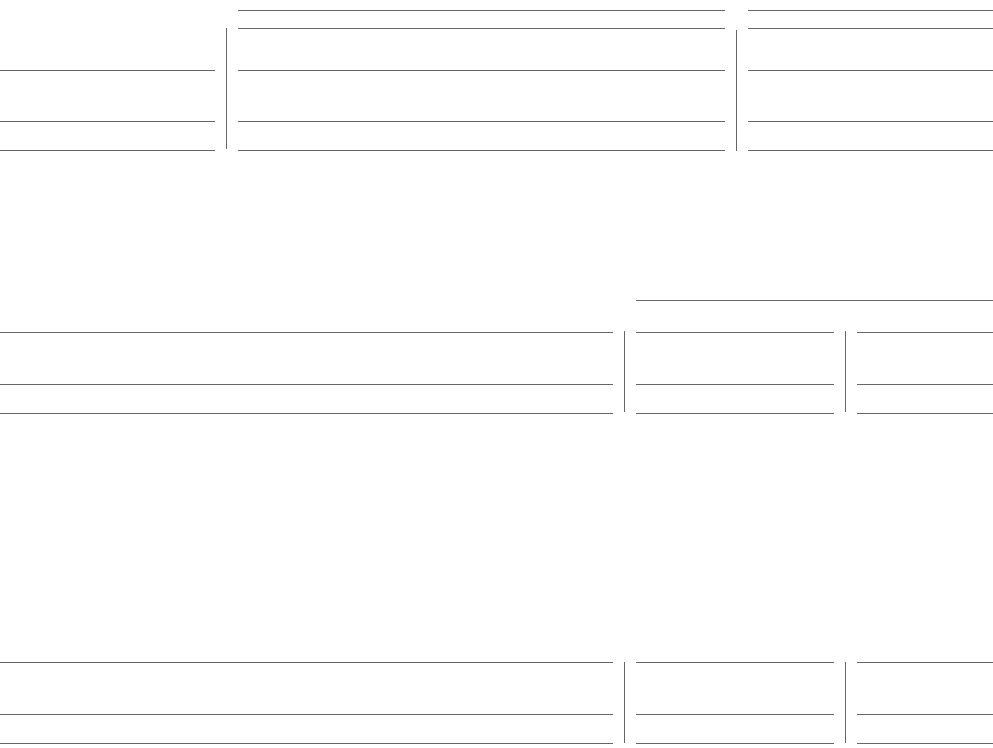

Pro forma information of leased property such as acquisition cost, accumulated depreciation, obligation under finance lease, depreciation

expense of finance leases that do not transfer ownership of the leased property to the lessee on an “as if capitalized” basis for the years ended

March 31, 2003 and 2002 was as follows:

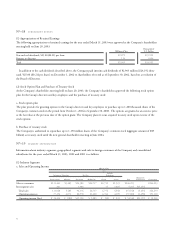

Millions of Yen Thousands of U.S. Dollars

2003 2002 2003

Machinery Furniture Machinery Furniture Machinery Furniture

and and and and and and

Vehicles Equipment Total Vehicles Equipment Total Vehicles Equipment Total

Acquisition cost ¥3,571 ¥3,305 ¥6,876 ¥2,966 ¥3,975 ¥6,941 $29,758 $27,542 $57,300

Accumulated depreciation 1,904 2,025 3,929 1,470 2,282 3,752 15,867 16,875 32,742

Net leased property ¥1,667 ¥1,280 ¥2,947 ¥1,496 ¥1,693 ¥3,189 $13,891 $10,667 $24,558

The imputed interest expense portion as lessee is included in the above acquisition cost.

Obligations under finance leases:

Thousands of

Millions of Yen U.S. Dollars

2003 2002 2003

Due within one year ¥1,191 ¥1,235 $09,9250

Due after one year 1,756 1,954 14,6330

Total ¥2,947 ¥3,189 $24,5580

The imputed interest expense portion as lessee is included in the above obligations under finance leases.

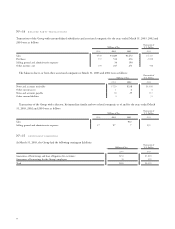

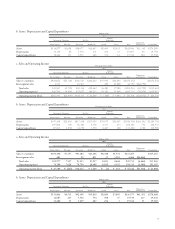

Depreciation expense for lessee, which is not reflected in the accompanying consolidated statements of income, computed by the

straight-line method was ¥1,344 million ($11,200 thousand), ¥1,413 million and ¥1,745 million for the years ended March 31,

2003, 2002 and 2001, respectively.

Depreciation expense for lessor, which is reflected in the accompanying consolidated statements of income, computed by the

straight-line method was ¥3 million and ¥36 million for the years ended March 31, 2002 and 2001, respectively.

The minimum rental commitments under noncancellable operating leases at March 31, 2003 were as follows:

Thousands of

Millions of Yen U.S. Dollars

Due within one year ¥0,099 $00,825

Due after one year 1,137 9,475

Total ¥1,236 $10,300