Pentax 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

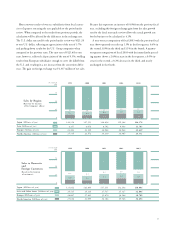

Lifestyle Refinement (Crystal Division)

Net sales in the Crystal division fell 23.5% from the previous fiscal

year to ¥6,719 million, due mainly to the decline in individual con-

sumption and social gift-giving due to the economic slowdown, as

well as a shrinking of the business scale implemented as part of the

business reform measures aimed at restructuring the brand.

The division recorded an operating loss for the year of ¥12 million.

The net sales growth ratio fell further from a negative 11.6% in the

previous fiscal year to a negative 23.5%. The position on the graph of

the circle representing this division has moved down the vertical axis,

and on the horizontal axis representing the operating income ratio,

the division’s circle has moved from 0% to a negative 0.2%.

Capital expenditures in the division increased from ¥254 million in

the previous fiscal year to ¥776 million. This was due mainly to, in

accordance with the Company’s restructuring program, the conver-

sion of excess facilities to more appropriate functions, in order to

avoid further losses.

28

0

7,500

5,000

2,500

10,000 4.0

2.0

0

9,942 8,788 6,719

285

2.9%

-1

-0.0%

-12

-0.2%

9,828 8,684 8,409

552

610

498

254

302

776

(%)

2001 2002 2003

(Millions of yen)

Net sales

Operating income

Operating income ratio*

Assets

Depreciation

Capital expenditures

*The operating income ratio above is calculated on net sales plus intersegment sales. Please refer to

details on page 52 Segment Information.

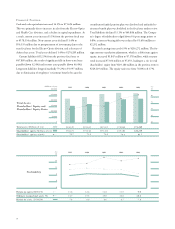

20

30

10

0

-10

-20

05101520 25 30

Sales Growth Ratio (%)

Operating Income Ratio (%)

North America Asia

Europe

Japan

Consolidated Basis

Sales Growth and

Profitability by

Geographical Segment

Fiscal year ended March 31, 2003

(Compared with the previous fiscal year)

Size of circle shows the volume of operating income.

Consolidated Basis